(BRAIN) — The good news is that the number of Americans riding bikes is at a twenty-year high. The bad news is that sales are still slow to nonexistent, and the tsunami of inventory in both supplier warehouses dealer floors is still crushing the health of the supply chain.

The latest inventory data suggests that sales remain down, and the excess inventory just isn't moving off dealers' floors and into consumers' hands. So, if there are that many more new riders, why not? The answer is both counterintuitive and provides valuable insight into the way our quirky little industry works.

First, the good news

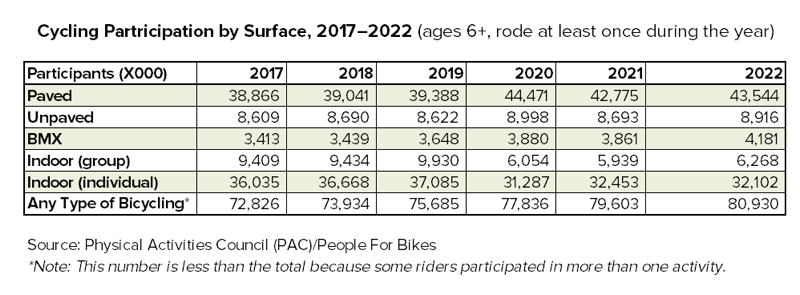

New data, both from PeopleForBikes and the National Sporting Goods Association shows post-pandemic ridership is up significantly. Let's start with the PFB numbers:

As you can see, PFB shows total ridership up by about 11% overall, with the largest percentage gains coming from BMX (+23% in this small but encouraging category) and riding on paved roads (+12%). The only decreases are in indoor riding, both in groups and individually (-33% and -11% respectively )... which is not surprising as more Americans venture outdoors to go cycling. In any event, the decline in indoor cycling is not enough to offset the overall gains.

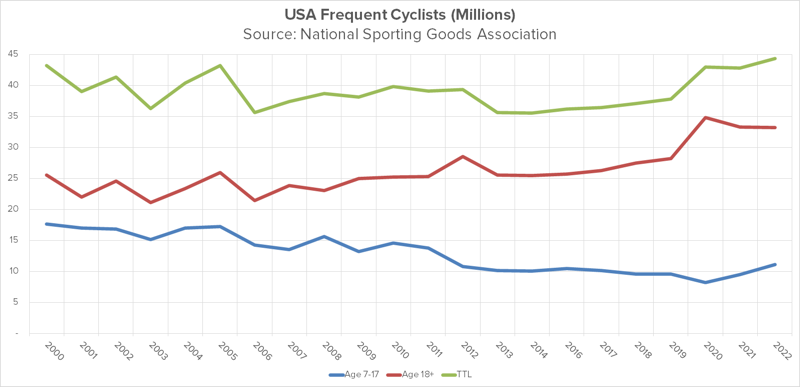

Data from the NSGA is even more encouraging, showing 2022 as the best year for frequent cyclists since 2000, which is as long as I've been keeping track. Even better is the uptick in youth (ages 7–17) ridership, which had been in steady decline since 2000 and shows an increase in 2021–2022, indicating more young folks are getting out and riding during the pandemic and post-pandemic years. At the same time, adult riders showed a steep increase at the start of the pandemic, only to taper slightly in 2021 and stay flat in 2022.

Nevertheless, the overall news is very good and, when combined with the PFB data, shows a strong trend toward healthier ridership numbers, both during and post-pandemic and, hopefully, into the future.

But there's still way too much inventory

The industry's tried and true pump-it-and-dump-it strategy simply isn't cutting it in the current market reality.

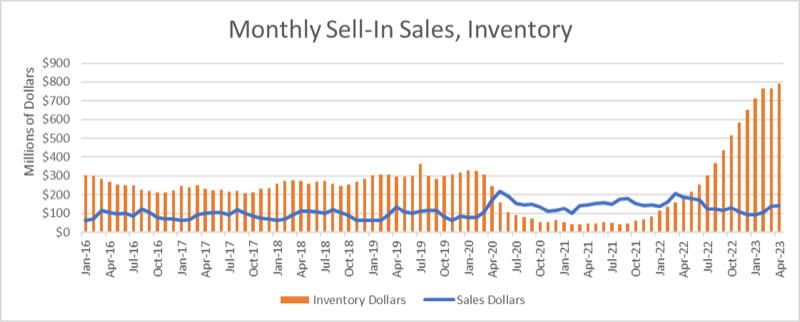

The latest data from PeopleForBikes shows inventory levels at retailers persist at record highs, suggesting sales to consumers continue at record lows. Bottom line is, even the aggressive discounting put into place by many bike brands has failed to have the desired effect of luring consumers into bike shops. The industry's tried and true pump-it-and-dump-it strategy simply isn't cutting it in the current market reality.

