Let's face it. The first couple months of 2023 were some of the worst the industry has seen in years, if not ever. Sales were down, inventory was up, and even heavily discounted product wasn't moving off retailers' floors.

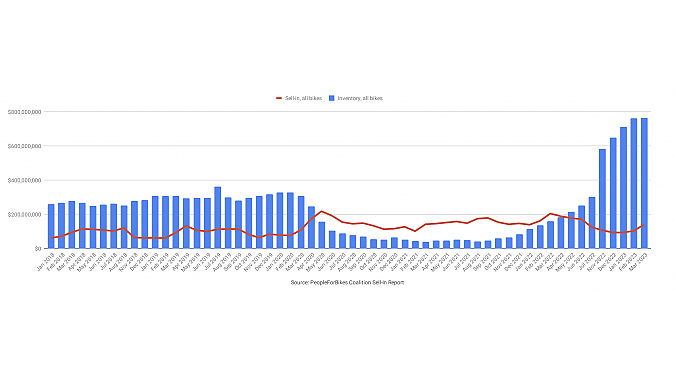

To give you an idea of the significance of the situation, let's start by looking at a chart (below) showing wholesale sell-in versus wholesale inventory, courtesy of PeopleForBikes and based on data from its participating wholesaler members, compiled by Circana (formerly known as NPD Group).

Yes you read that right. At the close of Q1, the wholesale side of the industry was sitting on more than three-quarters of a billion dollars ($765 million) in inventory. PFB Senior Research Manager Patrick Hogan confirms that's 181% of the inventory in February of 2018 and the highest inventory valuation since the organization (and formerly the BPSA, the old Bicycle Product Suppliers Association) began keeping records in 2016. It's also nearly double the number of units, up 95% over February 2018 to 1.45 million bikes. As an industry old-timer going back to the early 1980s, I can't recall a time when the industry was carrying anywhere near this level of product, ever.

And then there's the other side of the double whammy, this from the PFB's retail sell-through report in April: "In the first two months of this year (2023), fewer than 1 million bicycles were sold. (The sell-through data, also compiled by Circana for PeopleForBikes is extrapolated from data from participating retailers). Before the pandemic, the bicycle industry could expect to sell 1.3 million bicycles in the first two months of the year at retail. In 2019 and 2020, that number fell to about 1.1 million as tariffs began affecting the market." As Hogan puts it, "(The 2023 numbers are the) lowest we have ever measured, going back to January and February of 2016." And I'm going to guess it's the slowest-ever rate of January-February sell-through since before the '70s Bike Boom.

Retailers know this, too. In BRAIN's unscientific online dealer poll in April, a full 60% of responding retailers replied their Q1 sales were down either "slightly" or "a lot."

At the risk of restating the obvious, record-low sales is bad for the industry. Record high inventory levels is at least as bad. But the combination is not just bad news, but something that's literally unprecedented in industry history.

Where we go from here

Over time, we can chew through the inventory glut and settle back into what hasn't been "business as usual" since 2018.

Over time, we can chew through the inventory glut and settle back into what hasn't been "business as usual" since 2018. Of course, spring does come each year and people do get out and ride bikes, and at least some of those people, bless them, come into bike shops and purchase new rides. We'll take a closer look at the ridership numbers in a future column, but for the time being let's just say that ridership is holding steady and at least some of the gains made during the pandemic years appear to be sticking with us.

That's good news for retailers and suppliers alike. But even a large influx of ready-to-buy riders is going to take a while to work through three-quarters of a billion dollars in standing inventory.

At this point (mid-May), all we can do is hope for lots of good sunshiny weekends and a long, sustained season of favorable weather where lots of consumers get out and ride bikes. Over time, we can chew through the inventory glut and settle back into what hasn't been "business as usual" since 2018, five long years ago. But it's going to take most if not all of 2023 and a lot of help from the weather for that to become a reality. Until that time, look forward to ongoing price reductions — yes, even deeper cuts than we have seen to date — and continued pressure from suppliers to put still more inventory on the shop floor.

One additional question worth asking is whether 2023 is the year that finally breaks the back of the model-year mindset. The sell-in of 2024 models is going to be tough while there's still a lot remaining from the million and a half units of mostly MY2023 stock in the system in February.

In the end, the businesses that survive will be those with the brains, agility, financial resources, and just plain luck to stick it out over the long run. Because a long run is exactly what it's going to be.