OGDEN, Utah (BRAIN) — ENVE Composites is returning to its roots as a Utah-owned and managed brand after several years as part of a global sports empire, the company’s general manager says.

Since 2016, ENVE has been owned by Amer Sports, the parent of major brands like Wilson Sporting Goods, Arc’teryx, Salomon, Louisville Slugger (and, for a time, Mavic). Amer announced early Tuesday that it had agreed to sell the company to a Utah investment group for an undisclosed amount.

The sale followed Amer's hiring of Mike Stimola as general manager in early 2023.

Stimola's LinkedIn account describes him as a “Turnaround CEO.” He has a background in the restaurant and healthcare industries, but also came to ENVE with some relevant experience as a Cannondale board member from 1997-2003 and in the 1980s he was founder and CEO of a Connecticut-based carbon fiber supplier, Carbonite. He told BRAIN that Amer brought him in to “look at next steps for the brand.”

Stimola said what was clear to anyone reviewing Amer’s portfolio: ENVE didn’t really fit, especially in relative size. As Stimola put it, “We are in the millions, they are in the billions.” And despite ENVE’s expansion into offering frames and complete bikes, and a brief foray into softgoods, there wasn’t an obvious path to grow the company to become an Amer-sized brand, he said.

Instead, the company identified potential buyers. It talked to industry companies interested in a strategic acquisition, but returned to Mark Hancock, an ENVE customer who lives 20 minutes from the ENVE factory and whose son worked one summer at ENVE as a wheelbuilder.

Instead, the company identified potential buyers. It talked to industry companies interested in a strategic acquisition, but returned to Mark Hancock, an ENVE customer who lives 20 minutes from the ENVE factory and whose son worked one summer at ENVE as a wheelbuilder.

“He’s a longtime fan of ENVE; I think he owns two custom (ENVE) road bikes,” Stimola said.

Hancock is the founder of PACS Group, a holding group for healthcare providers that went public on Nasdaq this month in an IPO that raised $450 million. Hancock is now a board member at PACS. PV3 Investments, the entity that acquired ENVE from Amer, is Hancock's “family office” investment group, Stimola said.

“He’s still a businessman. He wants ENVE to be in a really good place. It’s important that we maintain the stability and the strong business plan we have in place now, and the strong management team we have,” Stimola said.

He also said he expects Hancock to be involved in running the company.

“Mark is not a buyer looking to build it up and sell it, he’s interested in the long term. This is an investment, not a private equity,” Stimola said.

Manufacturing, bikes and IBDs

ENVE continues to manufacture its rims and custom road frames in its 80,000-square-foot factory in Ogden. Components and stock frames are made in Asia. Stimola said the company remains committed to making all its carbon rims in Utah "forever," and may bring the production of some smaller parts back to Utah. But he said its usual strategy, for products other than rims, is to develop products in the U.S. and then move production overseas when demand exceeds the capacity of the Utah facility.

Over the past year, ENVE has added internal and outside sales reps to reach out to independent bike dealers, he said. While ENVE sells direct to consumers online, it directs potential buyers to IBDs for most purchases, and especially for complete bikes, he said. The only complete bike that can be purchased directly from the ENVE website is its custom road bike, which can be configured on the site.

"Over the past year we've focused on increasing our relationships with independent bike dealers in the States, and in Europe we've consolidated our distribution into one location in France. We are building out our rep group in Europe under that distributor, so we've opened a number of additional bike dealers in Europe. So we are developing a parallel model in Europe to the U.S.," he said.

Amer days

When Amer acquired ENVE (in 2016, for $50 million), Amer was based in Helsinki and publicly traded; the company also owned Suunto and Mavic at the time. Under Amer, ENVE went through some chaotic times as the company was briefly paired with Mavic and the other brands based in Utah and went through several leadership changes. In 2019, Amer was acquired by the Chinese sports conglomerate Anta Sports, which divested Mavic, Suunto and other brands, before taking Amer public again this year.

