TAIPEI, Taiwan (BRAIN) — Cambodia, already the biggest bicycle supplier to the EU, is making up ground in the U.S. market as well due to the recent tariffs imposed by the Trump administration.

Trek Bicycle plans to move production of at least 200,000 bikes from China to Cambodia next year, according to multiple sources who spoke with BRAIN at the recent Taipei Cycle show and elsewhere. The bikes are opening-price-point models with aluminum frames and will be made at the A&J (Cambodia) factory. Since opening in Cambodia in 2006, A&J has made bikes for Bianchi, Scott, Felt, Rocky Mountain, Norco, and Kona there.

A Trek Bicycle spokesman did not reply to multiple inquiries from BRAIN to comment on the move.

(Related: Trek says tariffs would cost company $30 milllion a year)

The production is being shifted away from Giant Manufacturing's facilities in China. Giant Manufacturing's Irene Chen said she would not comment on Giant's OEM business, but noted that the company is focused on e-bike and high-end traditional bike manufacturing and is seeing growth in those areas.

"The overall global economy and market poses many uncertainties due to the trade war between U.S. and China," Chen said. "Giant will continue to take leverage of its Asia and European production facilities, focusing on short supply lead time and global positioning to maintain its growth opportunities in this challenging market."

Kent International also plans to move a large share of its production from China to Cambodia in the next few months. One of Kent's major Chinese suppliers is building a new, 500,000-square-foot factory in Cambodia. Kent's CEO, Arnold Kamler, said the factory will begin shipping some bikes in September 2019.

"Assuming the 25 percent tariff takes effect, the idea is to move essentially all of our production from China to Cambodia," Kamler told BRAIN. He said that to comply with U.S. Customs rules of origin, the Kent bikes from Cambodia will have at least 35 percent of their value from Cambodian parts or labor and will have Cambodia-made frames and forks.

While most of Cambodia's bike factories are near the Vietnam border in the north, the factory that Kent is working with is in the south, near the nation's capital city of Phnom Penh.

(Related: Pedego shifts some e-bike production to Vietnam)

Cambodian bikes are imported in the U.S. duty-free because of the country's Generalized System of Preferences status. Bikes from most other countries (including China and Taiwan) have been historically subject to a U.S. import duty of 11 percent. With the imposition of a 10 percent tariff on Chinese bikes in September, the tariff advantage over Chinese bikes is now 21 percent. Trump's 10 percent tariff is set to increase to 25 percent in January, furthering Cambodia's head start on China.

Manufacturers are also looking to Vietnam and Indonesia as alternatives to China. And production of higher-priced bikes is shifting back to Taiwan, although that country does not have the capacity or available labor to resume supplying all the brands that moved production to China in recent years.

Europe has been ahead of the U.S. in moving bike production to Cambodia, which is now the largest bike supplier to the EU. Most bike imports into the EU are subject to a 14 percent tariff that is waived for Cambodian bikes under the EU's GSP Plus program. Under GSP Plus, the EU even waives a 14 percent tariff on the costs of shipping bikes from Cambodia. The shipping cost tariff is collected on imports from most other countries.

In Europe, there are some concerns that the European Commission could end the GSP Plus status for Cambodia because of human rights concerns. And Taiwan still has the edge on Cambodia in exports of higher-value bikes and e-bikes to Europe.

