By Jay Townley

Yogi Berra, all-star baseball player, coach and philosopher, uttered these prophetic words (although he probably was not the first to say it — editor). Bicycle business philosopher Rick Vosper recently asked, “What happens to all those optimistic orders that were placed at the peak of the demand wave and are now finally going to ship in 2022 and beyond?” (Rick did say that — editor)

We all know the bicycle business supply chain got totally out of kilter. What some of you don’t know is this started in 2019 because of the imposition of Section 301 punitive tariffs on Chinese imports and got far worse when Covid-19 hit during the first quarter of 2020, causing order reductions and cancellations, followed shortly thereafter by surging consumer demand that started the bullwhip effect through the channel of trade, consisting of aggressive forecasts and orders for as much as suppliers could make and ship.

Consumer demand continued to grow in intensity as the pandemic led to stay-at-home orders, and consumers shifted their buying from services to goods, and isolating at home with additional money from the government sparked an unprecedented online spending spree. This fed the bullwhip effect like putting gas on a fire.

Retailers ordered more, wholesalers and brands forecast and ordered more, and OEMs ordered more. Order lead times grew longer and longer as COVID-driven delays disrupted every aspect of the bicycle supply chain, and ocean freight and trucking became high-cost nightmares.

OEMs and most major component brands made it clear early on that they were not going to increase their manufacturing footprints by making substantial long-term investments in new plant expansion when demand was likely to cool before new capacity could come online.

The Just-In-Time (JIT) playbook was tossed, and the channel of trade adopted the Just-In-Case (JIC) inventory management system that drove retailers and brands to order as much as they could get when they could get it, and pay the ever-increasing product and costs of logistics.

It is fair to say hoarding has occurred at both ends of the supply chain, with some OEMs hoarding component inventory, and some retailers hoarding accessory and bicycle inventory as the JIC inventory management system spread and lead times grew to the point that top-tier component brands are telling customers that their high demand products have lead time pushing out into 2023. Like I said … out of kilter.

The bullwhip effect is supply chains buying too much during time of scarcity, ending up with excess inventory that later becomes a problem. From what we have seen, the bicycle business inventory to sales ratios didn’t look bloated by historical standards, through 2021, but grew exceptionally fast during the first two quarters of 2022 as consumer demand ebbed.

As inventory grew during the first quarter of this year, it also went further out of balance, in some cases because of component shortages and delays, so that as we have reported, bike shops and brands had too much of what consumers didn’t want, and not enough of what they did want, with plenty of juvenile and BMX bikes as one example, and medium and middle size women’s triathlon and road bikes in short supply, as another.

Brands, bike shops for certain, probably mass-merchants, as well as full-line sporting goods retailers, have been building inventory because of the uncertainty surrounding the supply chain. Suddenly there was a decline in the demand from consumers. This in turn was attributed to inflation, overlooking the shift by consumers back to spending on services, in combination with rising prices for goods.

So, now the bike shop channel of trade, and probably the other channels of trade as well, have more inventory than they have ever had. They have paid more for the inventory than they ever have, but the demand they were told would come, that they were expecting to make up for the increased cost of the inventory, suddenly evaporated.

To answer Rick Vosper’s question it is, for the most part, floating inventory, although it may help balance some of the overstock. Consumers who were willing to pay just about any price to get their hands on a bicycle last year are now walking out because of sticker shock at the prices that bike shops now have to charge because of the increased landed cost of goods.

Too much inventory has traditionally led to selling at a discount, as we have seen with Target’s huge clearance sale last month. Or it has meant putting in fewer orders, as we have seen Samsung do in freezing procurement.

We are also watching bicycle brands, including direct-to-consumer (DTC) brands, some that have been around for decades, and others that are start-ups new to the business, follow these same traditional reactions and actions relative to too much inventory.

That was then, this is now. We caution that the traditional ways of dealing with too much inventory in the American bicycle business simply will not be sufficient to solve the size and scope of the supply problem that has been created, and certainly not this year.

To begin with, there is too much inventory, particularly in the bike shop channel, to be sold down in a matter of months at discounted prices. There will be sales and discounting, but they will dent the overstock, not reduce it to manageable levels, according to our analysis, until next year.

This is a blunt statement, and we would like to be proven wrong, but we project an estimated 6 to 7 finished goods units in the bike shop channel inventory for every 1 being currently sold, with more in transit. Over the next two months this could increase to an estimated 8 to 9 finished goods units in inventory for every 1 being sold at retail.

Brands and their OEMs understand that U.S. finished goods inventory is linked to the supply chain, but they are going to be slow in reducing or freezing procurement because our analysis also indicates they do not want to lose their position with either the OEMs or the component suppliers.

