A version of this feature ran in the May issue of BRAIN.

BOULDER, Colo. (BRAIN) — For our May magazine edition, we asked our State of Retail panel members: What types of insurance do you carry, and have you increased coverage in the last 1 to 3 years?

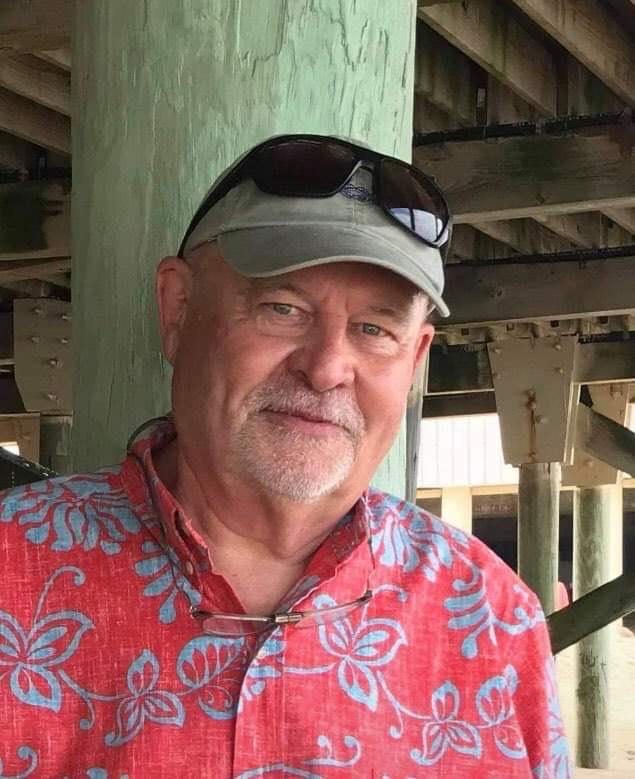

CARSON CITY, Nev: Win Allen, owner Win’s Wheels

We carry a wide variety of insurance coverage. The policies currently in place are for property, commercial general liability, business personal property (replacement cost), accounts receivable, valuable papers, electronic data processing, data and media, business income and off-the-premises coverage for when we work off-site at events. Because I relocated to Nevada from California, my business and business auto insurance requirements changed. In the last year, we increased our general aggregate limit from $1 million to $2 million and increased our deductibles from $500 to $1,000. This combination of adjustments helped to bring down or maintain our monthly payment close to what it was before.

Our business and auto insurance policies, which are provided by the same company, have both increased by 10% in the last 12 months. We have not had a claim since 2010, and we’ve never been late on a payment, but the rates keep creeping up with inflation. My insurance provider has been very easy to work with; that and their very competitive rates are what keep me with them.

CHARLOTTE, N.C.: Matthew Crawford, manager The Spoke Easy

We have the standard types of insurance policies for our business. General liability and workers’ compensation are the main types we carry. We renew these policies each year with our carrier and make changes as they require based on their questionnaire. We haven’t made any changes recently to our coverage. Our costs have been increasing in the last 1 to 3 years. For example, for no apparent reason, our workers’ compensation premium jumped up many thousands of dollars this year.

CHAGRIN FALLS, Ohio: Jacob English, owner Mountain Road Cycles

We carry standard liability, building, and inventory coverage. As far as healthcare for myself and employees, I find most have coverage from previous professions and would prefer a higher wage. The tricky part is providing for the employee plus their spouse. For a small business owner, these costs are through the roof. It’s like a second mortgage. In the last year, our other insurance costs haven’t really increased, based on yearly sales and an insurance audit. We have not added any coverage; however, we’re considering looking at our policies. While our sales inventory is lower than it used to be, the amount of high-end bikes in for service on any given day has increased. A lot of these have not been purchased from us, and I wonder about making sure the clients’ bikes are safe. Specifically, adding insurance coverage for electric bikes is on my mind.

