It's been a tough year for a lot of people, both suppliers and retailers. If you're one of the businesses that did well in 2023, congratulations and more power to you. As for the rest of us (you know who you are), there's some relief to be found in knowing 2023 is finally behind us.

To get a sense of what happened on a nationwide basis, I reached out to Patrick Hogan, senior research manager for the PeopleForBikes Coalition.

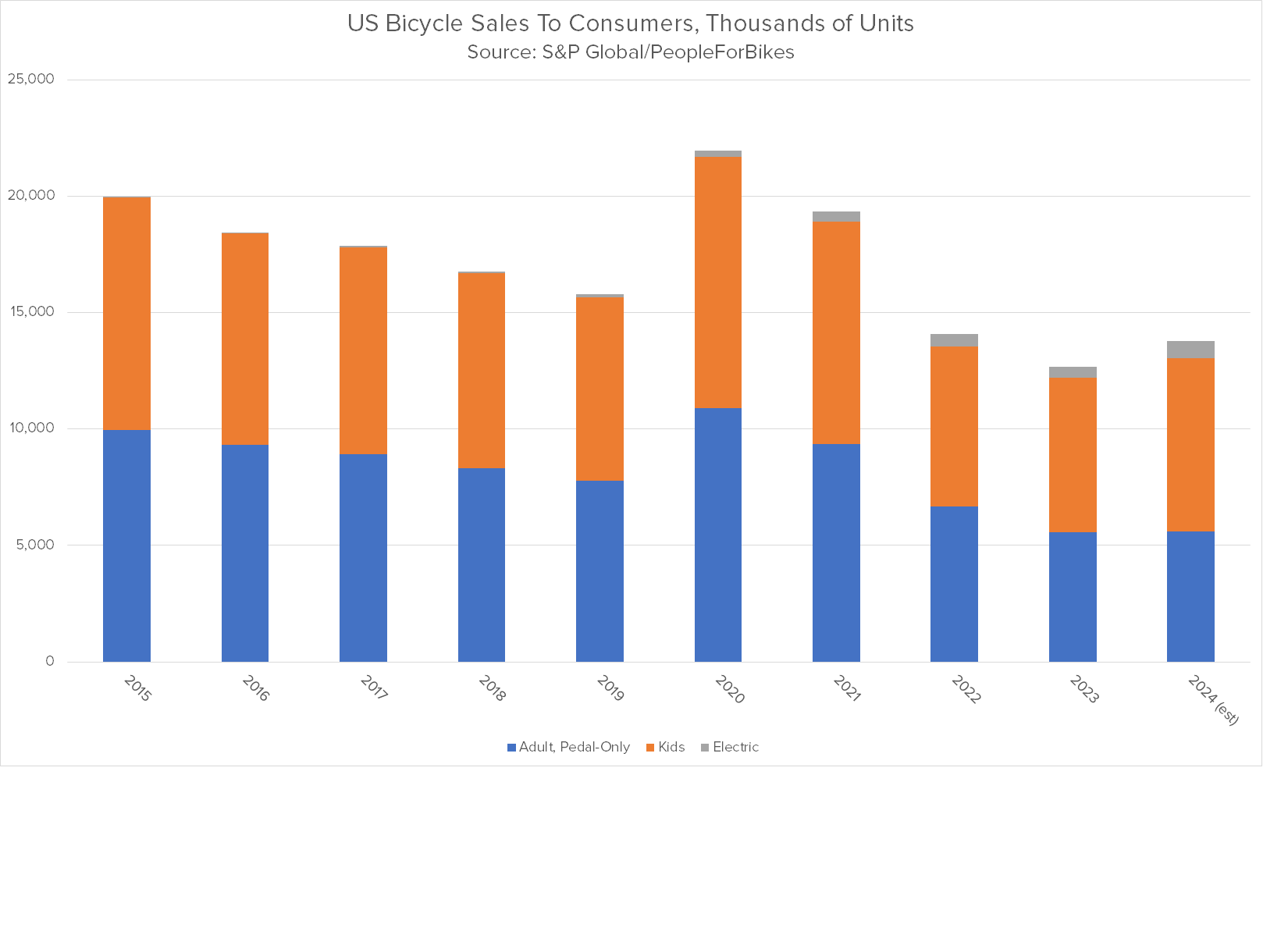

"2023 (consumer bike) sales have been at an all-time low for 20 of the last 24 months," as measured through Circana (formerly NPD), Hogan told me. "We've seen a steady decline in unit sales for adult non-electric bikes. Units have historically ticked down, while dollars tick up as the price tags get higher every year. This is especially true as more and more e-bikes enter the product mix."

The year is projected to come in at 12.8 million units, he says, for specialty and mass channels combined, a number that does not include the growing category of consumer-direct sales, which leaves out a huge piece of the e-bike market. In fact, it's the weakest year for bike sales since PFB began keeping track of that data in 2015. Combine all-time low sales with all-time high product inventories, and it's made for a 12-month series of body blows to many in the industry.

Fortunately, 2023 is finally over, and the new year offers a slightly less bleak picture.

Looking ahead to 2024 and beyond

Regarding 2024 estimates, here's Hogan again: "13.8 million units are projected to be sold to consumers in 2024. Historically, that number has been more like 15 or 16 million." These numbers come from the Global Risk and Opportunity Forecast, produced by S&P global for PFB. This is the fifth report in the series. If you're a PFB member, you can get a copy of the report here. If not, you may want to consider becoming a member.

As you see in the chart above, 2024 is scheduled to be slightly better than 2023 (up almost 9%), but significantly less (-22%) than the pre-pandemic average in 2015-2019.

As you see in the chart above, 2024 is scheduled to be slightly better than 2023 (up almost 9%), but significantly less (-22%) than the pre-pandemic average in 2015-2019.

Whether this is good news or bad news for the industry is a matter of opinion. For what it's worth, long-range projections for 2025 are for a total of 15.8 million, another improvement, but still not up to pre-pandemic levels.

"The exciting bit for me is that we see in the short term that units are declining, but electric bikes are going up," Hogan says. "Over the next five years, we expect to see this bring total sales up to a more normal level. The 13.8 number we project for 2024 reflects growth in the kids' category and is also the result of an increase in the electric niche. In the long run, we expect aggregate bike sales to stay flat at about 15 million bikes/year for the foreseeable future."

The unanswered question is to what extent units sold are actually going down, and/or if these numbers at least partly reflect a growing number of consumer-direct sales, which again are not included in PFB's data set, and particularly affect electric bikes.

The other piece of the puzzle: inventory

If bike sales were down in 2023, inventories were also up, hence my term "double whammy." But at least some of us are beginning to see some relief in that area.

It may take us until well into 2024 before we move past the remaining 2023 inventory glut and begin to get back to business as normal.

"Regarding inventory on the retail side," Hogan says, "inventory levels have mostly corrected. However, brands are still holding about double the number of units compared to a pre-pandemic year."

That may be good news for retailers, but it's bad news for suppliers as shop owners decline to take on any new inventory that isn't already sold to a customer. Between the backlog and the at-best modest gains in anticipated sell-through for 2024, it also stretches out the length of time it will take to burn through that supplier inventory. In fact, it may take us until well into 2024 before we move past the remaining 2023 inventory glut and begin to get back to business as normal.

All in all, despite it being a new year, it appears the post-pandemic blues will still be with us for the near to mid-term future, albeit in a somewhat milder form.