WASHINGTON (BRAIN) — In July the U.S. imported bikes worth 5.3% more than in June, an increase that closely matches the 5.9% month-on-month increase for the entire U.S. economy, the Commerce Department reported Thursday.

The most dramatic increase was from China. After a decline in Chinese bike imports in June, the industry made a sudden 128% increase in July, likely in a bid to get ahead of a triple-digit tariff that was expected to take effect in early August, but which the Trump administration delayed at the last minute.

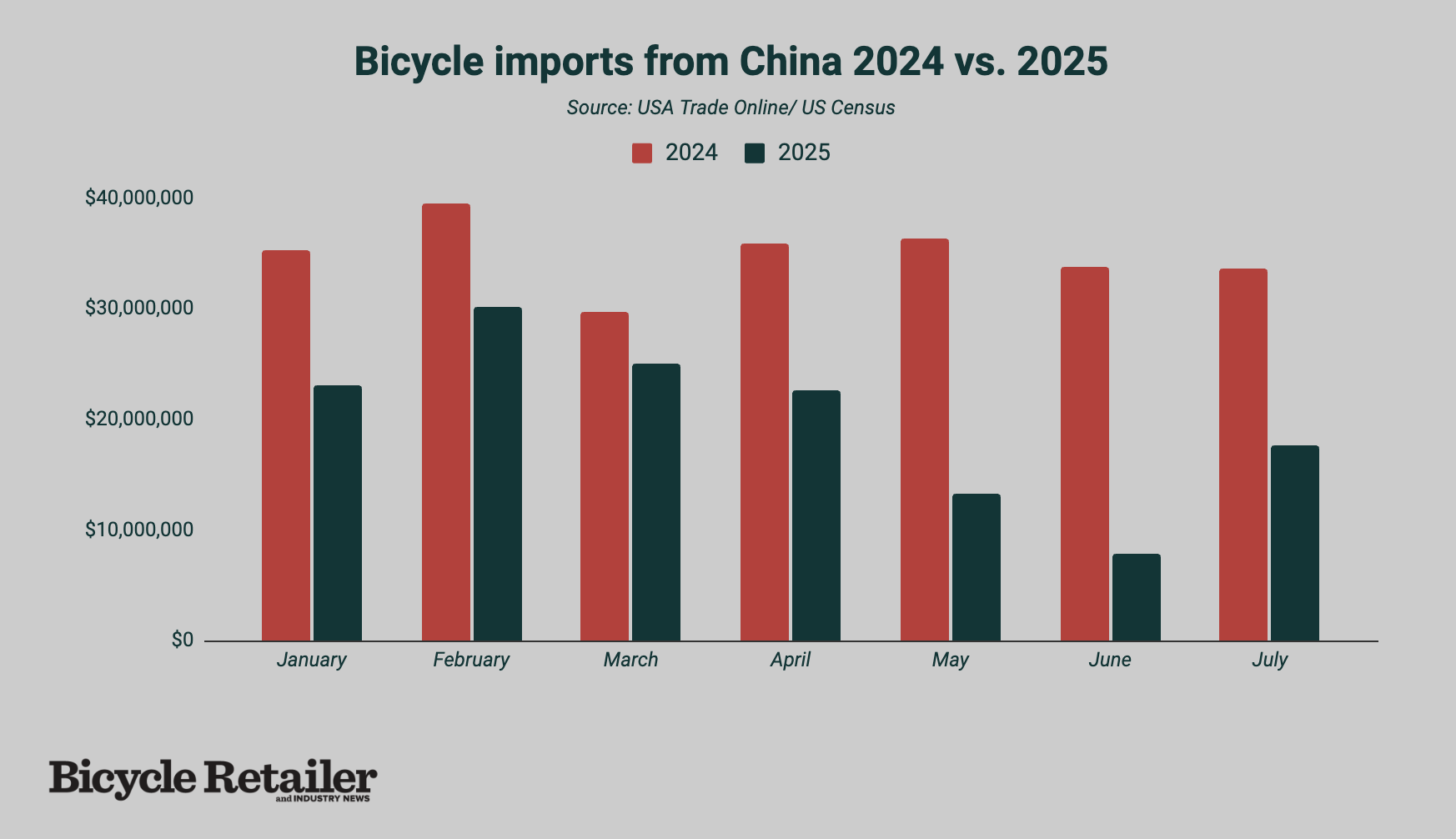

Even with the monthly increase, Chinese imports were well below last year's levels, as the chart below shows:

Cambodia passed China to become the U.S.’s largest source for bikes, by value, in the first half, and that trend accelerated through July. July bike imports from China were valued at $17.7 million, while imports from Cambodia were valued at $32.6 million, up 19% from June.

Cambodia produces more high-value adult bikes than China, so China still leads the way in the number of bikes exported to the U.S. with 3.3 million units through July, compared to 889,000 units from Cambodia.

July imports from Taiwan, Vietnam and India were down from June, with the increases from China and Cambodia accounting for most of the 5.9% bump. (See related story on Indian bike imports.)

Delay left significant tariffs in place

The July import spike was likely inspired by the Trump administration's threat to impose a “reciprocal” tariff on Chinese goods of as much as 145% — in addition to other tariffs — on Aug. 7. Hours before that deadline, the U.S. and China agreed to a 90-day delay.

But while the threatened triple-digit reciprocal tariff would have been devastating, most Chinese bike imports are still subject to a 25% Section 301 tariff, a 20% IEEPA tariff related to fentanyl, and a 10% reciprocal tariff, plus long-standing duties on most bikes of 5.5-11%. The total is about 66% on regular bikes and 55% on e-bikes from China.

Plus, in August e-bikes, some tools and indoor trainers were added to the list of steel derivative products subject to a steel tariff. The steel tariff is 50% from every country except the United Kingdom, whose steel exports to the U.S. get a 25% tariff.

Year-over-year shows decline

While the Commerce Department releases seasonally adjusted figures for goods and services and focuses on the month-on-month changes, the bike industry more typically looks at year-over-year, non-seasonally adjusted figures. By those measures, bicycle imports totaled $84 million in Customs value in July, down 10% from the same month in 2024. For the year-to-date through July, bike imports were $530 million, down 11% from the same period in 2024. The figures do not include e-bikes.

Looking at the number of bikes imported, the U.S. imported 4.87 million units in the first seven months of the year, for an average Customs value of $108.69 per bike. Last year during the same period the U.S. imported 6.30 million bikes, for an average Customs value of $94.46. (Customs value is the figure used for assessing duties and includes the price of the goods plus other costs like shipping and insurance.)