By Jay Townley

Editor's note: Townley is the Resident Futurist at Human Powered Solutions, an industry consultancy.

From January 1983 through October of that year I served as Vice President and Assistant to the President of the Schwinn Bicycle Company with my primary focus being the closing of the company’s domestic factory in Chicago and moving 90% of the production to Taiwan and the remaining 10% to a domestic contractor.

From November 1983 until leaving the company in April 1990 I served as Vice President Purchasing and was responsible for converting the company's purchasing and logistics operations from supporting a domestic build-to-order manufacturing and parts supply model to supporting an import ship-to-order wholesale model.[footnote]

I am referencing this seven-year period because I want to confirm that I was a purchasing and logistics practitioner in the American bicycle business, and while it was 30 some years ago, I still have first-hand experience with and knowledge of the current supply chain nightmare.

Over the last 30-plus years, the U.S. bicycle business has become totally import-dependent and that dependency has migrated from Taiwan to China since 2000 to the present. Table 1 is taken from the NBDA U.S. Bicycle Market Overview 2020 Report (where it is identified as Table 19), and it shows U.S. Bicycle Market Import and Estimated Domestic Production as Percent Shares of Annual Market Consumption from 2911 through 2020. Over the ten years shown imports have a low of 96% to a high of 99.7% of the U.S. bicycle market.

Table 1

U.S. Bicycle Market

Import and Estimated Domestic Production

Percentage Share of Annual Consumption

2011-2020

|

|

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

|

Domestic%* |

0.4 |

0.3 |

0.4 |

1.1 |

2.5 |

2.8 |

4.0 |

3.0 |

4.0 |

3.7 |

|

Imports%* |

99.6 |

99.7 |

99.6 |

98.9 |

97.5 |

97.2 |

96.0 |

97.0 |

96.0 |

96.3 |

|

Total |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

100.0 |

Sources: U.S. Department of Commerce Import and Export Statistics for 2011-2020; The Gluskin Townley Group estimates for 2008-2016; Human Powered Solutions 2017 - 2020 * Excludes exports.

Does not include e-bikes or used bicycles.

Table 2 is also taken from the NBDA U.S. Bicycle Market Overview 2020 Report (where it is identified as Table 31), and it shows U.S. bicycle imports by Country of Origin for the last three years, 2018, 2019 and 2020. China has dropped from the source of 94.9% of total U.S. bicycle imports in 2018 to being the source of 88.9% in 2020.

Table 2

U.S. Bicycle Imports by Country of Origin

2018, 2019, 2020

Units and Country Percentage of Total

|

Year |

China Units |

Taiwan Units |

Cambodia Units |

Vietnam Units |

Other Countries Units |

World Total U.S. Imports |

|

2018 |

16,287,067 |

581,209 |

128,364 |

7,769 |

166,180 |

17,170,589 |

|

2018% |

94.9% |

3.4% |

0.7% |

0.0% |

1.0% |

100% |

|

2019 |

11,578,356 |

792,931 |

264,919 |

104,809 |

147,798 |

12,888,813 |

|

2019% |

89.8 |

6.2% |

0.8% |

0.8% |

1.1% |

100% |

|

2020 |

15,109,868 |

755,691 |

793,715 |

104,308 |

226,614 |

16,990,196 |

|

2020% |

88.9% |

4.4% |

4.7% |

0.6% |

1.3% |

100% |

Source: Bicycle Retailer and Industry News March 2021 Issue; Human Powered Solutions Analysis

Obviously, the Section 301 25% punitive U.S. tariffs which were imposed on imports from China in 2018, in addition to the standard 5.5% and 11% import tariffs on bicycles and the “0%” tariff on e-bike. They were suspended in late December 2019, and remained suspended throughout 2020, but were reimposed late December 2020. They seem to have had no appreciable effect on the consumer demand at retail for bicycles and e-bikes — until, perhaps, most recently.

Also of interest is the subtotal of U.S. bicycle imports from the four Asian source countries of China, Taiwan, Cambodia and Vietnam, with 99% in 2018, 97.6% in 2019 and 98.6% in 2020, leaving only 1.3% of total U.S. bicycles imports coming from any other source country.

This becomes extremely important to the evolving supply chain nightmare when viewed in the context of reports in the last week that COVID-19 is surging back into Asia-based supply chains – creating a fresh wave of disruptions and bottlenecks from ports in China to factories in Taiwan and Malaysia.

According to The Wall Street Journal Logistic Report June 11, “Dozens of vessels are backed up off the Yantian port in Shenzhen, straining fragile shipping operations that have been battered by a persistent empty container shortage and a continuing bottleneck at U.S. West Coast ports.” The reason? A shortage of workers because of a surge in COVID-19 cases!

Container costs are soaring, and logistics service providers report desperate American importers are paying well beyond even the listed spot rates. Human Powered Solutions (HPS) Senior Logistics Advisor, Dave Karneboge reported on June 7 that the none contract rate, which currently represents about 30% of container shipments is currently $10,000 for a 40-foot container that cost under $2,000 a year ago. Twenty-foot containers now cost $9,000 – a cost that makes them currently unaffordable, and HPS is advising clients to use freight consolidators until container prices come back down.

