MASER, Italy (BRAIN)— Like many Italian cycling brands, Sidi, founded in 1960, struggled with a succession plan in recent years, with its founder entering his 90s and his children in their 60s.

The solution came in the form of an even older Italian family company, Italmobiliare, which was founded in the 1850s as a construction supplier and is now managed by the fifth generation of the Pasenti family.

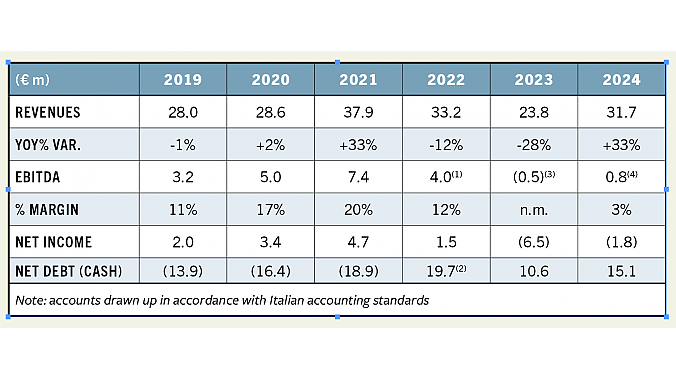

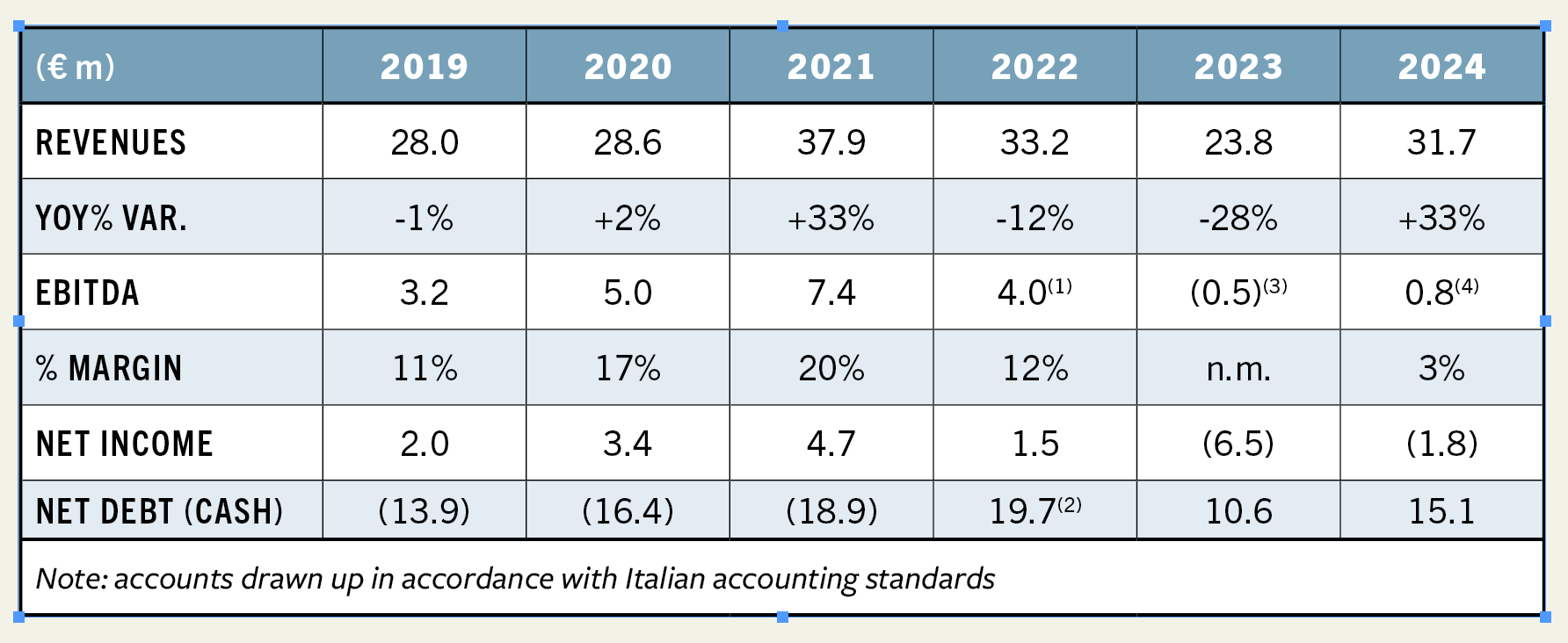

In 2022, at the height of the pandemic sales boom, Italmobiliare bought Sidi for 88 million euros, giving the shoe maker an enterprise value of 66 million euros with Sidi holding 20 million euros in cash. Sidi had revenues of about 38 million euros that year.