CHICAGO: Gillian Forsyth, owner BFF Bikes

We carry policies for property, general liability, auto, and workers’ compensation, plus an umbrella policy. In the last 1 to 3 years, we have not added to our insurance coverage in terms of levels or types of coverage. We have seen cost increases, however. In the last year, it was only an increase of 5%, but in the last three years, it’s increased by at least 25%. Unfortunately, we have had several thefts in the last few years, so that probably doesn't help us. I did look into shutters for our windows as a means for theft prevention but they are a significant cash outlay, and I just don't feel comfortable spending that much money at this point. Despite having an industry specific middle man as our broker, I do plan on shopping around for better rates.

NEWINGTON, N.H.: Steve Gerhartz, owner Seacoast E-Bikes

We carry general liability, workman's comp, rental, vehicle, and event insurance. We started as an electric bicycle-only shop, so this coverage has been in place since then. We recently had an audit, and I was able to explain the precautions we take with battery storage and explain that all of the brands we carry are UL or CE-approved. CE is the European standard that indicates a product complies with European safety standards. Our insurance costs have increased as the dollar value of inventory on hand has increased; plus, we added another location. The cost for that was minimal. I expect to see much more scrutiny by insurance carriers in the future, especially if we see more battery failures, fires, or other negative press. We will also see more government regulation, and I hope they do not create legislation in a vacuum, which some states have done when trying to restrict e-bikes for various reasons. Recently, we helped kill a bill in our state that restricted e-bikes to 15 mph on trails, which was written with no input from the bicycling community.

WINTHROP, Wash.: Julie Muyllaert, co-owner Methow Cycle & Sport

We carry comprehensive business insurance to cover all of our exposures: inventory, sales, service, and rentals for bikes, e-bikes, Nordic skis and stand-up paddleboards. We also carry additional coverage for our coaching and event activities and a personal umbrella policy. We review our policies annually with our agent and adjust them as needed. Insurance coverage has been a challenge the last couple of years for two reasons: significant rate increases and our location in a landscape that has seen a rise in and intensity of wildfires in the last 10 years. Our previous primary insurance company dropped us in 2023 because of our location, even though we are within town limits with a fire hydrant adjacent to our property and are surrounded by green space and a state highway. It was difficult to find replacement insurance, and the two companies that were willing to offer policies quoted us rates 4x and 8x higher than our previous rate. Needless to say, we chose the more “competitive quote.” We will be shopping for a more affordable policy this spring but feel pretty powerless in the current insurance market.

AUSTIN, Texas: Audrey and Mark Sze-To, owners Electric Avenue

We have various policies and work with our insurance broker to ensure proper coverage for our business operations and locations. In the last 1 to 3 years, we have added some policies and reduced others. Our costs have increased each year.

