FRIEDRICHSHAFEN, Germany (BRAIN) — It was a hard-to-miss trend at Eurobike this year. Electric drive systems are now appearing on the holiest of holy bikes: the high-end performance road bike.

Several brands, including classic road bike brands like Pinarello, Wilier Triestina, Bianchi and Focus, have launched new e-road bike models, and other brands are queuing up their own offerings.

Many of these bikes are coming to the U.S. market — but not as quickly as their brands would prefer. That's because the hot drive system of the moment, the compact Evation unit made by Munich startup Fazua, has not yet received U.S. regulatory approval. Fazua officials expect to receive the green light in the first half of 2019.

Focus, for example, is champing at the bit to begin selling its Paralane Squared e-road bikes in the U.S. The bikes are now hitting European markets.

The delay "affects us on a daily basis. We get requests, definitely on a weekly basis, from end consumers or retailers about this bike," said Andreas Krajewski, marketing manager for North America. "We actually see the consumer pull that every brand wants to have. That's great, but it's not great when you can't deliver the bike. We could sell them today, that's for sure."

Fit for the road

The unique demands of road bikes have created an opening for new drive system suppliers like Fazua and Spanish company Ebikemotion. The drive suppliers that now dominate the premium electric bike market, including Bosch, Brose and Shimano, are for now excluded from the market because their mid-drive motor systems are too bulky and heavy.

"You don't use the battery for two hours or three hours. You just maybe use it for 20 minutes."

Bafang, the giant Chinese drive supplier, launched a new system for e-road bikes, the M800, and should pick up spec in future months. The Italian car brand Maserati showed a Bafang-equipped road bike at Eurobike. The bike was developed with Diavelo, an Accell Group-owned brand. Bafang's 200-watt motor is paired with a small 200 Watt-hour battery, keeping the total system weight down to under 10 pounds.

Bafang says the motor "has been tuned to perform optimally when starting off and accelerating, as well as on short sprints and steep climbs." When the motor's maximum assist speed is reached, the drivetrain unit runs almost resistance free, the company claims.

While Fazua and Bafang put the motor in the bottom bracket, the Ebikemotion X35 drive relies on a compact 250-watt rear hub motor.

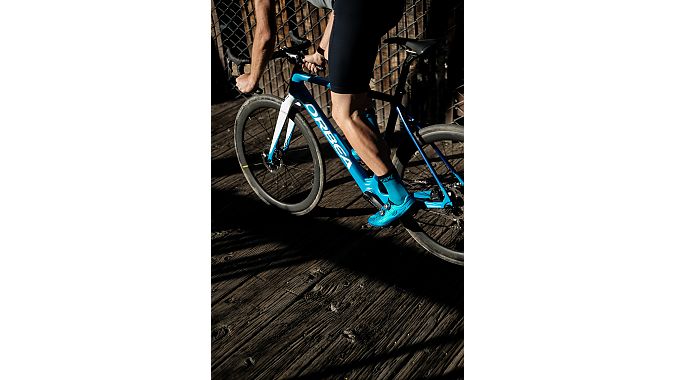

By using the Ebikemotion system, Orbea and Bianchi have sidestepped the Fazua delay. Their new e-road bikes, the Orbea Gain and Bianchi Aria E-Road, will be available at U.S. retailers in the fall.

Jim Stevenson, vice president of sales and marketing for Bianchi in the U.S., said about the e-road bike market here remained "undiscovered."

"We don't know the size of the market. We'll bring it in and we're going to go out and put it out there and let people try it," Stevenson said.

With a price tag of around $6,000 to $6,500, the Bianchi Aria is intended for serious road cyclists, not for riders who just want a transportation bike. (Bianchi released another e-road bike, the Impulso E-Road, last fall that uses a mid-drive system from Italian company Polini. But Stevenson said Bianchi doesn't plan to offer the Impulso E-Road in the U.S.)

Stevenson expects the Aria to appeal to longtime cyclists who want to ride centuries but don't have the time or stamina to train. Bike tourists are another target customer, especially couples where one is a stronger cyclist than the other.

"Regardless of how big the market is right now, it's a market that will be there and will grow over the next 10 years," Stevenson said.

The Ebikemotion system weighs 3.5 kg, or under 8 pounds, which allows for complete carbon road bikes that weigh less than 26.5 pounds.

Jordan Hukee, Orbea's creative director, said the U.S. will focus on Orbea's second-generation version of the Gain with a carbon frame. Orbea originally launched the bike in Europe with an aluminum frame.

That's because the Gain Carbon, which Orbea says is the lightest e-road bike now on the market, is aimed at cyclists who are already accomplished road bikers, so they are used to bikes that are light and sleek. "Everyone's just been dying over the carbon one," Hukee said. Orbea will also offer a gravel version of the Gain with a 1x SRAM drivetrain and 40c tires, and a flat-bar version for the urban market.

Orbea announced the Gain in July and U.S. journalists were able to test it out at the Impact Sun Valley media event. In a review this week, Outside Online called the Gain "the most cutting-edge concept in e-bikes right now: it’s the closest thing I’ve seen to a single bike that can be ridden enjoyably with or without electric assist."