A recent Sea-Intelligence analysis shows an estimated 60% of container ships globally were late in arriving at ports in March, and according to the Wall Street Journal Logistics Report this “… trend toward increasing delivery delays” has undercut the efforts of brand and retailers to restock depleted inventories.

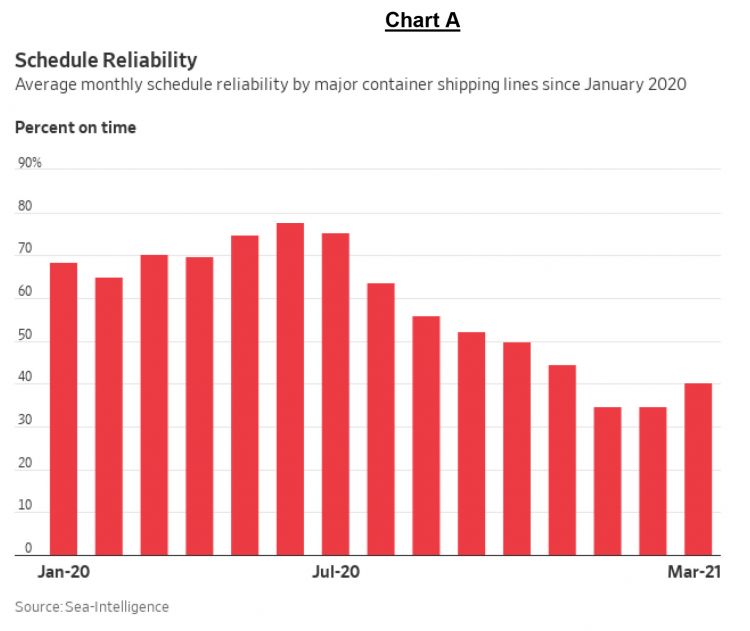

The following Chart A is from Sea-Intelligence and shows the Average Monthly Schedule Reliability by Major Container Shipping Line Since January 2020 through March 2021.

Note that the Average Monthly Schedule Reliability has steadily declined since July 2020, and while it did increase in March 2021 it was at 40% On Time, meaning 60% of scheduled container shipments were late – adding to the uncertainty and disruption.

Bicycle Retailer and Industry News ran an article June 11 quoting a Shimano Newsletter announcing the component brand's “… Malaysia factory is shut down completely until June 14 based on the Malaysian government direction.” So far, the Malaysian government has not informed Shimano what it plans to do after Tuesday, so stay tuned. The reason for the Shimano factory being shut down? The current COVID-19 situation.

This past week Taiwan announced an alarming increase in COVID-19 cases and deaths and the spread of the virus into Taiwan’s factories that are threatening to delay shipments that are already behind schedule because of component shortages.

While relatively small, with 23.86 million people, Taiwan is, in many ways, the linchpin in the American bicycle business supply chain, and it is suffering from its first large COVID-19 outbreak. It is estimated that about 80% of the bicycle export business done by China is owned or controlled by Taiwanese companies and brands and this supply chain is already under huge pressure, so any further reduction in supply capacity is going to exacerbate the shortages.

While discussing this situation at the end of this past week the HPS team was informed that a component brand (not Shimano) had just announced a new lead time, out to December 2024 – that, in turn, was threatening new start-up customers with literally shutting down.

Part of this situation is being driven by both the availability and rising cost of raw materials. On June 2, The Wall Street Journal reported that: “China’s factories are buckling under the weight of rising raw materials prices.”

According to this article: “Some manufacturers are refusing to accept new orders and are even considering suspending operations” and while we could not confirm that any of these manufactures are in the bicycle supply chain, the article did go on to report that the pressure to suspend operations was the result of “… the added costs weigh on production and threaten to further strain global supply chains.”

There is no question that many Chinese manufacturers have passed along higher costs to overseas buyers, evidently, some are finding it hard to raise prices enough to make up the difference.

The quandary The Wall Street Journal is reporting is just the latest result of COVID-19-led disruptions that have thrown supply and demand fundamentals grounded in Just-In-Time, or JIT Systems, off-balance, triggering shortages in many sectors and soaring prices for many commodities.

From 1990 to 2020 the bicycle industry's global supply chain has been focused on improving and refining JIT manufacturing and logistics. The JIT System was conceived by an American, Dr. William Edwards Deming (Oct. 14, 1900 – Dec. 20, 1993), an American engineer, author, and management consultant. Deming helped develop the techniques still used by the Asian bicycle supply chain manufacturers engaged in exporting their products to the rest of the world.

Deming is best known for his work in Japan after WWII, particularly his work with the Japanese industry leaders, including Toyota. That work began in 1950 and was soon embraced by Shimano Corporation and spread to the rest of the Japanese bicycle industry and the Taiwanese and eventually the Chinese bicycle industries. However, Deming and his JIT System was not known, recognized, or taught in the U.S. until the early 1990s.

At its very best the JIT System forecasts, purchases, manufactures and delivers on the day and hour that a component is planned and required for assembly of a manufactured product so that it can ship on schedule and be delivered anywhere in the world on the day it is scheduled to ship to a retailer or directly to a consumer. This is the ideal that was, continually strived for, and while not often achieved pre-pandemic — most supply chains came close.

