Opinion/Analysis

No matter how pristine your store or how beautifully it flows, regardless if your prices are competitive, or if you have great curb appeal, what matters most is your staff. Your staff are your game changers, they are the key to everything retail.

The same Last Mile challenges that are putting power into retailers' hands with D2C brands has the potential to the change dealers' relationship with their primary specialty brands, too.

Let’s get straight to it: Cycling is a risky activity.

Here’s an interesting paradox: the more popular consumer-direct bicycle sales become, the more mission-critical Last Mile providers will be to their success. Should we embrace this trend, or resist it?

In case you want the skinny of this article, here it is: Be a good person. For those with more time, read on.

These are two women that dealers should pay attention to: Wendy Appleby and Diane Runyan.

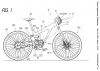

What this potential replacement for the venerable derailleur drivetrain tells us about disruptive technology, the concept of net novelty, and the future of the entire cycling industry.

BOULDER, Colo. (BRAIN) — While negotiations are continuing and things can change quickly in the Age of Trump, as of Thursday morning the U.S.-China trade war continues and there is no agreement to roll back tariffs on e-bikes, contrary to some optimistic reports elsewhere.

Providers in the micromobility supply-chain, including bike shops and self-service rental companies need to be proactive in making sure lithium ion battery fires simply don't happen – because they are preventable!

As the largest bike brands struggle to gain controlling share of a flat market, the Quadrumvirate’s Bike 3.0 model has failed in several fundamental ways.

As an industry, we have gone too long only looking at what we do and talking about it among ourselves in small groups.

DURANGO, Colo. (BRAIN) — A bonus episode of the Channel Mastery podcast features Amazon expert Larry Pluimer, who examines recent Amazon policy changes and how they relate to specialty retail this holiday season.

Defining retailers by their primary brand is a poke in the I. Specifically, the one at the beginning of IBD.

It’s now dawning on most companies as well as dozens of dealers that Interbike’s withering away has been a colossal mistake.

Now that you are living the dream of owning a bike shop, have you stepped back to evaluate whether it got you where you wanted to be?

The top four bike brands are currently represented in 52% of U.S. bike shop locations. But what about the other 48%? Is lack of alignment with The Quadrumvirate a one-way ticket to the poorhouse? Available data suggests not.

As a retailer you may be feeling like you are fighting a never-ending uphill battle. I still feel that you can make great profits, however grim all the battles appear to be.

As the Bike 3.0 model evolves, the rich are getting (somewhat) richer, the poor are getting (a lot) poorer, and the rest of us worker bees are getting told it's all just Business As Usual. And maybe it is.

After 40 years of bike biz time, I'd like to pass along one key element to those who are steering brands in the modern, digital world.