LAS VEGAS (BRAIN) — A year after announcing an expanded lineup that goes beyond its BMX roots, Haro is taking it up another notch, fleshing out its product line with new aluminum-framed full suspension mountain bikes last year and new e-bikes and other adult models being introduced at Sea Otter next month.

At the CABDA West trade show that opened here Wednesday, Haro is showing some new models while also promoting a program that locks in pre-tariff pricing on its Shredder coaster-brake juvenile bikes for retailers who commit before the end of March.

Haro, which is about 48 years old, began its transition about 24 months ago, adding new staff as it expanded its product line, all at a time when the retail bike industry has been struggling with oversupply and declining margins.

"We joke that nobody likes pushing a boulder uphill more than Haro Bikes," said James Ayres, who has been with Haro since 2007 and was promoted to director of North American sales in 2023.

Ayres said Haro has slowly added back some U.S. dealers who left the brand during the pandemic, as well as some new ones. "Ball park, I'd say we've added about 30 dealers, either new or returning to the brand," Ayres said. The brand also has been adding new dealers in Europe as its expanded its line.

Filling out the range

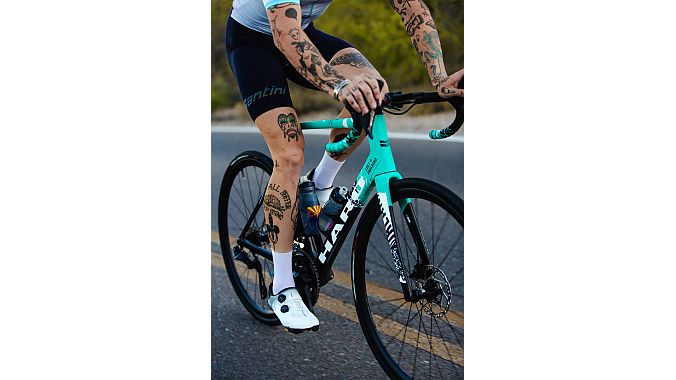

Haro introduced a line of high-end carbon road and gravel bikes last year, which it supports in part by sponsoring domestic road racing athletes and teams.

Haro introduced a line of high-end carbon road and gravel bikes last year, which it supports in part by sponsoring domestic road racing athletes and teams.

"The goal was to fill in the range to be a complete supplier at the performance level," Haro's Chief Marketing Officer Megan Tompkins told BRAIN in an interview in early March. Tompkins, a former BRAIN editor and publisher, left Haro recently.

"Coming in new to performance road, one of the things that we discovered very quickly was that we needed to show how legitimate we were in that category," Tompkins added. "So we've put a lot of emphasis on bringing on some really legit teams across the country."

As the brand expanded into mountain bikes, road and gravel, the BMX community grew concerned the brand was moving away from its roots. At some CABDA shows last year, Haro showed only a handful of BMX models, contributing to the concerns.

But the company said it remains committed to BMX and plans a major refresh of its BMX line this July.

"It was never in place of what we've internally referred to as 'Haro 1.0,'" said Ayres. "It was always in addition to. ... the goal with this entire initiative that we've embarked on over the last 24 months was solely to become a more well-rounded line. To be a player in categories where we had never played before, but not to forsake anything that we've built a foundation on."

The Shredder program

Haro expects some of its China-made bikes, including its juvenile Shredder models, to be hit with increased tariffs this year, which will mean increased wholesale pricing.

The company is moving some more production out of China to Malaysia and Taiwan but also offering retailers the opportunity to lock in wholesale pricing on Shredders at pre-tariff pricing if they commit to a program by the end of March.

"We know that in some form or fashion, we're going to have to pass some of this tariff burden along to the retailer and ultimately along to the end user," said Ayres.

"We can't say the word, 'pre-book,' because that has become a dirty word in the industry right now. So we're saying, 'if you order now we will grandfather you in to pre-tariff wholesale pricing,'" he said.

He said the program offers up to keystone margins on "bread-and-butter" bikes. It allows retailers to structure shipments between April 1 and Sept. 1, allowing them to set up for the holiday season at the current pricing. He said the program will help dealers combat some expected consumer sticker shock later this year.

"We see these insane deals finally slowly starting to dry up (across the industry) and then when you mix in this tariff implication, we're really going to be telling consumers, 'well, not only is that bike no longer on sale, but now you're paying 25 or 30% more for it then you would have a year ago ... I feel like there's going to be a bit of a system shock that the general public is going to go through ... We'll see how that plays out."

Haro's Shredder Margin Stretcher program shows wholesale pricing and MSRPs increasing from 9-17% on April 1. The new pricing structure puts dealer margin at about 42% on these models, while locking in the current pricing and selling at the new MSRP would produce margins of 47-50%.