Last month I wrote that 2024 would be similar to 2023, just not as miserable, based on PeopleForBikes' projected retail bicycle sales for the year. This month, I'd like to look a little deeper into the on-the-ground reality behind those numbers and what it means for dealers and suppliers.

The bottom line for the bicycle market is that there is still a huge amount of unsold inventory held by suppliers and that it will take most or all of the coming season to work through it ... if not longer. Exactly how long is entirely up to cyclists, their willingness to buy that inventory, and to what effect an ongoing wave of discounts can stimulate their buying behavior.

Inventory is still up, dealer sell-in is still down

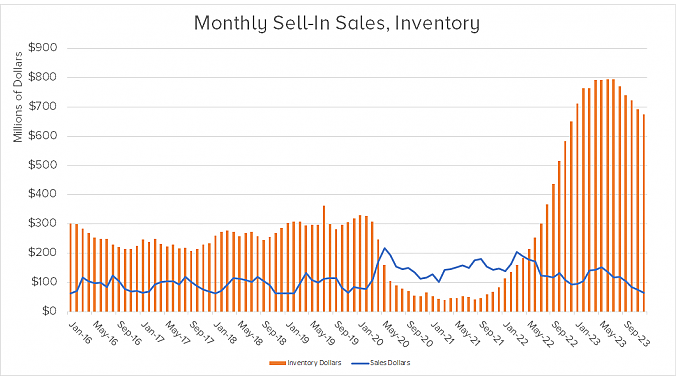

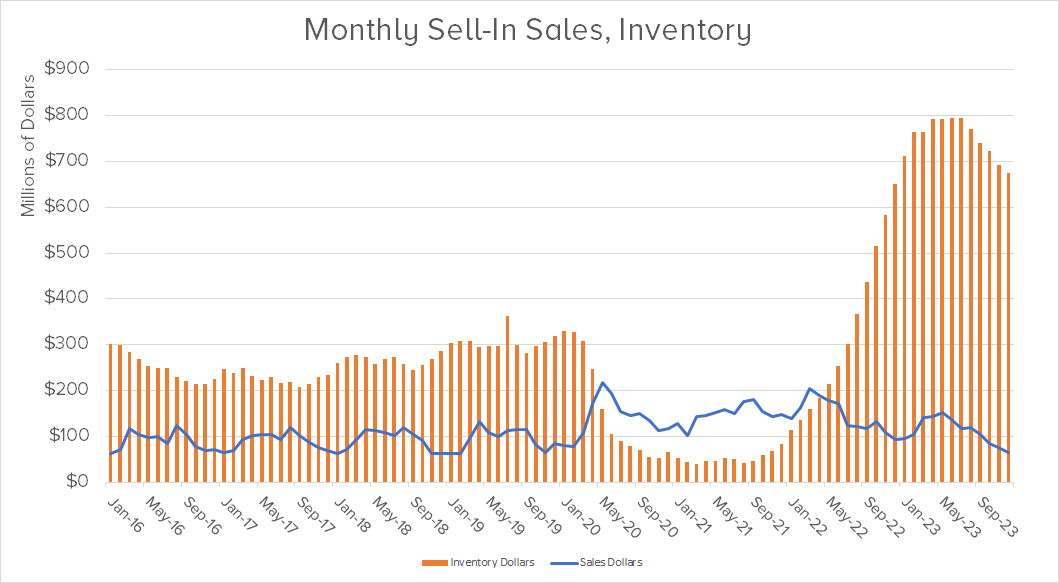

As before, I reached out to PeopleForBikes' senior research manager Patrick Hogan, to help clarify the situation. He provided the following chart, showing dealer sell-in versus supplier inventory from 2016 through the end of 2023.

"In terms of units, sell-in (to dealers) is as low as it's been since 2016," Hogan says. "Dollars are up somewhat as prices have increased. Units on hand are coming down, but in December inventory dollars were still about 60% over what they've traditionally been, pre-pandemic. Right now, there's a lot of dollars tied up in (supplier) inventory."

"The overall picture right now is that discounting just isn't working in the short term, at least not to the degree we need it to" —Patrick Hogan, PeopleForBikes

At the same time, Hogan says, "Overall, the estimates we've seen from Circana show that 2023 bicycle inventory levels at retailers are around 2019 levels." So while there's still a huge amount of inventory sitting in suppliers' warehouses, dealers' inventory levels in general are normal and even healthy for this time of year.

As Hogan puts it, "Right now, dealers are trying to mitigate their risk. They're not going to buy a bike now that they don't have a buyer for ... and preferably one with a cash deposit on it." Now inventory is stabilizing, he says, but he doesn't expect to see big changes in the sales picture until 2025. "It's not a lack of riders. It's just the lack of anything drawing consumers back to the market."

This is a telling point. In fact, data from the National Sporting Goods Association shows that ridership is higher post-pandemic than it has been at any time since 2000, but it's clear those consumers are not buying new bikes, even with the deep discounts currently on offer. "The overall picture right now is that discounting just isn't working in the short term," Hogan says, "at least not to the degree we need it to. It's just not moving as many units as we need. By the end of '24, definitely by '25," Hogan concludes, "we'll start seeing more regular levels (of sales)."

Finally, an end to the pandemic era?

We may be seeing a sea change in terms of who holds the power in the ever-shifting supplier/retailer relationship.

As an industry, we find ourselves in an unusual situation, one we haven't seen since the Bike Boom nearly 50 years ago. We have a long-term (multi-season) glut of product on the market and consumers with a marked lack of interest in it, even at discount prices. Unlike the last days of the Bike Boom, however, the excess inventory in our current situation is held largely by suppliers; attempts by suppliers to shift that burden onto retailers' floors have proven unsuccessful.

There are three lessons to be drawn from the current state of affairs:

- Only time will ease the inventory overload. Discounting excess inventory to move it through the channel is a one-trick pony, and consumers seem to be thoroughly tired of its one trick. Ultimately, retail buying patterns have to shift back to a more favorable scenario, but in the final analysis, no one can dictate when consumers will decide they want to start buying bikes again. And of course, when they do, they'll still be expecting the kind of discounts that have been in place for more than a year now.

- Business will not return to normal (or whatever form "normal" may take on in the future) until at least 2025 ... and maybe even later. Despite PFB's forecast of slightly higher bike sales in 2024, there won't be anything resembling "business as usual" until a: the existing overstock backlog is brought down to a manageable level and b: consumers decide to start buying bikes again at historic (which is to say, pre-pandemic) rates.

- We may be seeing a sea change in terms of who holds an important lever of power in the ever-shifting supplier/retailer relationship. The days when suppliers could force retailers to buy more inventory than they might reasonably need or want (a relationship I've referred to as "invendentured servitude") may be over ... at least for the foreseeable future. Dealers are ordering inventory on an as-needed basis only and resisting all attempts to push more of it into the retail pipeline and onto their shop floors.

Can this trend last? Historically, suppliers have leveraged inventory by telling dealers they need to order more bikes now to get any at all in-season when they're needed. (Never mind that — as the chart above clearly shows — suppliers have had hundreds of millions of dollars in-season inventory on hand for years.) But the current massive levels of supplier overstock may put the final lie to that longtime boondoggle, and dealers' refusal to commit to more inventory than they will reasonably need may finally become an ongoing feature of the specialty retail landscape.

Whatever else happens, it's a safe bet that 2024 will be not a new beginning, but rather a year of transition. It may even be overly optimistic to call it the last of the pandemic years. Instead, we would do well to recognize that we won't really be in the post-pandemic era until at least 2025 ... and maybe not even then.