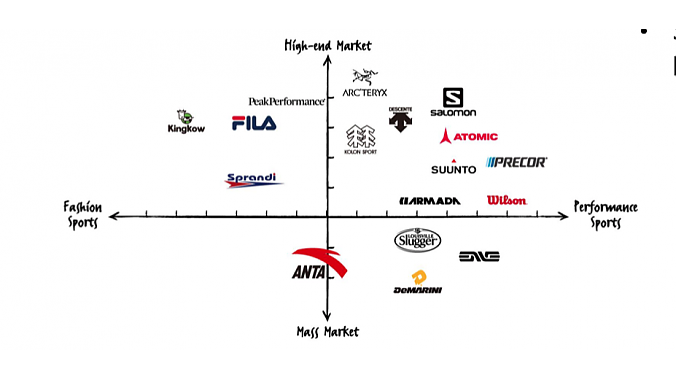

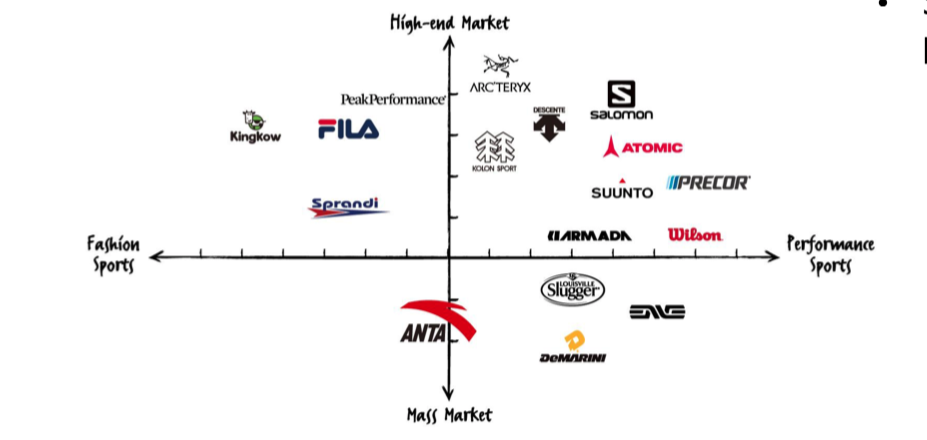

At one point in 2019, an Anta Sports financial report included a brand portfolio graphic (right) that positioned ENVE as a mass market brand, to the surprise of the high-end brand's leadership in Utah. Under its most recent structure, ENVE was paired with snowboard brand Armada in Amer financial filings. The filings show ENVE and Armada had combined revenue of $57 million in 2022, accounting for just 1.12% of Amer's total sales.

But while its ownership structure and brand portfolio mates changed, ENVE did not appear starved for resources: it entered the frame and bike market in 2021, and has expanded its athlete and team sponsorship to include supplying wheels and handlebars to the UAE Team Emirates team, home of two-time Tour de France winner Tadej Pogacar. ENVE also is the bike, wheel and cockpit component supplier for Team TotalEnergies, a UCI-registered ProTeam.

ENVE began offering softgoods in 2022, a natural growth strategy for an Amer Group brand, Stimola said. But the apparel program ended after Stimola joined the company.

"Amer has been a good owner," Stimola said. "But when I came on, I said it’s all about focus, focus,” he said.

Teams and athletes

Stimola said he expected ENVE to continue to sponsor high-level teams and athletes.

“Totally, that was one of our strategic initiatives and our goals, and the buyers have full buy-in to what we are doing. (Sponsorship) is a key part to what we do; it serves a lot of purposes. Obviously, it’s a great marketing tool for us, but we develop a lot of product (through the athlete relationships). We have the best of the best riding our product and we get great feedback … it means a lot to us, it’s core to what we do and what we are going to do.”

Asked if ENVE had been profitable in recent years, Stimola said, “ENVE is in a much better place than we were a year ago. And that’s a tribute to the people here. All we did was put the focus on what matters and the people responded. So we are growing over last year and we are growing in profitability,” he said.

While Amer brought in Stimola to evaluate strategic opportunities for ENVE and to manage the sale, he said he’s committed to staying with the brand at least through this year. “ENVE is pretty addictive. I like the core culture, and it’s only an hour's flight from my real home in Arizona,” he said, suggesting he might be interested in staying longer.