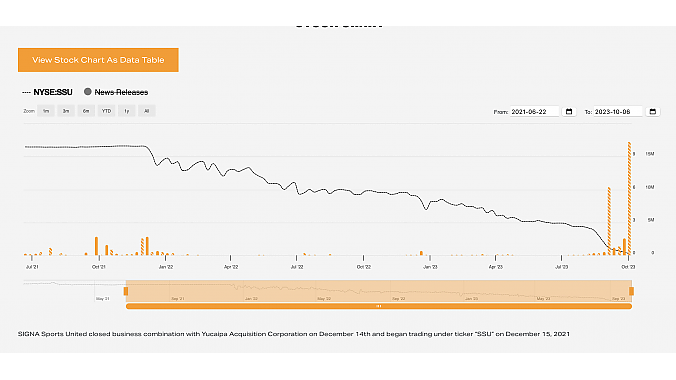

BERLIN (BRAIN) — Signa Sports United says it will restructure — including terminating some non-performing assets — due to the industry's "subdued demand and market overstock." SSU also plans to delist from the New York Stock Exchange, where its stock price has plummeted in recent months.

SSU owns the bike brands Nukeproof and Vitus, and the e-commerce retailer CRC/Wiggle. It also operates e-commerce sites in the tennis, outdoor sports and team sports markets. In a recent statement, the company did not say which of its business units would be terminated or "right-sized," although it said its bike business, specifically, has lagged company expectations.

As part of the restructuring, SSU's current e-commerce CEO, Torsten Waack van Wasen, will join the management team as Chief Performance Officer of the Group.

The company said its challenges began in the second half last year and extended into the first three quarters of fiscal 2023.

"Although some economic indicators across core markets have continued to improve slightly, the demand for the Company's products remains significantly below 2022 and pre-pandemic levels. In addition, inventory levels across the industry remain elevated as market participants still aim to clear excess inventory, resulting in a material adverse effect on the Company's gross margins and increasing negative cash flows," the company announced.

The company said it would delist its stock from the NYSE around Oct. 22. It said its board concluded that the benefits of being listed do not justify the costs to meet SEC regulatory commitments.

The company said its 2023 earnings will not meet previous forecasts and it expects market overstock will continue into fiscal 2024, impacting its ability to meet growth and profitability targets. It withdrew the forecasts it made at the end of the first half 2023 and did not re-state the guidance.