If this chart looks familiar, it's because it's the same as the one I showed last month, only updated through April. Inventories are still at record highs. Retailers are still unwilling to take on new inventory. And consumers are still unwilling to buy bikes. That's not some gloom-and-doom outlook, it's simply the way things are. And it's simply the way things are going to stay until there's a major shift in either consumer buying patterns or the way the supply chain consistently overproduces inventory. However, even a sea-change in industry sell-in patterns isn't going to improve the situation in the short to medium run.

But where are all the consumers?

"The rush to buy during the pandemic created some new sales, but we may have ended up robbing from our sales in the future." —Peter Woolery, Bicycle Market Research

So if there are all these new cyclists in the market, why aren't they buying bikes? Two answers:

The first is that post-pandemic buying patterns have changed and consumers are putting off all kinds of purchases, and not just in the sporting goods sector, either. Recent reports of declining sales at Home Depot and Bed Bath & Beyond underscore this trend.

But the second and more direct answer is even more simple: These people already bought bikes during the pandemic and they're just not ready to buy new ones yet.

As Peter Woolery, manager of Bicycle Market Research puts it, "The rush to buy during the pandemic created some new sales, but we may have ended up robbing from our sales in the future."

I had reached out to Woolery to talk about the notion of "consumer inventory" — that is, how many cyclists simply have more bikes than they want, and what they're doing about it. It's an interesting concept and one that's essential to any discussion of how we're going to deal with the industry-wide inventory crisis (chapeau to my friend Mark Hubbell for suggesting the idea to me).

Turns out, Woolery has an entire page on his website dealing with exactly that question (scroll down to the section on Used Bike Listings), but here are some highlights:

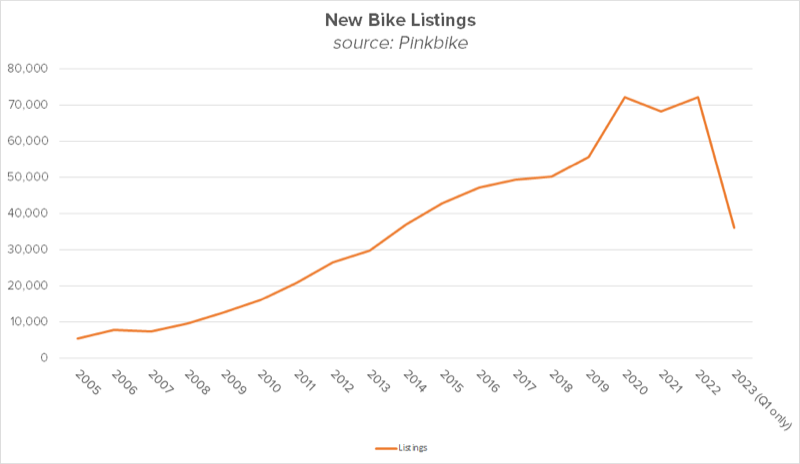

BRAIN's sister publication, Pinkbike, is arguably the leading platform for consumers to buy and sell bike-shop quality bikes. Its number of listings exploded during the pandemic and shows no signs of stopping. If nothing else, it shows growing numbers of consumers (and bike shops masquerading as consumers) have decided they have entirely too much inventory on hand and want to sell it off to make room for new stuff. Sound familiar?

"The surge in Pinkbike listings can likely be attributed to two distinct parties vying for attention within the platform," Woolery says. "Firstly, there are the passionate enthusiasts who are eager to sell their existing bikes. Secondly, retailers have also recognized the potential of Pinkbike as an effective advertising channel to address their stagnant inventory concerns."

At the same time, though, Craigslist listings seem to be headed in the opposite direction. Again, this data is from the Bicycle Market Research report, which I encourage you to read in full.

About this downturn, Woolery says, "This decline in average daily listings on Craigslist implies a potential shift in consumer behavior or market dynamics. It could indicate a decreased supply of used bicycles available for sale on the platform. [Another] possibility is that more people are holding onto their bicycles due to the ongoing pandemic, limiting the availability of second-hand options."

About this downturn, Woolery says, "This decline in average daily listings on Craigslist implies a potential shift in consumer behavior or market dynamics. It could indicate a decreased supply of used bicycles available for sale on the platform. [Another] possibility is that more people are holding onto their bicycles due to the ongoing pandemic, limiting the availability of second-hand options."

With respect to the question of consumer inventory, there is no firm conclusion to be drawn yet. But this much is clear from consumers' behavior: they have at least as much inventory as they want right now, and very possibly a lot more. Just like the rest of us.