Italmobiliare’s investment group, which has existed since 1946, is Italy’s largest such group. It has a portfolio of holdings across many industries; among them is Tecnica Group, the parent of the Tecnica, Nordica, Moon Boot, LOWA, Blizzard and Rollerblade brands.

According an Italmobiliare statement, Sidi’s revenues last year were 31.7 million euros ($34.6 million), up a third from the year before, with ebitda of 400,000 euros and a loss of 1.8 million euros. The company does about 11% of its business in Italy and the rest in other countries, with Germany its largest single national market for both motorcycle and bicycle products.

New management

Davide Rossetti took over as CEO of Sidi on the day of the acquisition. His prior experience is highly relevant, with leadership positions at Safilo Group’s sport division (parent of the Carrera and Smith eyewear brands), Alpinestars and most recently Northwave.

Rossetti said modernizing Sidi’s operations and bringing in new managers and younger workers was a major aim.

Rossetti said modernizing Sidi’s operations and bringing in new managers and younger workers was a major aim.

“It was clear from the beginning that we needed to create a new group of managers to drive the growth,” he said.

Rossetti brought on new managers in finance, product, marketing, operations and sales.

“And basically we started from there,” he said. “We knew the potential because all of us are coming from the (cycling or motorcycle) industry or the sporting goods industry.”

Rossetti said Sidi’s new hires are, on average, younger than 33 years old (the average age company wide is now 42). Sidi’s Italian office has about 35 employees, plus another 55 workers in production and logistics at the nearby factory. Its factory in Romania employs about 160.

Rossetti favors data-driven decisions to complement Sidi’s passion for the sport and its skilled workers.

“Data helps us make decisions. For sure there is a passion part of the company that we put on the table but then we need evidence of a number for sustainable long time growth,” he said.

The staff quickly drew up a product road map that is starting to bear fruit with sales growth last year and a major product line launch this spring.

The staff quickly drew up a product road map that is starting to bear fruit with sales growth last year and a major product line launch this spring.

Sidi’s new shoes appear more streamlined and lighter than previous generations, with some new lightweight materials.

Some models maintain the “classic” Sidi fit, while other models have the new Millenium fit, which among other things has a larger toe box.

Some off-road shoes use a rubber outer sole material borrowed from the brand’s motocross boots, said to be grippier and more durable than anything previously used on bike shoes. Many shoes continue with Sidi’s iconic Tecno dial closures, which Rossetti noted was adopted by NASA on blood constriction cuffs, used to limit the effects of blood movements to the extremities in space.

Distribution a key factor

Sidi has more than 50 distributors around the world, self-distributing only in the Italian market. In the U.S. the brand was distributed for 20 years in the cycling market by Veltec, ending in 2009 when the company set up a subsidiary, Sidi America, in Monterey, California. In 2013, Sidi combined its cycling and motorcycle product distribution in the U.S. with the motorcycle distributor Motonation, which formed a division, Ciclista-America, to handle the bike products.

In July 2023, a year after the sale to Italmobiliare, the company announced that QBP would take over distribution of the cycling products from Ciclista.

“We had been talking for a long time already with QBP (before the change),” Rossetti said. “2022 and 2023 were not exactly the best years for the bicycle business and even QBP was probably reevaluating its business model,” he said.

The two companies reached an agreement that QBP would become Sidi’s exclusive distributor in the U.S. The distributor also announced an exclusive agreement with Continental tires the same year.

“We were not looking for a box mover, we were looking for a business partner. And today I would say it’s a very good collaboration, one of the best we have with the new distributors whether in bike or moto,” he said.

This week Sidi and QBP released a statement to BRAIN about how new tariffs on European imports will affect its business. The tariffs announced April 2 include 20% tariff on EU imports — less than the new tariffs on many other nations that made cycling shoes.

"There are no concrete actions that we're ready to share at this point. We remain fully focused on keeping our customers first, being as planful as possible, and being transparent if or when we do take actions," the companies said in a joint statement.