I created the idea of three “ages” concept for the post-WWII specialty retailer bicycle channel back in January. You can read more about it here, but here’s the CliffsNotes version:

- Bike 1.0, roughly 1950 — 1975, when the specialty retail market was dominated by a single brand, Schwinn, creating an era of relative stability at both the supplier and retailer levels.

- Bike 2.0, extending from the bike boom and introduction of the mountain bike through the late 1990s/early 2000s. In hindsight, I would more narrowly define the start of this period with Schwinn’s Supreme Court loss in its decade-long antitrust battle and the rise of the current selective distribution model, especially as characterized by the now-ubiquitous Authorized Dealer Agreement. Most importantly, this period was governed by the phenomenon of Perfect Competition, where no particular brand or brands accrued enough share or competitive advantage to gain control of the market.

- Bike 3.0, starting near the turn of the current millennium. The present era features a few dominant players in both the supplier and (per geographic location or region) retailer segments of the market. The theory also predicts a declining number of traditional retailers, contraction and consolidation of the supplier segment, and is abetted by the rise of internet commerce, which impacts all segments.

At least that was (and is) the theory. To be sure, a few companies — Trek, Specialized, a few large retail chains, and certainly Shimano — hold premiere positions in their respective markets. But truly dominant? That’s debatable. And while I think the 1.0/2.0/3.0 model is still valid, we now have new information that suggests the 3.0 era has failed to fulfill its premise and that something else may be coming along to augment or replace it altogether.

The 3.0 Premise

The basic idea behind Bike 3.0 (or at least the first time it occurred to me) goes back to a letter John Burke sent to Trek dealers in late 1997. A friend sent me a copy. In it, as I recall, Burke said he had sent a memo to Trek employees and salespeople saying it was no longer possible to grow the company by simply adding more retailers. To succeed, along with improving operational efficiencies, Trek would have to do more business with its existing retailers, both by offering new and successful products and by working more closely with its dealer base for their mutual success.

A few years later, Specialized took a very similar — and probably more radical — position with what came to be known as the Specialized Dealer Alliance (full disclosure: I was a part of this effort, first as a staff writer, later as the company’s head of marketing). In the years that followed, and with contributions from many other factors, Specialized moved from an estimated fourth-place position among bike brands to its current #2 spot on the podium, increasing its gross sales more than fivefold and eclipsing competitors Giant and Cannondale (which had its own struggles in this period) in the process.

In a very general sense, the Trek and Specialized programs today incorporate all the 3.0 elements. The overall goal was to gain enough market share to command a price premium for the brands’ products and improved revenue for their select group of retailers. This would be accomplished when top brands allied themselves more and more tightly with the top retailers in each market, driving everyone else off a cliff like lemmings hurled from buckets by Disney technicians in some cheesy fake 1950s nature documentary. Everything else in the model — marginalization of competitors at both supplier and retailer levels, waves of consolidation, ongoing polarization of market share turbocharging brand growth — proceeded directly and inexorably from this fundamental realignment of sales channel elements.

The overall goal was to gain enough market share to command a price premium for the brands’ products and improved revenue for their select group of retailers.

Except that, in hindsight, most of it never really happened.

When "dominant" … isn’t.

Remember, the 3.0 model was a direct response to a period of Perfect Competition (more about that here), where, for various reasons, no single player can gain traction to dominate the market. And of course “dominant” can mean a lot of things.

One definition of dominance is that a brand can command a premium for its products versus comparable offerings from competitors, something that by definition can’t happen in a perfectly competitive market. Both Trek and Specialized currently do exactly that (in terms of MSRP and MAP; less so at the cash register). And, according to a dozen or so of their retailers I spoke with, they generally offer higher dealer margins as well … although the same retailers are quick to point out that those margins have shrunk over time, just not as much as competitors’.

In our current reality of cutthroat pricing and razor-thin profits, this is a huge accomplishment, and Trek and Specialized deserve full credit for managing it.

