Last year, BRAIN published three articles — available here, here and here — about Christopher Georger's list of nearly 7,000 US bike shops gleaned from dealer listings published by some sixty-ish US bike brands. Now Georger is back, with a fresh look at the dealer picture for 2020. This time, his data offers some tantalizing details about how dealers interact with suppliers to create the bike industry's retail landscape.

For starters, Georger groups the nation's bike brands into three classes, or Tiers. Tier One is the top four brands, which I've taken to calling The Quadrumvirate — Trek, Specialized, Giant and Cannondale. More about them in a minute.

Tier Two is the remaining six brands that make up the "top ten" of bike suppliers. If cutting the list off at ten brands seems arbitrary, keep in mind that together, Tiers One and Two are collectively represented in two-thirds (65.9%) of US bike shops, an overwhelming majority.

Tier Three represents the remaining fifty-odd brands Georger monitors regularly and includes a constant stream of brands moving up to or down from Tier Two status.

Taken together, Georger's system reveals a much richer, nuanced and more complex dealer ecology than it appears at first, and it's worth exploring for what it implies about the overall health of today's specialty retail channel.

Tier One: The Quad may not be as Umvirate as it seems

Almost four thousand (3,842) US bike shop locations feature one or more of the top four brands. Not quite three-quarters (72.1%) of these locations sell a single Quadrumvirate brand to the exclusion of the others, and of course, virtually all shops also sell additional brands from Tiers Two and/or Three.

The entire basis of the Bike 3.0 strategy is to have fewer dealers per brand, each with a greater commitment to that brand’s products. And in more than a quarter of Quadrumvirate dealers, that strategy has already failed.

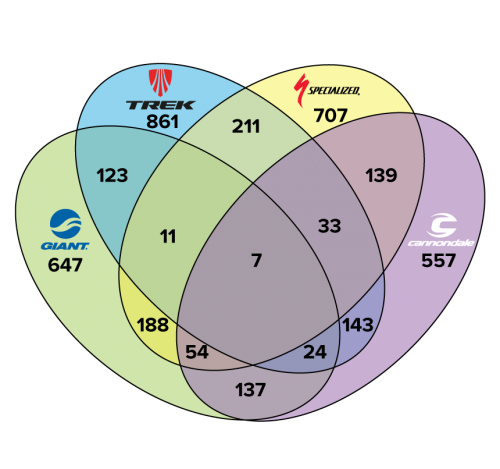

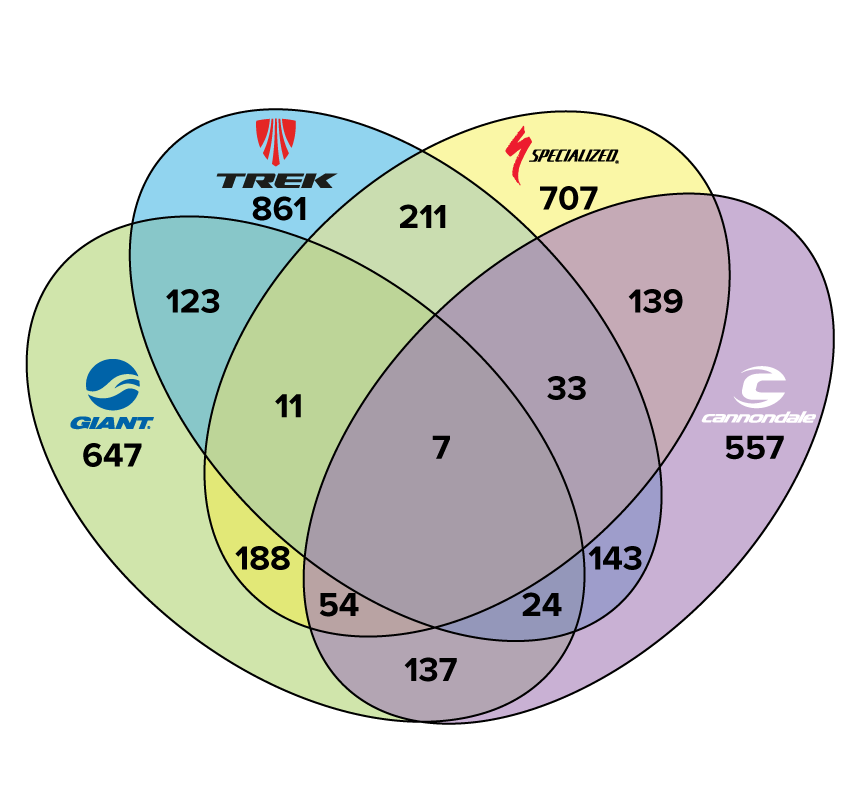

Things get more interesting when we look at the thousand-plus Tier One resellers (1,070 or 27.9%) who also sell one or more additional Quadrumvirate brands. The majority of these (941) sell a second Tier One label; 122 sell three of them, and seven retailers manage to fit all four brands under a single roof. The chart below maps out these complex and overlapping relationships:

There are any number of reasons why more than a 1,000 retailers would want more than one Tier One brand in their shop — controlling more lines within a market, offering a wider brand selection, or simply to play the brands off against each other, preventing any one of them from gaining a controlling interest in the retailer's business. And of course, most of these shops also carry brands from Tiers Two and Three. But what's interesting here is that every one of these reasons is straight out of the Bike 2.0 playbook, where brands struggle to be in as many shops as possible, and shops strive to offer as many brands as possible.

