SALEM, Ore. (BRAIN) — In the name of simplification, Oregon's Legislature has passed an updated transportation bill that expands the state's $15 bicycle excise tax to include all bikes selling for $200 or more, including e-bikes. The tax, which was originally passed last year and took effect in January, originally exempted bikes with wheels smaller than 26 inches and exempted e-bikes that were sold through bike shops.

The state House passed the bill on Friday on a 45-3 vote; the Senate passed it Saturday 25-4. It now goes to Gov. Katharine Brown. The changes to the bike tax were included with a large array of amendments to a $5.3 billion ten-year transportation package.

In a quirk of the original bill, e-bikes were hit with a 0.5 percent "vehicle privilege tax" only if they were sold at licensed auto dealerships. The modifications mean e-bikes sold at bikes shops are now subject to the same $15 tax as regular bikes.

In a joint letter from PeopleForBikes, the National Bicycle Dealers Association and the Bicycle Product Supplier Association, the groups opposed the expansion of the tax to bikes with smaller wheels, which include some recumbents, folding bikes and other nonstandard bikes as well as kids bikes.

"Our objection to altering the minimum wheel size requirement is premised on two issues: 1) the new bicycles that will be subject to taxation will primarily be children’s bikes; and 2) it will place an additional burden on bicycle shops that have already invested resources to comply with the tax," the groups said in the Feb. 21 letter addressed to the Joint Committee on Transporation's chairmen.

In the letter, the groups said they supported the inclusion of e-bikes, noting the exemption was "extremely confusing and does not align with how electric-assisted bicycles are regulated, sold or used."

"Treating electric-assisted bicycles identically to bicycles for the purposes of applying the excise tax is appropriate, particularly given that they are primarily sold at bicycle shops," the letter said.

In a statement Monday, PeopleForBikes' Alex Logemann said, "We are disappointed that legislators have voted for families to bear the burden of funding Oregon's transportation system when they purchase a kids' bike.

"Despite the fact that lawmakers said they did not want to tax children's bikes, were given ample notice about the problems in the current bill, and specific examples of kids' bikes that will now be taxed, legislators did not address the issue. Moving forward, we will focus on analyzing the data related to how much revenue the tax generates relative to the cost of administering the tax to assess the tax's effect and efficiency."

Logemann is PeopleForBikes' director of state and local policy.

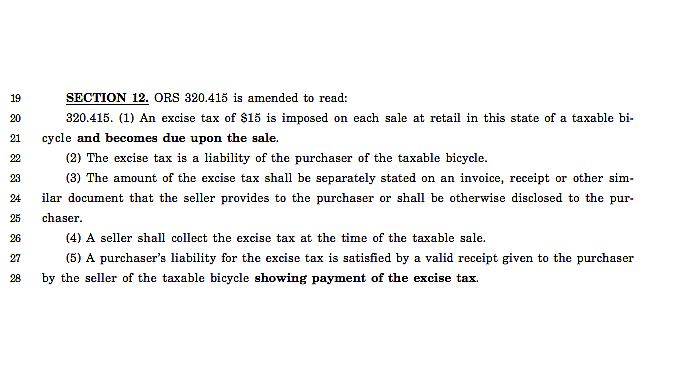

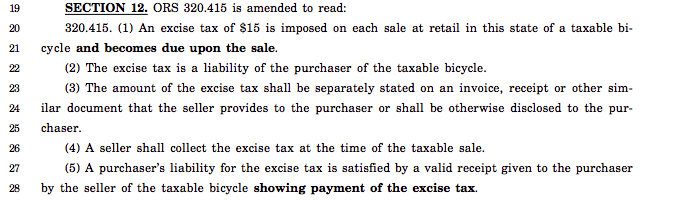

Under the changes approved by the Legislature, the bike tax clause was modified to clarify that the tax is due at the time of sale and that customers must be given a receipt that shows payment of the tax.

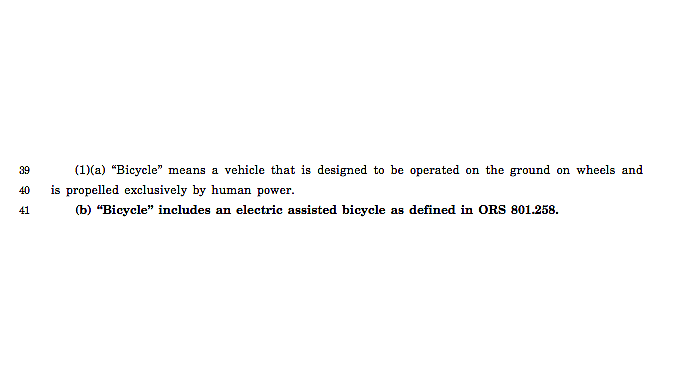

The bill is at olis.leg.state.or.us/liz/2018R1/Measures/Overview/HB4059. This image shows the amended bike tax clauses with additions in bold text and removed language bracketed and italic:

...

...

Previous articles

- Oregon retailers are (hopefully) collecting the new bike tax — Jan. 4, 2018

- Santa Cruz's Oregon Trail Tax riffs on state's new bike tax — Sept. 7, 2017

- Inspired by Oregon, Colorado lawmaker proposes bike tax — July 19, 2017

- Oregon legislature passes $15 bike tax — July 7, 2017