OSAKA, Japan (BRAIN) — Shimano said “strong interest” by consumers in bicycles shows signs of cooling down, but demand is still higher than it was prior to COVID-19.

In its third fiscal quarter financial summary, the component giant said market inventories are low for high-end bikes, although demand for those bikes is high. It said demand for lower priced bikes has cooled, and didn’t remark on inventory levels for those bikes.

Shimano noted that in Europe there are shortages of some high-end bikes and e-bikes, but otherwise inventory levels were approaching appropriate levels.

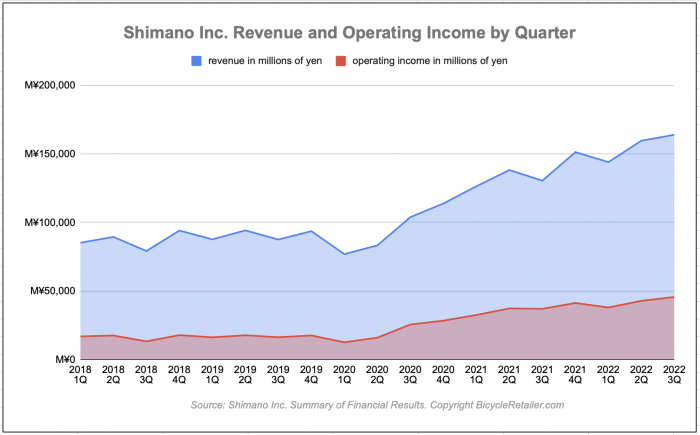

In the first three quarters of the year, sales of bike components increased 20.6% from the same period last year, to 384,654 million yen ($2.59 billion). Operating income increased 21.6% to 109,119 million yen. Quarter over quarter, third-quarter sales were up 25.7% over the same quarter last year. Shimano’s second- and third-quarter figures exclude Dash America (the parent of Pearl Izumi), which it sold to United Sports Brands in May.

Net sales in Shimano’s other major category, fishing, were up 9%, to 82,653 million yen.

Company-wide, net sales were up 18.3% year to date to 467,665 million yen, and operating income was up 18.3% to 149,682 million yen, as shown in the chart.

Regarding company-wide results, Shimano said, “In the U.S., although rising prices put downward pressure on consumers' purchasing power, a solid employment environment and rising wages continued to fuel steady personal consumption.”

In Europe, Shimano said high inflation and concerns about energy supply were causing consumer sentiment to deteriorate. It said personal consumption in China and Japan picked up after the easing of COVID restrictions.

Because of the strength of the U.S. dollar relative to Asian currencies, Shimano revised its full-year forecast up 1.7% for net sales and 6.2% up for net income. The revised forecast for full-year net sales is now 590,000 million yen, up from 546,515 recorded in 2021.