Conventional wisdom in the bike business has it that the new people who bought bikes during the COVID surge (probably best not to call it a "boom") have stopped riding them. But like a lot of conventional wisdom, that's just plain wrong. New data from the National Sporting Goods Association and PeopleForBikes, as well as indicators from bike shops all over the U.S., show that many riders who purchased bikes during the 2020-2022 period were still riding them in 2023, the most recent year on record. They're just not buying new ones.

Here's the news, and the news is good

Overall ridership, which peaked in 2022, is still higher than in any year since 2005.

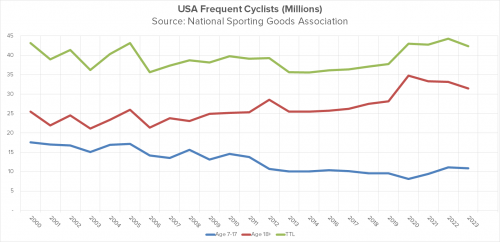

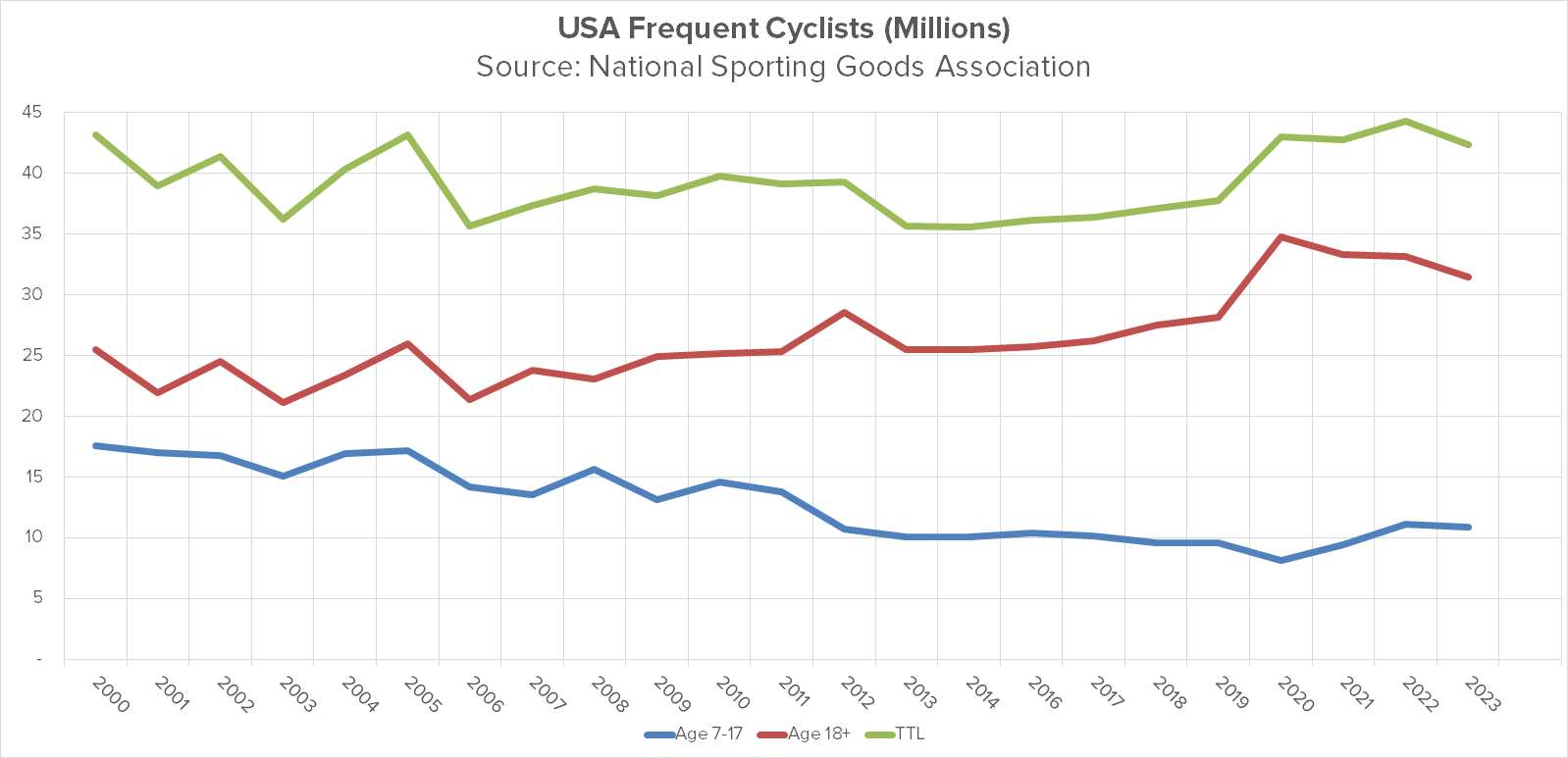

Let's start with the NSGA data, which you can see below. It comes to us courtesy of Nick Rigitano, the association's director of insights and analysis.

