NEWARK, N.J. (BRAIN) — Samuel Mancini, the director of a Denver-based fund that planned to invest in several well-known cycling brands, has pleaded guilty to one count of securities fraud.

Mancini, arrested last July, could be sentenced to up to 20 years in prison and hit with a $5 million fine for the one count. Sentencing is scheduled for Aug. 17.

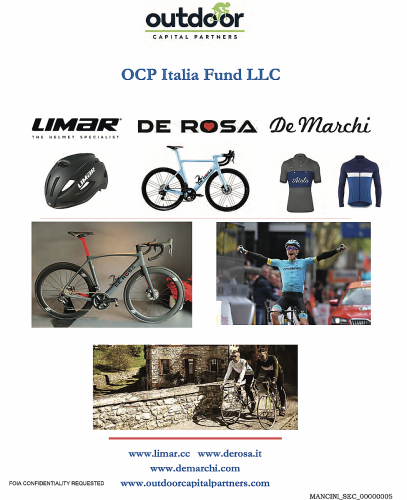

Prosecutors charged that Mancini, the managing director of Outdoor Capital Partners, raised over $11 million from about 40 investors in a plan to acquire De Rosa Cycles, De Marchi Apparel, Limar Helmets and Gruppo Srl, the parent of Cinelli and Columbus. None of the acquisitions were completed.

The guilty plea is related to criminal charges in the case filed by the U.S. Attorney's Office in New Jersey. In a separate civil case also filed in New Jersey, the U.S. Securities and Exchange Commission is charging Mancini with securities law violations. In the civil case the SEC is asking for disgorgement of ill-gotten gains with interest and civil penalties. The SEC also is seeking to bar Mancini from serving as an officer or director of any public company.

In January prosecutors said they had reached a plea agreement with Mancini in the criminal case; at the time, the civil court judge approved pausing the civil case until after sentencing for the criminal charges. A hearing in the civil case is now scheduled for May 2.

Mancini initially was charged with securities fraud, two counts of wire fraud and a count of money laundering in the criminal case.

The government's complaint referenced five victims who are investors living in Colorado, New Jersey, New York, Massachusetts and Florida.