The entire basis of the Bike 3.0 strategy, in fact, is precisely the opposite: to have fewer dealers per brand, each with a greater commitment to that brand's products. And in more than a quarter of Quadrumvirate dealers, that strategy has already failed. When there are two or more "primary" brands on a shop floor, who's #1? No one, that's who. Even more thought-provoking, the largest number of dual-brand Tier One stores—211 of them—have the two strongest brands together, Trek and Specialized.

If Bike 3.0 is supposed to mark a shift in the power balance in favor of suppliers, here are more than a thousand counter-examples where it is the dealer who is in control. And as usual, which end of the question is the tail and which is the dog depends entirely on who's asking the question.

Tier Two: fresh faces join the top ten

Tier Two status is subjective, determined by which brands Georger's clients ask him to monitor. Electra, for instance, is a Tier Two brand, despite it actually having more dealer locations (1,845) than its "parent" brand, Trek (1,388). That's because there are so many Trek dealers who opted to pick up Electra once the brand was made available to them. Another example is Sun, which actually has the most dealers listed of any brand (2,320), perhaps because it has no minimum or stocking order requirements, but doesn't have the overall brand presence of many other players, at least in the eyes of Georger's clients.

In terms of the Bike 3.0 model, it suggests that the Quadrumvirate, while capturing more than half of the overall dealer market (and, it’s reasonable to conclude, far more than half the unit sales), is still not achieving the business school definition of market dominance. There are simply too many other strong brands, in too many other strong stores, for the Quad brands to effectively control pricing market-wide.

The Tier Two players shift markedly over time. In the past few years both Raleigh and Fuji have dropped out, although both brands still maintain very healthy numbers of retailers.

In no particular order, Tier Two brands are currently Electra (even counting just the brand's non-Trek stores), Cervélo, Kona, Pivot, Scott and Santa Cruz. Even when you factor out the times these brands also appear in Tier One retailers, Tier Two brands are still featured lines in 11% of the dealer market. As mentioned before, this gives the Top Ten brands a collective presence in two-thirds (55% + 11%) of all U.S. bicycle dealers.

In terms of the Bike 3.0 model, it suggests that the Quadrumvirate, while capturing more than half of the overall dealer market (and, it's reasonable to conclude, far more than half the unit sales), is still not achieving the business school definition of market dominance. There are simply too many other strong brands, in too many other strong stores, for the Quad brands to effectively control pricing market-wide.

Tier Three: rising (and falling) stars

While the very notion of a three-tier system would seem to imply that Tier Three is the bottom third of the market, that is neither Georger's intention nor is it objectively the case. Some 50 brands are fighting for a place in a very significant sector of the dealer landscape. And some of them are doing very well for themselves.

To be sure, Tier Three retailers tend to be more recently established shops; more than half (57%) of them came onto the GDS radar screen within the past five years. Conversely, the number of Tier One retail businesses that were in place prior to 2015 is 64%. That suggests the more established shops tend to favor more established brands, and vice-versa, a notion which should surprise no one. But it also implies that as young shops establish themselves and some of them thrive, there may not be enough available Tier One locations to go around; which means Tier Two and Three brands have the opportunity to grow along with smart, agile young retailers who can adapt more quickly to changing market conditions.

In fact, this shift is already happening. The most notable is Electra, but even in the wake of the ASI/Fuji implosion, Breezer has more than doubled its number of dealers since 2018. Salsa, which had fewer than 300 retailers prior to 2016, now boasts almost triple that number. Urban mobility brand Brooklyn Bicycle Co. now has more than 350 dealers, and almost two-thirds of those are in Tier One. Santa Cruz has grown from 350 dealers in 2015 to more than 550 today and is a recognized leader in the high-end off-road market. Make no mistake, there is an entire generation of sharp fresh brands in the market, and the inexorable mechanics of Bike 3.0 are forcing them to ally themselves with sharp fresh retailers because they often are only allowed a limited presence on Tier One retailers' shop floors.

In a market that has experienced an incredible change in the past two years and is likely to continue changing rapidly for the foreseeable future, that spells huge opportunity, both for Tier Two and Three brands and the retailers who sell them.

Is the notion of a new generation of smaller, leaner brands and dealers a likely reality, or just part of a sky full of pie? I certainly don't know, but it wouldn't be the first sea-change in industry memory, either. It's a shame no one took a poll of the Schwinn dealers in 1982 who thought their dynasty would last forever. At the height of the Bike Boom, Schwinn's lock on the specialty retail channel was approximately what the Quadrumvirate's is today. But, just as in life itself, nothing in the bike business lasts forever.

Rick Vosper has been helping companies in the bicycle business solve marketing problems since 1989. Email rick@rvms.com for a free consultation.

Disclaimer: the author has purchased services from GDS on behalf of his clients.