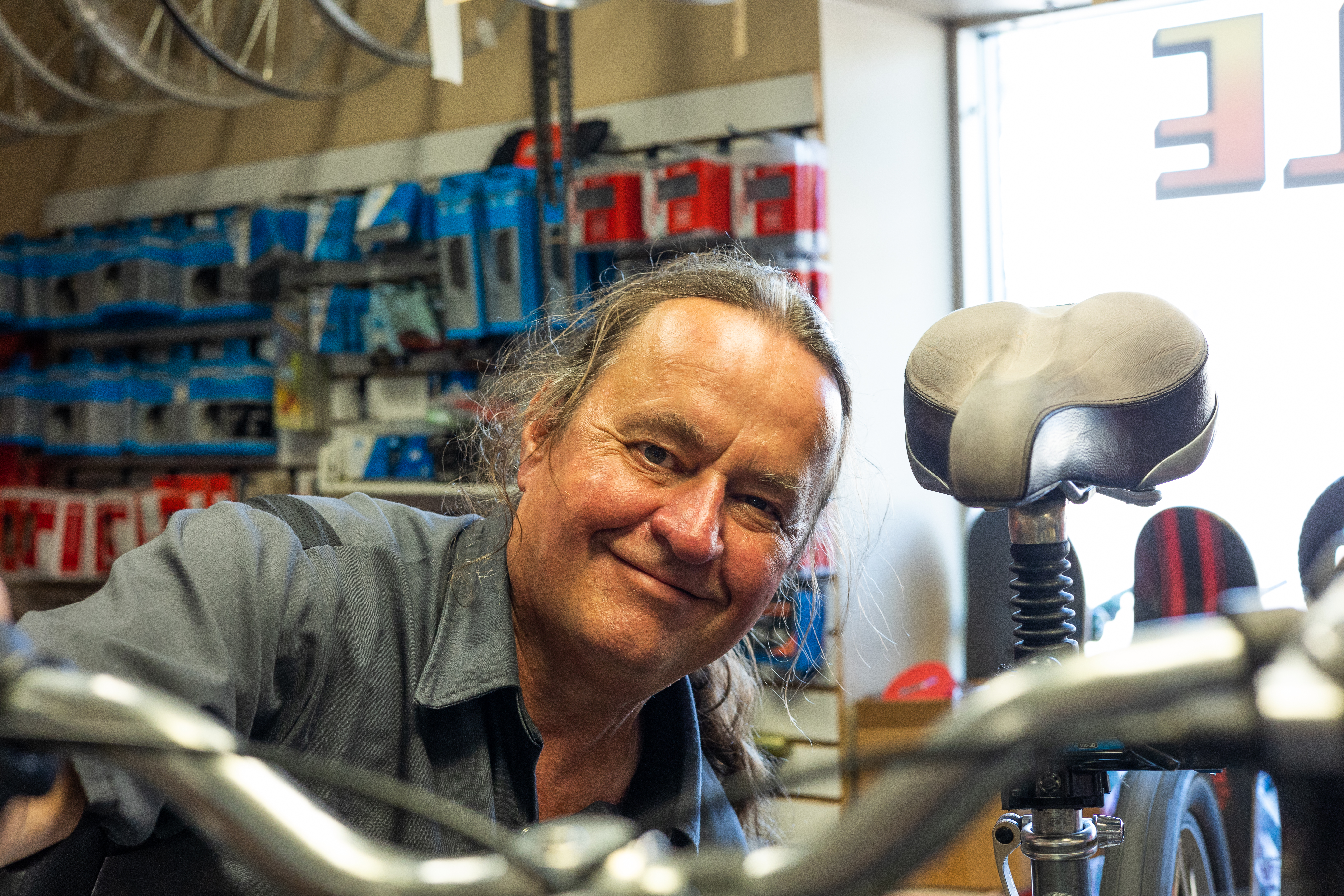

LITTLE FALLS, Minn.: David Sperstad, owner Touright Bicycle Shop

We carry policies for small business and bicycle retail and repair. We had to change insurance brokers this year as the previous broker didn’t have an account available for bike shops that sell electric bikes. We shopped around and were able to find a local provider — supporting local businesses is a priority for me because we like people to shop local in our store, so we should do the same. We did lower our coverage somewhat but made that up in working with partners on group rides and events. We are no longer the primary insurance carriers on such events. Still, our costs went up about 30% from the previous provider, and we lost the ability to hold group overnight rides. The impact of that is minimal because these types of rides had very little participation. For weekly group rides and events, we’re now partnering with our local community education office. We are covered under its insurance as it is the promoter and main sponsor, and we are just along as support. Yes, we are still covered by our own insurance on and off our premises but are no longer the primary group responsible for such group events or rides.

ALAMEDA, Calif.: Larry Tetone, event coordinator Alameda Bicycle

Insurance costs in general have increased, both in regards to costs specific to the bike industry as well as general employee coverage and benefits. Our shop carries general liability insurance, building/property insurance, and workers’ comp insurance, as well as what we pitch in for employee health insurance. When I look at spending, I see things as needs and wants, and for insurance, it's obviously a need. Our types of coverage haven't changed at all recently. It does highlight the importance of other areas of our business like margins — the financial pie can only be sliced so many ways, and if a business starts getting squeezed on costs like insurance, healthcare, rent, etc., then our reliance on profit from our bike and accessory sales becomes all that much greater. Instability from uncertain MAP and MSRP stemming from an overabundance of supply in areas adds to this. We try to make smart decisions and jump on good deals when they are available.

Loss is another issue tied up with insurance as well, and certainly we try our best to mitigate accessories and bikes walking out of the shop. We use GPS trackers on more expensive bikes that go out on test rides. It's helped us recover two fairly expensive bikes so far. We've seen the effects large scale break-ins can have on some shops, both from a financial situation and general morale.