A version of this article ran in the June issue of Bicycle Retailer & Industry News. Print subscriptions are free for qualified retailers and industry members, sign up at subscribe.pcspublink.com/websis.

Let’s talk about dealer counts, the process of totaling up how many retail storefronts selling bikes there are in the industry and which brands they carry.

After the crazy year that was 2020, you’d expect to see a lot of volatility in the market, with dealers unable to get enough bikes going out of business and those who could prospering. Or at least that was what I expected.

And, as it turns out, I was wrong.

According to Christopher Georger, founder of Georger Data Systems, the total number of retailers listed in the dealer locators of around 50 U.S. bike brands only changed about half a percent between 2020 and 2021. As of January 2021, the number of retailer locations in the U.S. was 6,822, compared to 6,913 in 2020.

Statistically speaking, that difference is not significant. In fact, it’s the smallest amount of annual change Georger has observed since 2012. If there were some large number of dealers going out of business, there were a nearly equal number setting up shop during the same period. And that just doesn’t jibe with observable reality. For sure some number of shops sold to new owners, including Trek, but that doesn’t alter the total number of shops in the country.

(For more about Georger’s methodology, see a piece I wrote that was published on BicycleRetailer.com in April 2019. For a deeper dive into the numbers, read on.)

The Quadrumvirate: Trek, Specialized, Giant and Cannondale

Let’s begin with the industry leaders, the top four IBD brands.

In 2020, Trek and Specialized each grew their dealer base (number of storefronts) by about 2.5%. Giant grew by 1% and Cannondale shrank by a percent and a half. Nothing earth-shaking there, as the graph below shows.

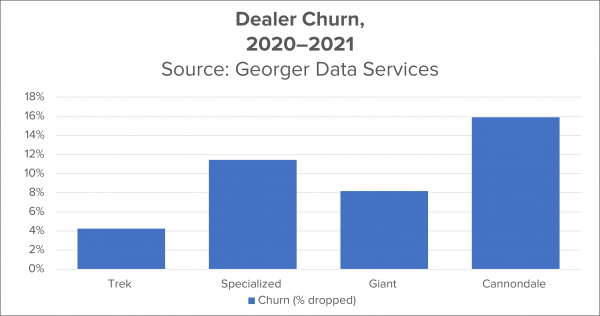

What’s more interesting is the question of churn, which is defined as the number of customers a brand loses over a period of time, in this case April 2021 versus the same month in 2020.

The most stable brand was Trek, which only dropped 59 dealers out of the 1,353 it had in 2020 for a churn rate of 4.2%. It also successfully added 95 new dealers, for a net 2021 result of 1,389 and a growth of 2.6%.

The next most stable brand was Giant, with a churn of just over 8%, or 94 dealer locations. But Giant also added 106 new dealers to bring its count to 1,151 for 2021, a net growth of 1.0%.

Specialized churned at 11.4%, dropping 158 dealers and adding 193 for a total of 1,382 and a net growth of 11.4%. This gives the folks from Morgan Hill statistical parity with Trek, a position they also enjoyed in 2020. Less than half a percent of difference separates their dealer counts, despite Specialized having two and a half times the amount of churn.

This brings us to an important point: Because we’re looking at long-term relations between suppliers and retailers, churn is not necessarily bad for bike companies whose dealer representation is probably close to saturation anyway. A brand loses some dealers and replaces them with others that are hopefully as good or better than what they had before. Even Cannondale, which churned at almost 16%, was able to replace all but 19 of the dealers it lost for a net growth of -1.7% and a total number of 1,120. This gives it 19% fewer dealers than industry leader Trek.

Six more brands of interest

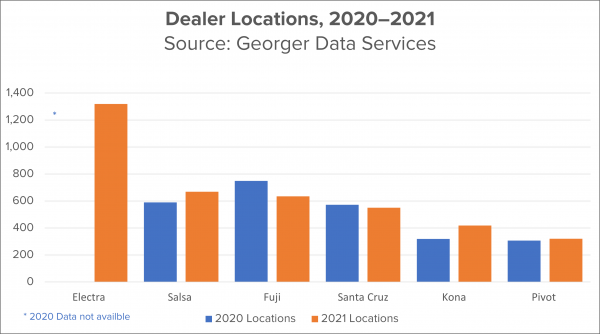

Note: it must be emphasized that the “next six” label for these brands is something of a misnomer. It does not represent the next six brands in terms of dealer count, but brands Georger has been asked to track by his clients. (I should further note that Electra has more dealers than either Giant or Cannondale. But this is the way GDS defines its data, so I’m sticking with it.)

Here’s how these selected brands stack up in terms of dealers:

Unfortunately, Georger doesn’t have reliable data for Electra’s footprint in 2020, so we can’t make comparisons for that brand.

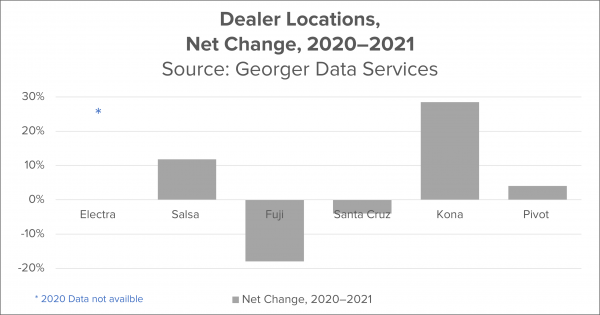

Rather than walk you through all the numbers, here are these brands’ net growth in chart form:

Clearly the standout brands are Salsa and Kona, with net dealer growth of 11.8% and a whopping 28.5%, respectively. Is this a reflection of these two players having bikes in inventory when no one else did? Seems almost certain. The interesting question will be how many of those new dealers will stick around in the long term.

Also of interest is Fuji, with a net loss in number of dealers of 18.0%. This kind of volatility is more likely due to the ongoing shakeout of the brand’s dealer network following its reorganization in early 2019, Georger says. Expect Fuji’s numbers to stabilize over time.

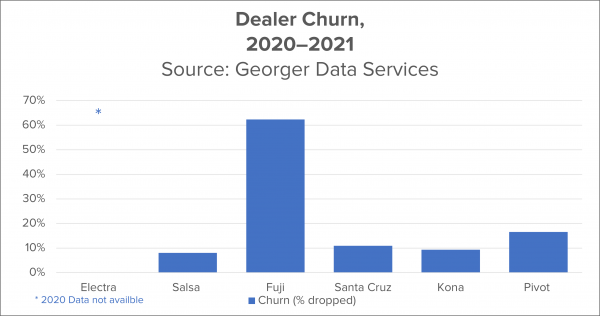

Now here are these six brands in terms of churn rate:

Once again, Fuji’s volatility is most likely the effect of its ongoing reorganization. But interestingly, Salsa, Santa Cruz, Kona and Pivot all have churn rates comparable to those of the top four brands. Perhaps that’s just how the dealer market works: somewhere between 5–15% of a brand’s dealers are going to churn in a given year. Only time will tell if this number is a good metric, or only specific to the rocky ride the industry took in 2020 and continues up to the present day.