It's been just about four months since a line of consumer-direct carbon road, gravel and mountain bikes premiered from a new brand called Viathon, emerging out of the bright Sea Otter sunshine like the goddess Athena springing full-formed from the forehead of Zeus.

Managing editor Dean Yobbi told the story in BRAIN's May dead-trees issue and online as well. I followed with an opinion column about Viathon's unique formation, business model and value proposition.

The bikes themselves, it was agreed, were competently designed and engineered, and marketed by respected industry professionals with big-brand credentials. And while low, Viathon pricing was at parity with any number of other name-brand carbon models, including Trek, Specialized, Cannondale and Canyon. But what was remarkable about Viathon was the identity of the brand's owner: Walmart.

"Of course, there was some backlash with the Walmart connection,'' said Mark Jordan, whose CrankTank marketing group staged the Viathon launch and was quoted in Yobbi's original article. "The negativity starts in-store with reports of forks installed backward. But when people saw these bikes here, it was like, 'Hey, these are real bikes!'''

And indeed they were. As technical editor Dan Cavallari pointed out in our sister publication VeloNews, "Viathon ticks almost all the high-end boxes for a bike with a lower pricepoint. But does it have enough soul and personality to compete with more established brands offering quality bikes at a similarly low price?"

Good question, Dan, and one we'll come back to in just a minute.

But the move that really set the cat among the industry pigeons was the Viathon sales strategy, which at least strongly hinted at distribution via Walmart.com.

"We're trying to build a culture, building an education," Jordan said at the introduction. "With Walmart's reach, we will create an awareness of the brand."

But the move that really set the cat among the industry pigeons was the Viathon sales strategy, which at least strongly hinted at distribution via Walmart.com.

Walmart.com, of course, is an internet behemoth with hundreds of millions of visitor sessions each month with peak holiday traffic topping half a billion, according to analyses by industry research firms SimilarWeb and Statista. Even more interesting was Jordan's underlying premise that at least some of those hundreds of millions of Walmart customers would for reasons unknown and perhaps unknowable leap at the opportunity to purchase a full-dress carbon bike with a price tag northward of $3,000 ... precisely because they didn't have to go into a brick-and-mortar bike shop to purchase it.

Except none of that happened. Or at least, hasn't happened yet.

That was then, this is the bike business

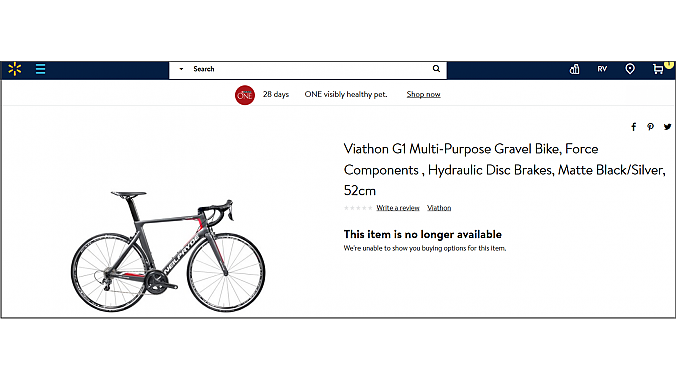

All this went down in April and May of this year. Nowadays, a search for Viathon bikes on the Walmart website (see here, here and here) returns a notice that the item is no longer available; the image from the final link (also shown above) displays another brand and model entirely.

By July, barely 90 days from its glitzy premiere, Viathon had announced via direct mail and on its website that it was dropping prices on all models by as much as $1,000 per bike, to as low as $1,998. At this writing, the various models are listed at "Summer Sale" prices on the Viathon website.

Industry watchers may remember the last time Walmart tried to get into the carbon bike game, which as I recall was about ten years ago. America's low price leader served up a single no-name (and possibly open-mold) model with full mechanical Ultegra group, complete with wheelset, at a very low price point. Crickets.

A year later, the bikes closed out for about $1,000 apiece, and I read at the time on various online consumer groups that sharp-eyed cyclists were snapping them up as preassembled build kits and flogging the framesets online for maybe a hundred bucks a copy. Certainly Viathon's not to that point yet, but time will tell.

The history of the bicycle business is, in one sense, a history of powerful outsiders coming in to teach us dumb yokels how things are done in the Big Leagues. And failing. In fact, the only example I can think of where a large outside brand has achieved even modest success is Dorel Industries, with its serial purchases of Pacific, Cannondale, Schwinn, GT and related brands. Kudos to them, but that story stretches back some 15 years and is still far from over.

The history of the bicycle business is, in one sense, a history of powerful outsiders coming in to teach us dumb yokels how things are done in the Big Leagues. And failing.

At the end of the day, we bike people live and work in a quirky, parochial and, more than occasionally, incestuous little industry, one with its own set of business realities. And just like any other reality, outsiders ignore ours at their peril. For sure we are also undergoing huge changes; times are tough now and likely to get tougher before they get better. But don't count the traditional players out yet, on either the supply or retail ends of the supply chain.

If nothing else, we've been surviving in this business for decades and we know the "easiest way to make a small fortune" in it ... a lesson which even the best-heeled outsiders have yet to learn.