As we lurch into the fourth consecutive year of a volatile cycling market, I'm reminded of a saying often misattributed to President Dwight Eisenhower: "Things are more like they are now than they ever were before." Sure, it's a nonsensical statement, but in the current case, it happens to be particularly true: the state of the bike biz is entirely unlike anything this industry has seen in the past fifty years ... and probably a lot longer than that.

Coming into the third quarter of 2022 with product availability beginning to stabilize, we are faced with a possible Perfect Storm of threatening market conditions. In particular, I see three vectors coming together that, while individually troubling, might prove disastrous to the industry's health in combination. These are flat to declining ridership, oversupply of product, and the coming recession.

Vector #1: flat to declining ridership

Hopefully some of those new riders will stick around, but I'm betting ridership will slowly decline to historic post-Great Recession levels.

Hopefully some of those new riders will stick around, but I'm betting ridership will slowly decline to historic post-Great Recession levels.

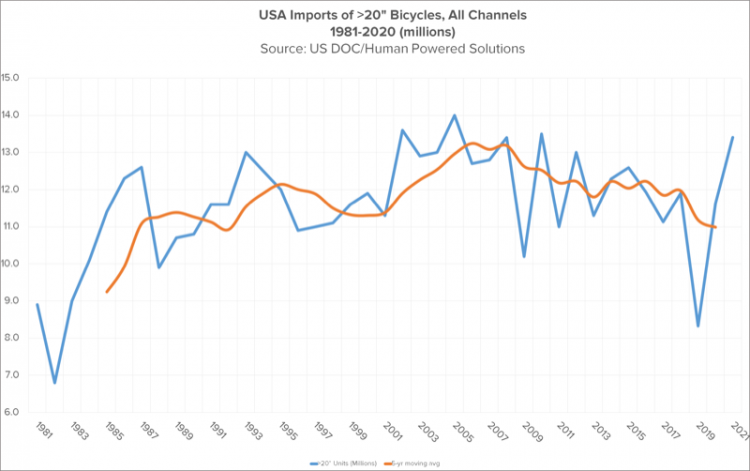

As we discussed in detail last month, the Covid pandemic brought us a welcome net surge in ridership of nearly 20% in 2020, and that number stayed strong in 2021. New customers were coming into bike shops in levels we hadn't seen since 2005, but there wasn't enough product to fill that demand and a lot of potential sales were left on the table.

With lead times stretching into 2022 and even '23, dealers and suppliers placed huge "firm and noncancelable" bets that demand would remain strong. But will it? The answer depends on whom you talk to.

Some dealers I've spoken to recently are reporting ongoing high demand. But according to an informal BRAIN survey, more than half of retailers saw their year-over-year sales slacken in Q1 of 2022.

My take is that the unique conditions of the 2020-21 pandemic directly caused the ridership surge, and that as those conditions gradually revert to normal (whatever that means in the post-pandemic era), much of that surge will go away. Hopefully some of those new riders will stick around, but I'm betting ridership will slowly decline to historic post-Great Recession (2010–2018) levels.

Vector #2: product oversupply

In some categories, that bubble of new cyclists has already hit its peak. They've bought what they need and won't be in the market for replacements for years. Others will leave the activity and their new purchases will gather dust or be upcycled into clothing hangers. And yet many dealers and suppliers have continued ordering for 2022 and 2023 delivery as if the 2020-21 market growth would never end.

Some categories are already overstocked and under-demanded. As one industry observer put it, "the indoor trainer market was in front of this by about 6 months. So far Wahoo has had layoffs, Saris is undergoing state bankruptcy realignment, and Zwift killed off their hardware dreams. That market dried up overnight."

Other categories won't be far behind.

In terms of bikes, in 2021 we imported more units than at any time since the Great Recession ended. In some categories, retailer inventories are currently full and suppliers' warehouses are bulging at the seams. And remember there are still orders for more product stacked up well into next year.

All that inventory has to go somewhere. When the pipeline is full and there's still more product coming down the pike, there's only one proven way to pull more sales through the supply chain: reduce pricing (and profits) to stimulate market demand. And sure enough, some brands are already announcing midseason discounts. The folks at The Bike Cooperative, SmartEtailing and NBDA have even come together to create a direct-mail promotion with comped-up sale ads for its clients.

"What's happening now is that dealers need to run promotions to sell more inventory," SmartEtailing president Ryan Atkinson told me, "and having a sale is one tool they can use to stimulate demand."

Vector #3: the looming recession

Already low margins for suppliers and retailers alike will be whittled down even further. Eventually, something has to give. As if all that weren't enough, there is a recession on the horizon. The US gross domestic product already decreased by 1.5% in the first quarter of 2022, and many experts believe we'll be in a full-on recession by Q1 of 2023, if not sooner. The question of exactly when the drop will come is best left to the experts, but even the threat of an imminent recession is bad for public confidence. And it goes without saying that this does not make for a great time to move an oversupply of bikes to a dwindling community of riders, at any price.

Already low margins for suppliers and retailers alike will be whittled down even further. Eventually, something has to give.

Combine an economic downturn with product oversupply on the one hand and a flat to declining rider base on the other, and we may be in for a sustained period of long-term or "evergreen" discounts. Pretty much everything will be perpetually on sale, all the time, all year long.

We're already seeing the first wave of failed businesses and financial troubles in the trainer market. I'm sure there will be more segments — and more failed businesses — to come. Watch for more cashed-strapped operations, both retail and wholesale, either being acquired at fire-sale prices or going out of business entirely.

Frankly, I would love to be wrong about this. But the scenario seems increasingly clear. The roller coaster is pulling out from the departure area even as you read this. It's going to be a wild ride. And the best we can hope for is to sit back, strap in, and hang on.