The biggest news at the American International Motorcycle Expo (AIMExpo) in February this year wasn't motorcycles, according to attendees I spoke with. The really big news this year was — and is — e-bikes.

Intense brand e-bikes are being distributed to powersport dealers by Parts Unlimited. Tucker Distributing announced it will be distributing Cannondale's e-bikes to the powersports industry. In a BRAIN article last year written by my colleague Ray Keener, Aventon claimed that 30% of its dealer base was "power sports type shops," And more than a dozen e-bike brands — from familiar names like Felt and Bianchi USA to heavy motorcycle hitters like Yamaha, Triumph and Ducati showed e-bike models this year at AIME, hoping to snare some interest from powersports dealers.

Which shouldn't be that hard to snare, as such things go. According to Motorcycle and Powersports News, "For the past few years, e-bikes have been subtly sneaking their way into the [powersports] industry, but this year really proved how important they may be to manufacturers and dealers moving forward. According to research firm MarketsandMarkets, this additional category is set to grow from $49.7 billion in 2022 to $80.6 billion by 2027." And when you're forecasting just over $30 billion dollars worth of growth for e-bikes in the powersports market alone over the next five years, dealers tend to pay attention.

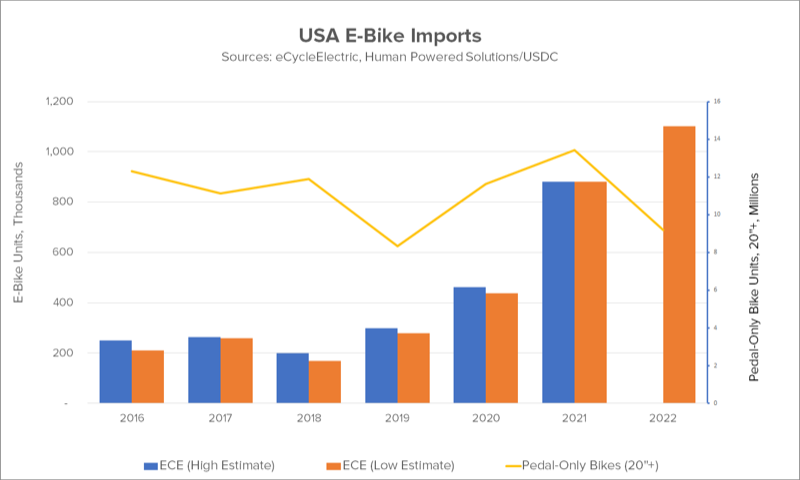

Overall, e-bikes enjoyed a record year in 2022, growing to more than 10% of pedal-only bike imports for the first time, although this was largely because imports of regular bicycles were so limited that year.

Make no mistake, the powersports industry is hungry for a slice of the IBD-quality e-bike market share. And with products from well-known brands at IBD prices, backed by professional sales and service staff, they see no reason why they shouldn't get at least some of it. But the real opportunity for the powersports market is to reach out to members of its existing customer base, including a lot of people who haven't been in a bike shop in decades, and perhaps not ever.

So can IBDs and powersports dealer coexist?

Talk to the expert

"Only a small percentage (of powersports customers) are interested in e-bikes. On paper it looks like such a great fit. I keep reading about it, but it hasn't happened." —George Gatto, bicycle and powersports dealer.

To find an expert in both the bicycle and powersports markets, you could do a lot worse than to talk with George Gatto. Gatto grew up in his family's motorcycle shop in the 1960s and watched the family successfully expand into bicycles during the Bike Boom of the late '60s and early '70s.

Today Gatto owns a Harley-Davidson dealership and a large multi-brand powersports dealership with a full-service bike store on its second floor. All are located in the Pittsburgh area.

The bike shop carries his e-bike offerings, along with pedal-only models from Giant, Batch, and Retrospec. At one point, Gatto says, he had as many as five bicycle shops and three motorcycle stores, which he gradually pared down to the existing three enterprises in two locations. Gatto was also a member of the NBDA board of directors for more than a decade in the mid-'90s to mid-2000s.

"A bunch of dealers in my 20 group (similar in concept to the NBDA's P2 Profitability Project Program) picked up Specialized e-bikes when they began to be offered to powersports dealers," Gatto says. "These are some for the best dealers in the country and they did it right: bought all the equipment and tools and displays and fixtures. But the e-bikes didn't sell well, and when Specialized started selling D2C, they all dropped the line. What we found was that we just didn't see the hyped-up crossover with customers."

And it's not just the Specialized brand, either. Gatto reports the same results with Harley-Davidson's Serial 1 e-bike line in most H-D dealerships, too. And there's more.

"Yamaha, Ducati, Triumph and plenty of others are all offering branded e-bikes," he continued. "Dealers bought them, but they did not sell well. A lot of brands are betting big on e-bikes, but I'm just not seeing the sales. Most dealers are not successful with them."

So is the typical powersports customer also a potential e-bike customer? "We're trying to figure that out," Gatto says. "Only a small percentage (of powersports customers) are interested in e-bikes. On paper it looks like such a great fit. I keep reading about it, but it hasn't happened."

And in a final thought that will be familiar to IBDs, Gatto notes, "What I do see is the low-priced (D2C) e-bikes, which are gobbling up the business."

A thing of sound and fury, signifying nothing

E-bikes are trending, and auto and motorcycle brands have world-class PR machines behind them. Bike brands, not so much.

E-bikes are trending, and auto and motorcycle brands have world-class PR machines behind them. Bike brands, not so much.

So if there is no menacing tsunami of powersport dealers coming to take e-bike sales away from bike shops, or car and motorcycle-branded e-bikes outcompeting bike brands, what's with all the media attention every time an auto or motorcycle brand introduces an e-bike?

Simple. E-bikes are trending, and auto and motorcycle brands have world-class PR machines behind them. Bike brands, not so much, despite them outselling auto- and motorcycle-branded e-bikes by at least one, if not more, orders of magnitude.

Oldtimers in the industry will remember back around the turn of the millennium, when BRAIN told us that the Segway would replace the bicycle and the country would soon be knee-deep in Segway dealers, because after trying one, no reasonable consumer would ever want to ride a bike again. (This was prior to BRAIN having much of an online presence, so I can't link to the article, sorry.) Well, powersport e-bike sales is a lot like that.

The plain fact of the matter is that when it comes to selling specialty retail e-bikes, the specialty retail bicycle sector is still king of the hill. And likely to stay that way for the foreseeable future.

Related: E-bike brands look to powersport dealers to reach dirt bike enthusiasts — and more (December 2019)