The data shows riders age 7 and up who rode a bike six or more times per year. As you can see, these younger riders stayed mainly flat (just a 2% drop) versus 2022 but still maintained the overall trend of being up relative to the steady decline in kids riding bikes from 2000-2020. That's not great news, given the overall 38% decline in kids' ridership since 2000, but it's better news than we've had any year since 2012.

Among adult riders, participation is down 5% versus 2022, but grown-ups since 2020 are still riding bikes more than in any time period since 2000, which is as far back as my records go. Overall, this should be seen as good news for the industry.

Combining the two groups, we see that overall ridership, which peaked in 2022, is still higher than in any year since 2005. It's down about 4.5% from its 2022 crest, but in a historical context, it's still good news.

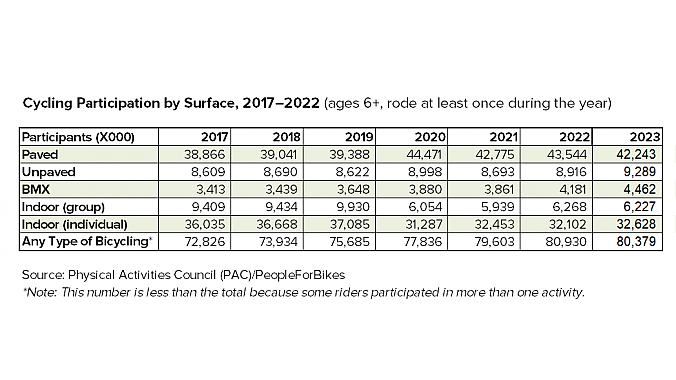

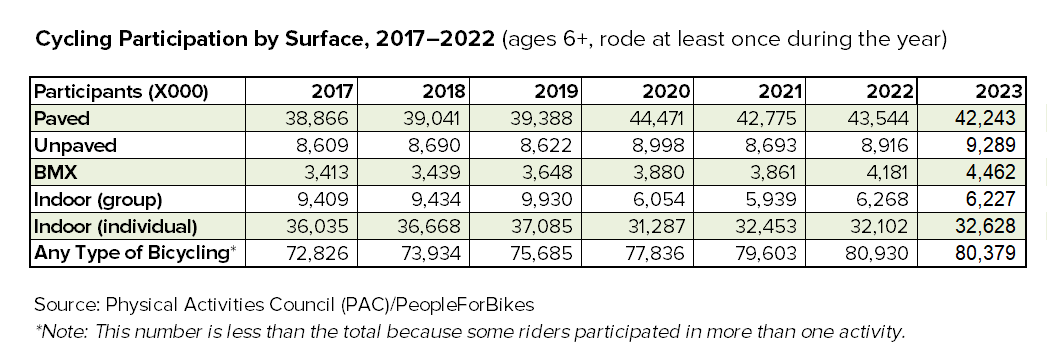

The PFB data, which comes to us courtesy of Patrick Hogan and Liam Donoghue there, measures anyone over the age of 6 who rode at all during the year. The news is even more encouraging.

The decline from 2022 is statistically insignificant — less than 1%. 2023 is flat versus 2022, with declines in road participation offset by gains in off-road (including gravel), BMX, and individual indoor riding. The big picture is that Americans are getting out on bicycles in record numbers post-COVID. And it appears they want to keep it up.

Finally, if you have any doubt that more Americans are out riding bikes, just ask any retailer about their service business. For most dealers I've talked to, service revenues are up 10% or more versus 2022, which was up from 2021. People are out riding their bikes and bringing more of those bikes in for service and repair than ever. And service business is becoming an increasingly important contributor to shops' bottom line.

Which is a good thing, because new (and even used) bike sales are mostly still in the doldrums. Note I said "mostly." More about that presently.

A little ray of bitter sunshine

“The challenging times are not over. It’s going to be another 12 months that we see pricing pressures in the market.” — Specialized CEO Armin Landgraf

The problem is that we've had excess inventory choking bike brand warehouses since 2023, and although it's been heavily discounted by suppliers — in at least some cases, below their own cost — consumers still aren't buying in sufficient quantities to move the inventory needle out of the red zone.

As Armin Landgraf, Specialized CEO, says at 9:55 in this Specialized dealer video featuring himself and company founder Mike Sinyard, "The challenging times are not over. It's going to be another 12 months that we see pricing pressures in the market." So one of the industry's leading brands expects discounted inventory to still be with us through summer of 2025.

According to the Consumer Confidence Index, consumers continue to take a glum view of the market, especially for premium-priced items like houses or automobiles. But confidence in big-ticket appliances and smartphones increased slightly in June, indicating a growing interest in actually buying these types of products, which just might include bicycles.

Even better, I've been hearing from some dealers on the Facebook page Cycling Industry Recovery that Q2 business has picked up, including sales at those formerly dreary mid-level bicycle price points. It's still anecdotal, and seems to apply only to certain individual markets, but it's the first sign of real hope I've seen this year that some excess inventory is finally starting to move through the pipeline.

The takeaway message to the industry is, remain calm and stay the course. Customers who purchased new bikes during the COVID surge are still riding them. In fact, participation in cycling is better than it has been in nearly 20 years. And at some point, some of those cyclists will absolutely come back into bike shops to buy new bikes.