And then there is Europe. Model year changes are already in the supply chain as evidenced by preparations for Eurobike, and the fact that top-tier component lead times, at least to U.S. brands, are still out to late 2022 and early 2023.

Keep in mind that continental Europe still has a more robust bicycle market than the U.S., with e-bikes at anywhere from 20 to 50 percent of individual country market share, well above the 4 percent e-bike share in the U.S. in 2021.

We are projecting the necessary order reductions from the brands will not begin until sometime in the fourth quarter of this year. The signal will be a reduction, and perhaps a dramatic reduction, in component lead times.

Meanwhile the sporadic order flow from Asia will continue into the fall as China struggles with its Zero Tolerance Policy, and the container lines shift backlogs and delays from China back to the U.S. at a time when the West CoastWest dock workers labor agreement gets down to the brass tacks, including the possibility of labor slowdowns.

The recent opening of China’s ports means a wave of finished goods, including bicycles, to west coast ports, and already full to over-flowing brand warehouses this summer.

Inflation, consumer purchasing and spending. We are in a twilight zone that the U.S. economy has never seen before. Consumers are continuing to demand certain goods, even as they pivot back to spending on service, and inflation drives up the price of gas at the pump. So-called “revenge” travel has increased airline bookings, and families are hitting the road despite the cost of gas, and import volume at U.S. ports remains high.

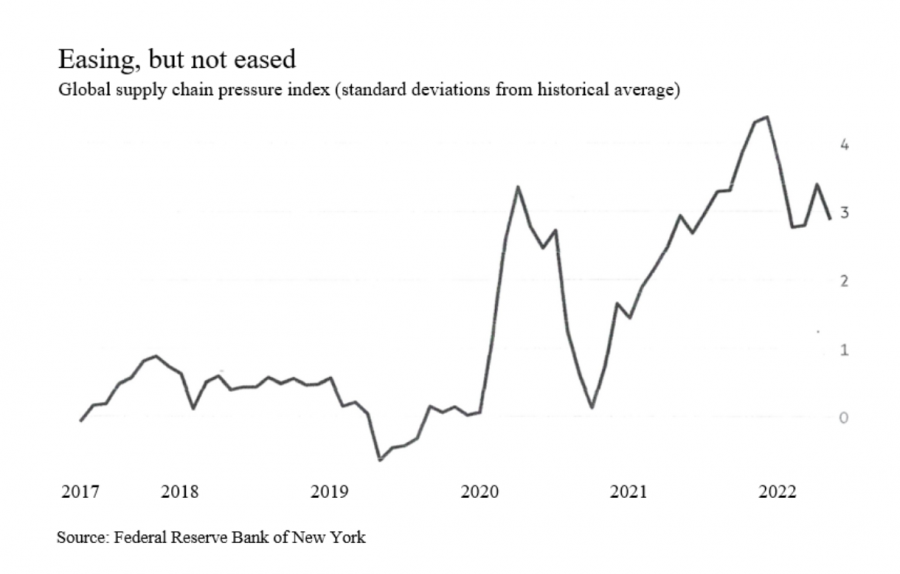

Table 1 is the New York Fed’s index of global supply chain pressure, and it gives a good sense of the bigger picture. It pulls together data on freight costs, backlogs and shipping delays, and strips out demand to determine how much inflation pressure is coming from supply constraints. I know this is a lot to take in, and you will have to trust me on this.

What Table 1 shows is that things are better than late last year, but we are far from any kind of normal stability in either the U.S. market or the supply chain. This is the story up and down the bicycle business supply chain: better but still bad.

It will be next year before discounting and terms will bring brand inventories down to reasonable and balanced levels, closer to 4 or fewer units (current models) in inventory for every unit sold at retail.

However, to make this scenario possible, the bike shop channel is going to have to cooperate and launch and support promotions through the rest of 2022 and into 2023.

As an example, on June 13, 2022, BRAIN ran the following press release: “The Bike Cooperative, SmartEtailing and NBDA unite to offer Retailers Summer Direct Mail Promotion." The press release started with this statement, “Three major industry organizations have announced a collaborative campaign focused on supporting retailer summer marketing promotions and community outreach. The partnership is a first of its kind, and at the core shows the dedication of these organizations to support and strengthen the Independent Bicycle Retailer. The Summer Direct Mail Promotion will launch late June and not only offers retailers special savings on direct-to-home mailers but free correlating web homepage graphics for all SmartEtailing retailers.”

This is the kind of promotion and cooperation the bike shop channel of trade needs to manage its way out of the challenge presented by the evolving supply chain situation created, in part, by the bullwhip effect and resulting JIC inventory management, and turn it into an opportunity.

