Editor's note: The following article appears in the December issue of Bicycle Retailer & Industry News. To subscribe to the magazine, click on the link at the upper right.

American brand tweaks business strategy to build on European success

By Matt Wiebe

FERNDALE, WA—A decade of supplying freeride bikes has not raised Transition Bicycle Co.’s profile beyond its hard-core customer base in North America. However, the brand is growing in Europe.

After attending its fifth Eurobike, Transition is revamping much of its business strategy—switching to model years and expanding beyond its big-hit roots to offer cross-country/trail bikes, 29ers and a carbon fiber model. Europe is by far the company’s largest market.

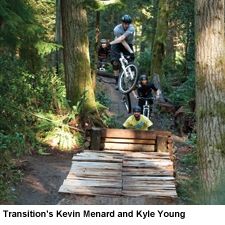

“2012 is our first for model years, because it is something our international distributors want. It’s not something I believe in,” said Kevin Menard, who with childhood friend Kyle Young co-founded Transition in 2001.

“It’s how the industry works and dealers are just used to it. So we are caving in. U.S. dealers can still order in season when they need a bike like always, and like always we could be out. But if they pre-book they can get it when they need it,” he added.

Posting growth of 70 to 120 percent over the past few years, the company sells out of bikes pretty early in the season, Menard admitted.

But distributors place big orders for their markets, and Transition’s old model—if it is in the warehouse we will ship it—was not keeping up with international growth.

Transition’s success selling its big-hit bikes into Europe rubs against the stereotype that continental riders prefer minimal-travel, lightweight bikes.

“Some of the most extreme terrain and riding I’ve ever done is in the Alps. We are not adapting our bikes to the European market; they want our bikes because they are designed for the places they ride,” Menard said.

Menard and Young may have strategized about creating their own bike company over a pingpong table while the pair worked at T-Mobile, but it was Menard’s tenure at Vision Recumbents that determined Transition’s model.

He loved Vision’s can-do attitude and commitment to local manufacturing, and the fact that they did everything in-house.

“It was a great place to work and be creative. But Vision grew to 40 employees and you have to do a lot of sales to support all those people. As a manufacturer, Vision found it hard to scale up or down with demand,” he added.

So Menard and Young took their designs to Asia and focused on other areas of the business. One aspect of business they were committed to was riding and developing bikes with employees and dealers. When the company does a sales trip, muddy bikes outnumber dealer packs and sales materials.

“There are a number of rider-owned companies in BMX, less so in mountain bikes. Everyone’s bikes are really good, so it comes down to whose bikes do you want to ride,” Menard said.

Transition’s 100 North American dealers are salted around ski resorts and areas known for technical riding, mostly in the Rockies and the Pacific Northwest.

“Many companies are too busy running the business to take the time to ride. That’s not what we want. It’s more work to ride with a shop owner and employees than to send a rep in, but that’s who we are,” said Menard.

Mitchell Buck, owner of Dirty Fingers Bike Shop in Hood River, Oregon, loves the personalized attention he gets from Transition, pointing out that when he calls, Menard or Young will pick up the phone and take time to talk.

For his customers, the brand is something else. He calls it his shop’s best bike for the working class. He also sells Ellsworth, Moots, Tonic Fab and Cervélo, but the savings of more than $400 Transition has over similar bikes is a big deal for many of his customers.

“Transition is not only a good value, and durable, but for riders who can’t afford a free-ride and a cross-country bike, bikes like the six-inch-travel Covert do it all,” Buck said.

Where other companies rely on the bragging rights a string of suspension patents provides, Transition depends on well-proven single-pivot designs.

“The end goal of any suspension design is to make the user comfortable and confident on your bike. We offer no patented technology or the smoke and mirrors it provides. You are either confident on our bikes or you are not,” Menard said.

For years Transition offered dealers a few freeride and jumping hardtails, but by the end of next year the company hopes to offer a 13-model line, including its first carbon fiber full-suspension design.

Expanding Transition’s model lineup beyond its freeriding roots comes from personal rather than business reasons. Menard and Young both have young families.

“Weekends are for the family, so Kyle and I are taking more weekday rides, mostly trail riding. Since we sell what we ride, our models are changing to reflect that. And who knows? We could do a kids’ 24-inch freeride bike,” Menard added.