We’ll pause here while the Comments section fills up with remarks about floor space and cross-stocking requirements, inventory levels and terms, onerous dealer agreements, channel interdiction via predatory Click & Collect programs and so forth. Well, guess what, folks: those are all part of the “tighter alignment” bargain, that “double edge” you may have heard of. And compare “predatory” practices by big bike companies with their counterparts in other industries I have experience with — including telecom, high tech, or even other outdoor sporting categories — and the cycling industry is practically awash in peace, love and grooviness.

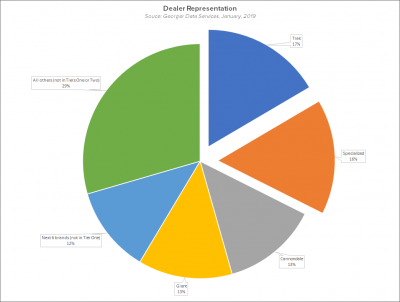

Another (and more common) definition of dominance involves overall market share, and this is where the 3.0 bubble is, if not bursting, then at least quivering. If we look at Christopher Georger’s research into the state of retail bike shops, we see that Specialized and Trek are currently represented in only a third of U.S. bike shop locations nationwide. It’s actually more than that if you exclude sporting goods and internet-only brands, but it’s way less than half. If we factor in the other Tier One brands, Giant and Cannondale, the four brands are represented in a little over half (52%) of U.S. bike shops.

Since bike companies do not publish their sales numbers, there is no inexpensive and statistically reliable way to estimate the companies’ share of either units or dollars. But it is reasonable to suppose that if these four players had, say, double the unit/dollar market share they have in dealer locations, some very large percentage of retailers who don’t carry those brands would have been out of business years ago; there simply wouldn’t be enough bike-buying customers left to support them. Instead, the total number of retailers has trended more or less steady at about 7,000 since 2011 (note that while I believe this is a reasonable conclusion, the Georger data model is not designed to definitively support it).

So why hasn’t the 3.0 model been even more successful than it has? One reason is that while the two premiere bike brands have gained enough traction to establish themselves as market leaders, they don’t have enough market share to trigger the collapse of brands and retailers necessary for their own dominance. The continued strength of Giant and Cannondale are one proof of that. This is partly because the larger industry is still operating under the Bike 2.0 version of Selective Distribution; none of the top four brands can simply open some large number of additional retailers without violating the unwritten covenant with their existing dealer base and risking current position.

So why hasn’t the 3.0 model been even more successful than it has? One reason is that while the two premiere bike brands have gained enough traction to establish themselves as market leaders, they don’t have enough market share to trigger the collapse of brands and retailers necessary for their own dominance.

Another piece of the problem is that several conditions for perfectly competitive markets are still alive and even thriving in the 3.0 era.

The first of these is Low Barriers To Entry. Basically, it’s still amazingly cheap to start a new bike shop (when compared with the cool half a million to open a Subway franchise or five times that to start a McDonald’s, anyway). Moreover, because it’s also incredibly cheap to start a new bike brand (not to mention that bikes are a mature category where technology differences between brands are incremental at best), there’s a constant supply of high-quality competitive brands (Georger Data Services tracks more than 100 of these) to sell to all those non-allied dealers. And while we can document that lots of dealers and even some bike brands go out of business each year, it’s also clear that at least as many new ones rise up to take their place.

The other market condition that applies is Perfect Information — basically, everybody instantly knows exactly what everything costs. In Internet culture, perfect information is literally as close as your desk, your kitchen table or your pocket. And while this is certainly not unique to bikes, it certainly impacts us more than some other markets. Perfect information, after all, operates outside all sales channels; combine it with low barriers to entry and a mature product category you have things like Chinarellos on the Thursday Night Ride.

But it also gives you market forces like Shimano, not to mention the future of Bike 3.0 … which will be topics for Part 2 of this series.