Editor's note: A version of this article appeared in the Oct. 1 issue of Bicycle Retailer & Industry News

RENO, Nev. (BRAIN) — Dave Wiens is a very fast guy. If you tried to follow IMBA’s executive director around Interbike, you’d find that out soon.

The former top mountain bike racer spent the show stopping by virtually every booth, rallying industry support for the organization he has been leading since 2016.

“I was there all three days and visited just about everyone. I got a very warm reception for IMBA and had some great conversations,” he said a few days after the show closed.

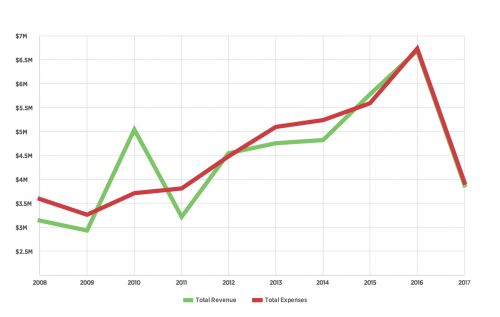

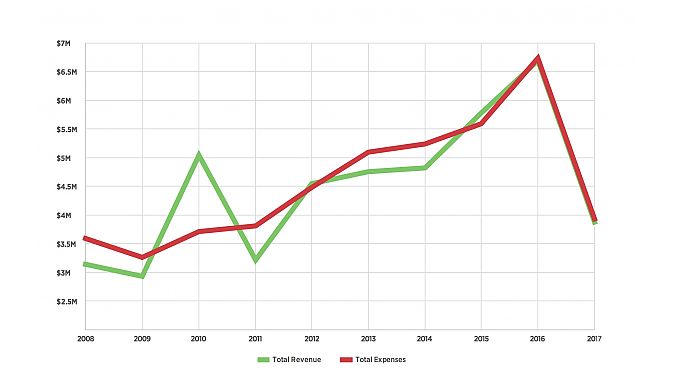

While by no means IMBA’s only challenge, industry financial support is one area that needs shoring up. IMBA’s total revenue plummeted from $6.7 million to $3.9 million between 2016 and 2017

A decline in bike industry support was a side effect of a larger loss, when longtime backer Subaru unexpectedly ended its funding in early 2016. That led to dozens of layoffs, salary reductions and other cutbacks at IMBA. “We lost a lot of contacts with the industry over the last one and a half or two years. At the same time, the industry was changing and going through a tough period of its own. When you lose those contacts, you lose funding,” Wiens said.

Among the notable industry departures was Specialized, a big supporter of IMBA for decades and an “Elite Level” corporate sponsor (meaning the company donated more than $100,000) as recently as 2015. The company is not listed as a corporate supporter in IMBA’s 2017 Annual Report. Specialized has also reduced its support of PeopleForBikes.

Specialized founder Mike Sinyard told BRAIN that his company has shifted its support to programs that help get kids on bikes, in particular the Specialized Foundation and the National Interscholastic Cycling Association. The company also has its own Soil Searching trail access program.

"Specialized has long sponsored PeopleForBikes and IMBA — as a founding member of both organizations, we’ve always seen the value in what each brings to the cycling community. And while we still believe in the goals of both groups, we want to focus our efforts on areas that will shape the future of cycling,” Sinyard said (Sinyard also wrote about the decision in a recent BRAIN Guest Editorial).

Wiens thanked Sinyard and the company for its years of support. “They’ve put a lot of money into mountain biking over the years and we thank them. We are going to focus on working with the willing,” he said.

The Subaru pullout exposed IMBA’s deeper problems, which date to the launch of its Chapter Program in 2010.

The Chapter Program set up membership revenue sharing between IMBA and regional chapters. By splitting membership dues with the regional groups, IMBA would support the groups and decentralize its organization. Individual chapter members would become IMBA members and vice versa, and IMBA bet it would wind up with more members, making up for the revenue it was sending back to the chapters.

“That didn’t happen,” said Chris Conroy, the president of Yeti Cycles and IMBA’s board chairman. Although the Chapter Program might have had success in some areas, Conroy said, "From a pure business point of view, we wound up with less revenue.”

Besides the declining membership revenue, there were other problems. The program offered a one-size-fits-all revenue sharing model to chapters, large or small. Many regional chapters didn’t see the upside of partnering with IMBA and thus lost contact with the group. Additionally, individuals were confused about whether they were joining one group or two, and the mandatory membership in IMBA felt to some more like a tax than a benefit.

After much bloodletting and rightsizing, IMBA is now a more modest organization. It gave up its nice office on West Pearl Street in Boulder, Colorado. Wiens works from his home in Gunnison, and his salary is about a third of that of the group’s previous director.

Subaru's pullout — and maybe to a lesser extent the departure of Specialized — taught the group the value of diversifying its funding. It’s looking for a wider group of supporters across the bike industry, as well as nonendemic support. Within the industry, it’s looking to offer a broader array of sponsorship opportunities and it’s also revamping its retail program. It has also created and filled a new position: a grants manager, whose role is to find grant opportunities from nonendemic foundations as well as managing the grants IMBA offers.

IMBA’s other major source of income is Trail Solutions, which provides bike trail design and construction. Trail Solutions contributed $1.4 million to IMBA last year, down from $2 million in 2016 and $2.1 million in 2015.

IMBA ended the Chapter Program late last year, replacing it with IMBA Local. Instead of a revenue share with regional chapters, IMBA Local offers several tiers of support, for a charge. For example, IMBA can provide membership enrollment services, or send a trails consultant or government consultant out to help chapters on a specific program — for a fee. That allows IMBA to work with more groups of varying sizes, potentially increasing the total number of mountain bikers it supports.

“Mountain bikers are mountain bikers, no matter what chapter they are in,” Wiens said.

IMBA no longer offers individual memberships. Instead it counts participating chapter members as its supporters, and it solicits individual donations.

IMBA Local and the elimination of the membership program was “an effort to clean up the confusion around the word ‘membership,’” said Kent McNeill, IMBA”s vice president of operations.

McNeill, a former bike retailer, noted that younger mountain bikers are less interested in becoming members of an organization.

“It just doesn’t resonate with them,” he said. “We can still offer supporters the same benefits, there’s just less confusion.”