NEW YORK (BRAIN) — Peloton Interactive on Tuesday announced that its revenues grew 6% in its recently completed second quarter, to $1.1 billion; the company recorded a net loss for the quarter of $439.4 million but could point to a 66% increase in Connected Fitness Subscriptions and a 26% increase in recorded workouts on its system in the quarter.

However, on Wall Street, the actual numbers were overshadowed by a variety of news surrounding the brand, including speculation that Nike and Amazon and Apple were looking at acquiring it.

Besides the acquisition rumors, the news included:

- The announcement that co-founder John Foley will step aside as CEO to become Executive Chair, while current president William Lynch becomes a non-executive board member. Barry McCarthy, a former executive at Spotify and Netflix, will become the new CEO.

- A “realignment plan” to reduce costs, which includes backing off plans to develop domestic manufacturing for its products and eliminating 2,800 global positions.

- A request by NordicTrack’s parent company — which is involved in a long-running patent fight with Peloton — to the U.S. International Trade Commission to ban imports of Peloton Bike+ bikes for infringing one of its patents.

And did we mention that on Jan. 24, a character on the “Billions” Showtime series suffered a heart attack while riding a Peloton, following a similar scenario in a “Sex and the City” episode last year?

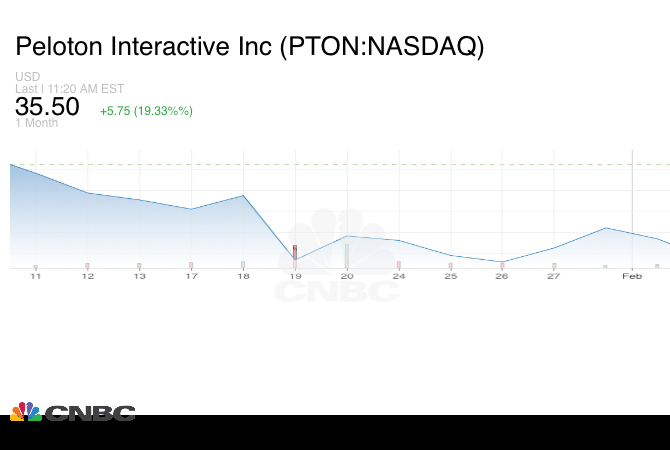

Peloton’s stock price has been yo-yoing as some investors get bearish about Peloton’s prospects in a post-pandemic world while others buy up its stock in anticipation of a high-dollar sale to a major brand.

The realignment

Peloton said it will save at least $800 million annually through operating expense efficiencies and reduce its planned capital expenditures this year by approximately $150 million.

“Peloton is at an important juncture, and we are taking decisive steps. Our focus is on building on the already amazing Peloton Member experience, while optimizing our organization to deliver profitable growth,” said Foley. “With today’s announcements, we are taking action to ensure Peloton capitalizes on the large, long-term Connected Fitness opportunity. This restructuring program is the result of diligent planning to address key areas of the business and realign our operations so that we can execute against our growth opportunity with efficiency and discipline.”

Peloton said it is winding down the development of its Peloton Output Park manufacturing facility in Troy Township, Ohio. The move will result in $60 million in restructuring capital expenditures. It also said it will reduce its reliance on its owned and operated warehousing and delivery footprint, and move toward more third-party relationships.

Peloton said the workforce reduction will occur across nearly all business operations, resulting in the reduction of approximately 2,800 positions, about 20% of the company’s workforce.

“While we still see strategic merit in diversifying our manufacturing footprint and developing capabilities in North America over the long term, we believe Tonic (Peloton’s Taiwan factory, which it acquired in 2019) and our third-party manufacturing partners can support our growth for the next few years,” Foley said.