These are the supply and demand fundamentals of the bicycle supply chain that are grounded in JIT Systems that COVID-19 led disruptions have thrown off balance!

Today, because of the growth of direct-to-consumer and the mindset of the JIT supply chain there has been inventory and ongoing demand, in just about every zip code in the U.S., and companies, including bicycle brands and retailers, are struggling with the trade-off between the customer experience and the cost of inventory — in the midst of -shortages created by a supply chain that is totally off balance.

At the OEM side of the supply chain, what is being reported is: China’s factory owners hoping that if they delay orders or slow production, they will be able to ride out the present period until commodity prices normalize or global demand for consumer goods cools.

Assuming that this reporting is at least partially if not totally accurate, this represents a bigger gamble than that taken by the American bicycle importers in reducing order flow in 2019 to minimize the financial impact of Section 301 punitive 25% tariffs. The end result then was a self-imposed shortage of 4.4 million fewer bicycles to meet the increase in consumer demand during the first two quarters of 2020 – when the Chinese OEMs could not increase production to meet the increased orders from the American importers.

The gamble the Chinese factory owners (including those owned or controlled by Taiwanese) are taking now has the immediate impact of more inflation across supply chains, including the bicycle supply chain, right down to the showroom floor and store shelves. While there is a lot of speculation right now about inflation, the most significant comparison with the consumer price index won’t be available until early next month so we will hold further comment on this topic until the beginning of the third quarter.

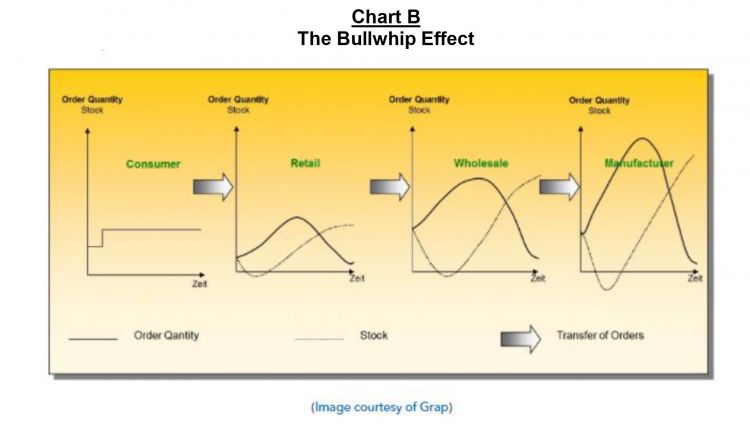

Of more immediate concern relative to the U.S. bicycle business supply chain is what logistics experts refer to as the Bullwhip Effect. The bullwhip effect (also known as the Forrester effect) is defined as the demand distortion that travels upstream in the supply chain from the retailer through to the wholesaler and manufacturer due to the variance of orders which may be larger than that of sales.

Chart B illustrates the Bullwhip Effect, starting with the consumer to the left, which is the handle of the bullwhip, or consumer demand.

The dark lines represent the Order Quantity, and the lighter lines represent the Stock or Inventory in the supply chain, starting with the retailer, followed by the wholesaler, or brand, and finally the manufacturer to the far right.

What is not shown in Chart B is component brands and manufacturers who certainly play a key role in the industry supply chain for bicycles and e-bikes to meet consumer demand.

However, Chart B does provide a visual representation of how the Bullwhip Effect manifests itself, moving from the consumer, upstream to the manufacturer. It's the reason why American brands and wholesalers are doing everything possible to minimize its effect, despite the supply chain nightmare.

The bullwhip effect in the supply chain can be reduced through shared knowledge with suppliers and retailers. If members of the supply chain can determine there is skewed or bad information causing the overreactions they can be resolved through improved communication and the exchange of accurate and timely information and data. However, this cannot be a one-way street and has to be open two- or three-way communication.

This only serves to emphasize what we have come to realize — 2020 was an Inflection Point! Economists tell us an Inflection Point Event, like 2020, results in a significant change in the progress of an industry, business or sector and can be considered a turning point after which a dramatic change, with either positive or negative results is expected.

Twenty-twentyone is truly a supply chain nightmare, but that doesn’t mean the American bicycle business cannot quickly learn and adapt to shifts and changes in consumer buying habits and change and modify both the supply chain and supply chain logistics to adapt to consumer wants and needs and turn the nightmare into a positive result — a dream for the future!

[1] Schwinn Bicycle Company established a national network of four regional warehouses known as Sales Companies from 1964 through 1977 that stocked and sold parts, accessories and tires and tubes to Schwinn retail dealers, along with a backup stock of bicycles and exercisers. So a complete wholesale warehouse structure was already in place when bicycle and exerciser manufacturing converted from domestic manufacturing and build-to-order to foreign sourcing and importing and ship-to-order from 1983 forward.

HPS is a unique consultancy focusing on product development, sourcing, logistics and operations for its clients in human transportation and micromobility. To learn more visit humanpoweredsolutions.com.