The following story appeared in the March 1 issue of Bicycle Retailer & Industry News

BPSA reports $50 million sales gain for 29ers in 2011

By Matt Wiebe

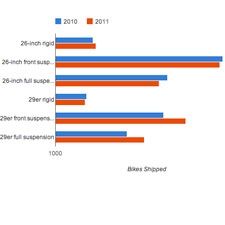

PHILADELPHIA, PA—Only 29er excitement kept Bicycle Products Suppliers Association (BPSA) members smiling last year. The group shipped 100,000 more 29ers to shops than they did in 2010, representing a $50.4 million increase in sales, more than 90 percent of last year’s sales gain.

Overall supplier sales were up 5.4 percent, a gain of $55.6 million, and shipments dropped by 62,012 to 2.6 million units. BPSA members’ wholesale shipments to bike shops fell across all categories except 29ers and hybrids.

“There is no doubt that 29ers have displaced 26ers. We see this each month in our Specialized sales figures. At this moment, 29ers are 49 percent of our total mountain bike sales. This should not surprise anyone,” said Bob Margevicius, executive vice president of the bike group at Specialized.

Twenty-niners’ gift to the industry is not growing the market of mountain bikers—shipments of mountain bikes, 26 and 29er, were up a modest 2 percent.

“Twenty-niner excitement hasn’t really created new sales; it has replaced existing business. That being said, it has lifted the average price point,” said Chris Speyer, BPSA’s president and Raleigh’s vice president of product and marketing.

And “lifted the average price point” is understatement. The average wholesale price of a 26-inch mountain bike shipped last year was $361, $500 less than the average $865 29er shipped. Every 29er a supplier shipped instead of a 26-inch bike lifted their sales an extra $500.

But few expect the 29er goose to continue laying golden eggs. Partly contributing to the higher cost of 29ers was the scarcity and limited production of 29er components. The volume and popularity of 29ers means components will no longer be scarce and high-volume production runs of 29er parts will lower costs.

Steady consumer demand also meant suppliers never had to close out 29er bikes, so they realized full margins. Going forward it’s doubtful 29ers will continue commanding the $500 premium they did in 2011.

Suppliers also noticed a small shift in pavement purchases for transportation and utility use last year, but not nearly enough to support the urban myth that economic hard times drives bike sales.

“I think the industry lost sales to some of our traditional customer base because of a bad economy, but we have new demographics now riding bikes in part because of the bad economy and in part because of lifestyle changes,” said Pat Cunnane, Advanced Sports’ president.

Cunnane points out that single-speed sales are to a younger and more urban customer, and commuter sales to an older and more urban customer. These are not customer demographics bike shops traditionally appeal to.

“Utilitarian bikes have gained market share. There was barely a market for utility bikes a few years ago, and now there are markets and players and solid product selection,” Cunnane noted.

These non-recreational utility customers are partly responsible for the 3 percent growth in hybrid shipments. And Cunnane and others note that cyclocross and rigid mountain bikes are also popular choices for riders wanting a utility or commuter bike.

But supplier optimism that the onset of the recession in 2008 would signal a cultural shift to more economical forms of transport never developed.

“I think this is one of the real challenges to our industry. The numbers don’t really validate the statement that people turn to bikes in tough times,” said Raleigh’s Speyer.

“There is a huge opportunity for the industry out there, but we need to solve issues related to infrastructure and mindset before the utility market can start to take off in a meaningful way,” he added.

The hardest hit categories last year were 26-inch comfort and cruiser bikes—shipments were down 22 percent and 14 percent, respectively. Rather than enthusiasts, these categories target recreational cyclists, who are more likely to postpone a bike purchase when money is tight.

Road bikes accounted for 39 percent of supplier sales last year, up a point of dollar business from 2010. Road sales were even larger than the next three sales leaders combined—hybrids and 26-inch and 29er front suspension bikes. Road shipments dropped a slight 2,000 units.

With 29ers unable to sustain last year’s gift to the industry, suppliers are still optimistic about the market this year. Even if the economy remains stagnant, the mild weather so far is getting the year off to a great start.

“Since we live with fairly long lead times, inventory is always tough to manage if you start selling well ahead of plan. I suppose we could spot some shortages, but currently I don’t see the numbers trending so far ahead in sales that it significantly weakens suppliers’ planned inventory positions,” said Speyer.

Big wheels loom large

Published March 14, 2012

Topics associated with this article: From the Magazine