I mentioned earlier that shoppers are now walking out of bike shops because of sticker shock at the prices that bike shops now have to charge because of the increased landed cost of goods. This began several months after bike shop foot traffic started to slow down during the latter half of the fourth quarter of 2021.

We watched the slowdown and cooling of consumer demand for bicycles during the last quarter of 2021 and first half of 2022 carefully, and gathered as much data as we could, along with anecdotal reports from the field.

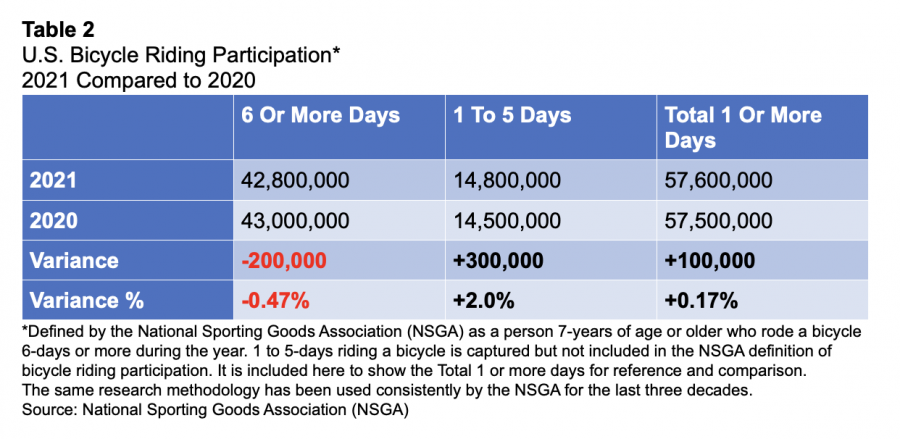

One reliable source of data is the National Sporting Goods Association (NSGA). We have used NSGA data as a part of the NBDA U.S. Bicycle Market Overview Reports for over two decades because of consistent methodology and panel data.

The following Table 2 is taken from the NBDA U.S. Bicycle Market Overview Report (USBMO) 2021 that will be published and made available for sale in early July.

42.8 million Americans 7 years of age and older rode bicycles 6 or more days during the year 2021. For those following the annual NBDA USBMO report this is a slight decrease of 200,000 or -0.47 percent in the number of bicycle riding participants as reported in 2021 compared to 2020, as shown in Table 2.

During the second year of the pandemic, 42.8 million Americans 7 years of age or older rode bicycles that they purchased new or used, received as gifts, shared with others, found in a garage or attic or rented through a bicycle ride-share.

What this also indicates is a slight decline in consumer demand in 2021 over 2020.

In analyzing this slight decline and the intent for future purchase data from the NBDA Bicycle Buying 2021 Consumer Research Study we concluded that consumer demand for bicycles would continue to ebb going forward into 2022, even as some other consumer goods would remain in demand through the year, driving the shipping volume from source countries like China, and keep the pressure on U.S. ports of entry and inland shipping to distribution centers, as shown in Table 1.

“I guess I better start doing promotions again!” In talking to bike shops, HPS partners have heard owners saying, “I guess I better start doing promotions again!” Yes, this is something bike shops did regularly pre-pandemic, but got out of the habit during the surge in demand in 2020 and 2021.

Dusting off the playbook on bike shop promotional events and activities now, and contacting suppliers and brands about promotions that the local shop can tie into is important, as is talking to the local Chamber of Commerce and Merchants Association about local promotions (and do not forget to join).

In addition to promotions, contact other bike shops and sales reps about buying excess inventory from you, and find out which bike shops are willing to join in promotions and both buy and sell inventory going forward until the market and supply chain conditions become more stable and predictable.

Today there is a great deal of uncertainty about consumer demand and product delivery and availability. I have mentioned the NBDA several times because the association is a good and growing resource and safe harbor. The NBDA P2 Groups are well worth the investment to join a peer group to financially mentor a bike shop, and to provide research reports and timely webinars and podcasts on topics of immediate interest.

What the bicycle business is experiencing is unprecedented. It has never happened before, so there is no experience to help prepare for the future. The supply side is in the same boat, as are consultants and analysts. The past is of little or no help. We need to reach out and gather the available data, keep our eyes open, pay close attention, and be prepared to make adjustments in our businesses as market conditions and demand require.

Like Yogi said: “The future ain’t what it used to be!”

Jay Townley is a co-founder of and Resident Futurist for Human Powered Solutions, a unique consultancy consisting of some of the most experienced and knowledgeable people in the Micromobility space – www.humanpoweredsolutions.com.

Questions? Comments? Contact Jay Townley: jay@humanpoweredsolutions.com