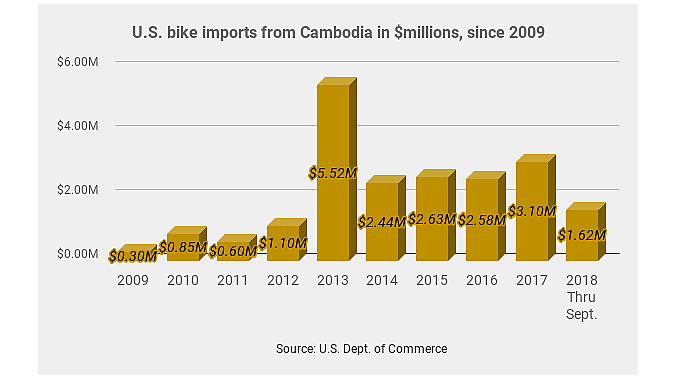

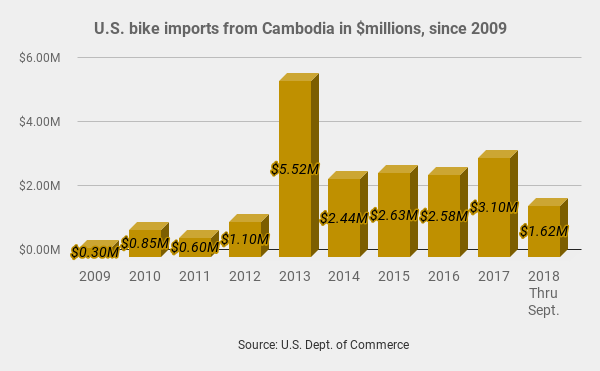

In the U.S., importers began bringing in significant numbers of bikes from Cambodia in 2011, as shown in the graph at left. The spike in imports in 2013 is likely due to the decision by Specialized to move a significant amount of its adult and kids bike production to Cambodia that year. The following year, Specialized moved most of its adult bike production back to Taiwan, but continues to have kids bikes made in Cambodia.

In the U.S., importers began bringing in significant numbers of bikes from Cambodia in 2011, as shown in the graph at left. The spike in imports in 2013 is likely due to the decision by Specialized to move a significant amount of its adult and kids bike production to Cambodia that year. The following year, Specialized moved most of its adult bike production back to Taiwan, but continues to have kids bikes made in Cambodia.

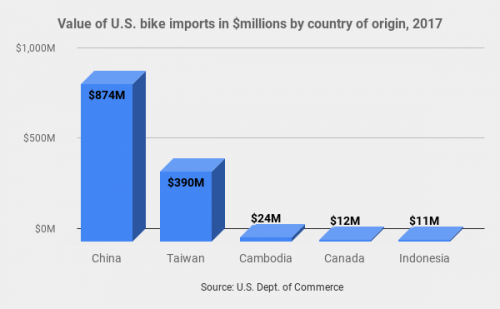

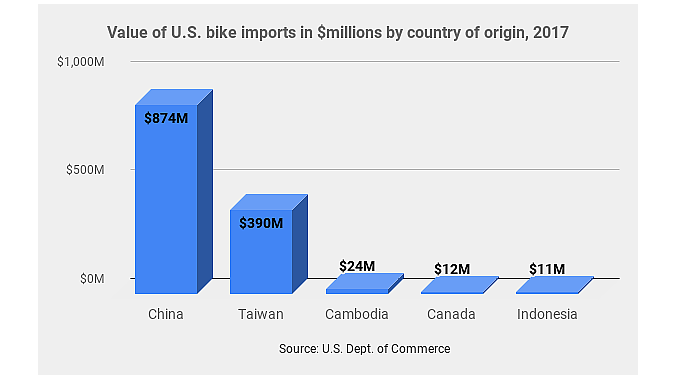

Last year, Cambodia was a distant third, behind China and Taiwan, in supplying the U.S. with bikes, as shown in the chart at the top of the page.

Despite the tariff advantage and lower labor costs, manufacturing in Cambodia remains a challenge for a number of reasons. The country lacks an industry cluster, so many components must be imported, adding to the cost and lead times. The country also lacks a deep-water port, so exporters need to use smaller feeder vessels to get inventory out of the country, adding to cost and lead times. The country has at times been politically unstable and labor strikes have shut down some factories for weeks at a time. However, companies doing business in Cambodia say those factors are improving each year.

Marc Sani contributed with reporting from Taiwan.