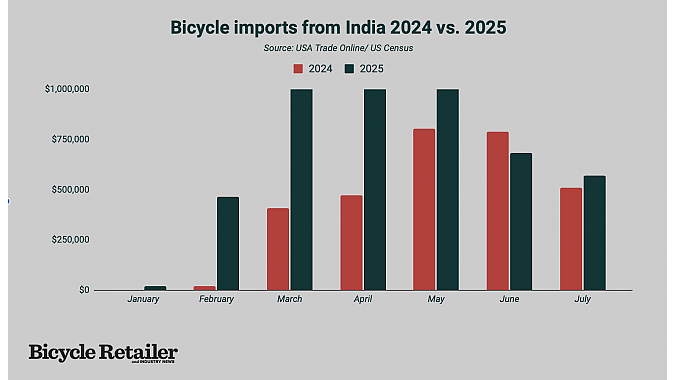

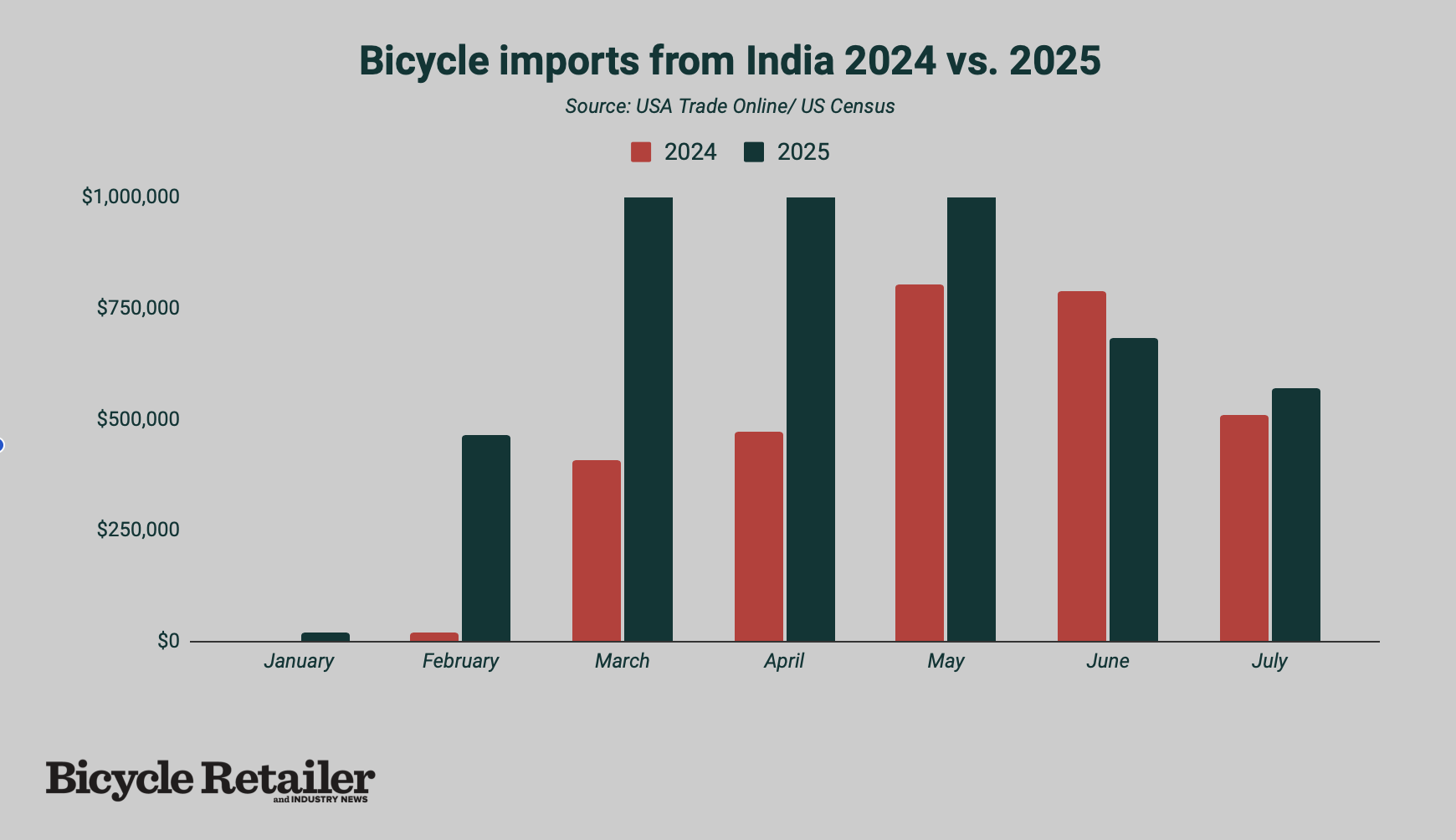

WASHINGTON (BRAIN) — The U.S. mass market bike industry began looking to India as a supply source this year, with U.S. bike imports from the country — while still small relative to other major nations — up 98% in value this year through July, according to figures released Thursday.

However, the Trump administration’s unexpected decision to impose tariffs of up to 50% on Indian imports has at least stalled the industry’s shift toward India. July's bike imports from India were down 17% from June.

In August the administration set a reciprocal tariff on 25% on Indian imports, then added another 25% in response to India's continued purchase of Russian oil. Bikes are subject to an additional 5.5-11% duty.

Also in August, the administration backed down from a threat to impose triple-digit reciprocal tariffs on Chinese goods, delaying that by 90 days. (Other tariffs on Chinese imports, including a 25% Section 301 tariff on complete bikes, remain in place, so that most bikes from China are subject to a total of 66% in tariffs. E-bikes are at about 55% not counting the steel tariff on e-bikes announced in August.)

For importers of many products, not just bicycles, the administration's varying response to India and China was frustrating.

"All Trump told us last year was that China would get hit with 60%. Now India is getting hit with 50% and China only 30%," said one U.S. importer in an email to BRAIN this week. "The steel tariff thing in Section 232 is insane. It's too much to follow! He signaled to us to leave China, now China is getting the best deal. It's an insane time."

The importer said they were in the process of moving production of a product (not a complete bike) from China to India this year, but paused that move.

Although India has some of the largest bike factories in the world, they produce bikes that are generally below the quality level expected in the U.S., even for mass-market juvenile models. One industry source told BRAIN that India's bike exports to the U.S. this year — less than 100,000 bikes so far — are probably close to its current capacity for U.S.-quality bikes.

Although India has some of the largest bike factories in the world, they produce bikes that are generally below the quality level expected in the U.S., even for mass-market juvenile models. One industry source told BRAIN that India's bike exports to the U.S. this year — less than 100,000 bikes so far — are probably close to its current capacity for U.S.-quality bikes.

While Indian manufacturers might invest in better factories in the coming years, products from Taiwan, Cambodia and Vietnam are all subject to significantly lower tariffs (20%, 19% and 20%, respectively), so the industry's investment dollars are headed toward Southeast Asia.

Imports from India's neighbor, Bangladesh, also get a 20% U.S. reciprocal tariff, and several factories there produce quality bikes and e-bikes for the European market.