ANOKA, Minn. (BRAIN) — Vista Outdoor Inc. said its sales were down $40 million, to $755 million, in its third quarter, compared to the same period last year. It said the decline was driven by a double-digit drop in organic sales across all of its categories with the exception of golf, partially offset by acquisitions.

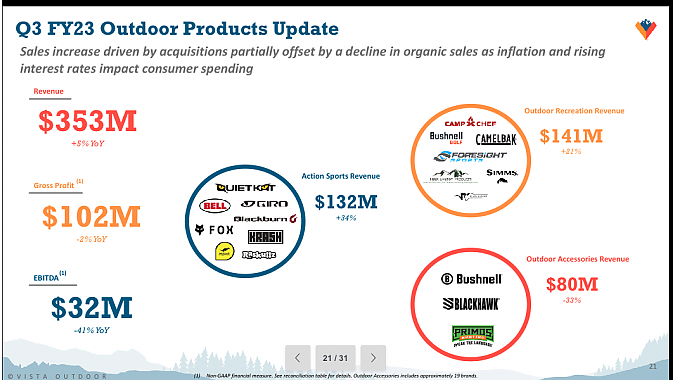

The company said its Action Sports business unit, which includes most of its bicycle and snow sport-related brands (except CamelBak), sales were $132 million in the quarter, up 34%. At least some of that increase was likely due to the acquisition of Fox Racing last year. The company said Giro's snow-sport sales were up 30% YTD compared to the prior year but did not break out third-quarter sales numbers for the brand or any others.

Company-wide, Vista Outdoor said gross profit declined 15% to $239 million and gross profit margin decreased 378 basis points to 31.6% primarily due to increased promotional activity, mix shift and other higher input costs including freight.

Earnings before interest and taxes (EBIT) decreased 39% to $97 million. Adjusted EBIT declined 33% to $112 million. Adjusted EBIT margins decreased 609 basis points to 14.9%.

In its Outdoor Products business unit, which includes the Action Sports brands as well as golf, CamelBak and fly fishing, sales increased 5% to $353 million. The sales increase was driven by acquired businesses and strength in golf, the company said, partially offset by declines in other organic businesses, primarily caused by reduced purchasing from international, big box, and other wholesale.

"Our business is operating from a position of strength," said Gary McArthur, the company's new interim CEO. "We've built a resilient operating model with strong brands, shared resources, leadership expertise and a clean balance sheet that allows us to achieve levels of performance out of reach for any one brand on its own. In the past two years, we have closed and successfully integrated eight acquisitions that have increased our total addressable market, broadened and deepened our platforms, and further diversified our leading brand portfolio."