While road cyclists can be traditionalists, some in the market believe e-road bikes will have an easier chance of market acceptance than e-mountain bikes simply because they are less controversial.

"The harshest blowback in the U.S. market to e-bikes has been related to trail access, which of course is a non-issue for road bikes," said Julie Kelly, a spokeswoman for Focus. "Our expectation is that out of the gate, there's going to be an easier threshold for an e-road bike to overcome for that reason."

Newcomer Fazua makes waves

Electrified road bikes are not new. The most notorious drive system is one made by Vivax, an Austrian company. The system, which fits inside a typical downtube, was linked to incidents of cheating by professional racers — only adding to the system's reputation.

But days before Eurobike, Vivax abruptly pulled out of the demo and the main show, citing "restructuring in the company."

Instead, Fazua seems to be riding the e-road bike wave. The young company recently received an $8 million infusion of investment capital and has been growing its workforce quickly. From its founding in a small room in Munich, Fazua now employs 50 people and has moved to a three-story building in the Munich suburbs.

Fazua co-founder Fabian Reuter said Eurobike 2017 was when everything "exploded a little bit" for the company, as high profile brands like Focus highlighted the drive in concept bikes.

"We decided to produce ten times more drive systems for [model year] 2019, which just started, than we had the year before," Reuter said. That led to a scramble for financing and employees. Reuter said production for MY2019 models began in May, and the company is delivering on time to customers.

"Right now — right in the middle of starting and producing our MY2019 orders — we are also preparing the upcoming model years 2020 and 2021, and we have to predict how many drive systems we think we can sell," Reuter said. "For this prediction, the U.S. market is a big thing for us."

But part of that depends on how quickly Fazua can receive approval from U.S. regulators for the drive system. The company also needs to find a U.S. partner to handle servicing for the Evation drive system. Reuter hopes to meet with potential service partners at Interbike, where it will have a booth.

"It would be best to have a very big partner, and service wherever you need it, and maybe a partner that everybody trusts," Reuter said.

One benefit for OEMs is that the Evation system mounts in minutes on an assembly line. The bottom bracket attaches with four screws, and there's only one cable that runs from the drive unit to the handlebar controller.

Fazua sees an even bigger potential for "really cool" urban and transportation bikes, along with gravel road bikes. Lapierre is even using an Evation system on a new full-suspension e-MTB.

Pinarello uses a Fazua Evation system on its $7,000 Nytro, launched last November in Europe. The launch was marred, at least in the U.S., by an advertising and social media campaign many perceived as sexist. Even repeating the company's marketing claims on our website earned BRAIN a raft of hate mail that editors won't soon forget.

E-road changes the game

The emergence of e-road bikes also has the potential of changing the "spec wars" in e-bikes. Instead of going for ever-larger battery packs and higher-powered motors, an e-road bike is all about using as little as possible.

"We dropped the weight and dropped the watt-hours, which is totally contrary to what e-bike manufacturers are marketing," Krajewski said. "They want to have bigger batteries, more power, whatever. But we flipped it around and said, we want to go with a battery that's just enough for one climb or two climbs, and that's it."

He added, "You don't use the battery for two hours or three hours. You just maybe use it for 20 minutes."

Another brand "feverishly" awaiting U.S. regulatory approval of the Evation system is Fantic, the Italian brand that is mostly known for its e-mountain bikes.

"I really think the same pattern we've seen on the e-mountain bike side will happen on the e-road bike side, and actually even quicker, because these systems are smaller, sleeker and more integrated. They just don't scream as loudly, 'hey, we're an e-bike,'" said Rich Kelly, national sales manager for Fantic. The company is selling two e-road bikes in Europe. One is a gravel bike and the other more of a classic road bike.

Bulls Bike, a big German brand with a small but growing U.S. presence, is also anticipating releasing its Fazua-equipped e-road bike in this market.

"This is a segment we are taking very seriously. In fact, we are bringing a couple of e-road bikes with the Fazua system to this year's Interbike," said Fernando Endara of Bulls. "The American interest is definitely there, and I think Fazua is the obvious way to go."

Bulls brought a drop-bar e-gravel bike, the Dail-E Grinder, to the U.S., which it equipped with a Bosch CX mid-drive motor. "That thing was sold out in less time than we expected," Endara said. "So, yes, this is a segment we've got our eyes on."

Giant has offered an e-road bike model for years, and is currently offering the second generation of its Road-E+ model in the U.S. It's a more traditional e-bike with a heavier mid-drive motor and a semi-integrated battery on the downtube.

John Munhall, director of product management at Giant USA, said the bike has mostly appealed to older riders who seek a fitness bike that will let them keep up with their riding buddies. The Road-E+ also appeals to cyclists who don't equate a road bike ride with an act of endurance.

"Traditionally as road cyclists and mountain bikers, we take pride in suffering," Munhall said. "But there is a faction of riders that want to enjoy the romantic beauty of road riding without that X-factor of punishing themselves in tough terrain."

Editor's note: A version of this story appears in the August 15 issue of Bicycle Retailer & Industry News.