MONTEREY, CA (BRAIN)—As retailers marched through the month of March, one of the warmest on record, it appears that bicycle sales were relatively flat, but the average selling price per unit was up.

Still, overall operating costs are on the rise putting downward pressure on margins. That was the overall assessment of bicycle sales through the first quarter of the year, said Charlie Cooper, president of Leisure Trends Group.

Cooper told attendees at Wednesday’s Bicycle Leadership Conference that the big story this year can be summed up this way: “Let’s all thank the weatherman.” A warmer than normal weather pattern has, in general, been a boon, whereas snowsports retailers had what Cooper called “a brutal year.”

Chris Speyer, president of the Bicycle Products Suppliers Association, opened the session by pointing out the “huge” amount of data available today from companies like Leisure Trends. “But the most interesting question we have to ask is, what do you with the data,” he said.

Speyer quickly reeled off numbers noting that between 2008 and 2011 units sales sold through IBDs ranged between 2.5 million to 2.6 million units. “As a specialty group we’re not growing,” he said, “although some brands within the industry may be growing.”

Part of the problem the industry faces is how people spend their time. Those over the age of 16 now spend 7.4 hours a day in front of a screen, whether it’s a computer, tablet, laptop or smartphone. “That should be an overwhelming figure for the industry,” he said.

According to Cooper, last year IBDs sold approximately $3.3 billion worth of bikes and accessories with an additional $300 million in Internet sales that appear to be IBD related. Chain stores and sporting goods outlets accounted for about $550 million in sales, while mass merchants sold another $2.45 billion worth of bicycles and cycling accessories making cycling a $6.6 billion industry.

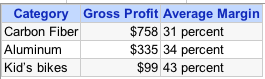

He also offered a snapshot of gross profits and average margins for three categories of bicycles:

For IBDs it’s become more important for retailers to aggressively sell the activity of cycling—along with a bike—if they want to see business grow. “We think the bikes bought at specialty are ridden more frequently than those bought in the mass,” Cooper said. The more frequently someone rides a bike, the more dollars they spend, and the more often the come into the store. “You have to invest in new riders,” he added.

Robin Thurston, founder of MapMyRide.com, said retailers need to make sure customers know where to ride, encourage them to sign up for an event and try to sign them up for a class.

“Don’t let them leave the store without getting them signed up for something,” he said.