Editor's note: The following article appears in the March 1 issue of Bicycle Retailer & Industry News.

By Matt Wiebe

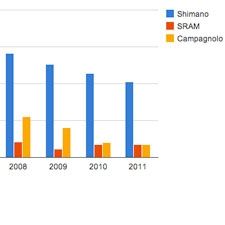

IRVINE, CA—Nothing says “engineering driven” more than patents and patent application activity, and on this front Shimano has its competitors beat. Over the last five years the U.S. Patent Office has published 513 Shimano bicycle-related patents and patent applications, compared with Campagnolo’s 149 and SRAM’s 77.

Shimano’s patent activity has diminished with the world economy—82 of Shimano’s patents and applications were published last year, compared with 133 in 2006, and the patent activity of its competitors is similarly reduced.

Even so, it is moving into areas of development—dirt suspension, hydraulic rim brakes, dropper seatposts and electric integration—that could shake up the market if the technology makes it into production.

Take suspension: Shimano released its sophisticated electrically controlled forks and shocks for its high-end trekking line called Smover seven years ago. And the company teased a line of dirt suspension forks at Sea Otter more than a decade ago, but has not brought any dirt-related suspension to market.

Last year seven damping designs of Shimano’s were published, two with electrically controlled suspension internals. This is more suspension activity than the prior six years combined.

A survey of suspension engineers, who declined to go on record, said Shimano has the technology to make competitive forks, but none thought the company was setting up to enter the market.

At the same time, however, they wonder how long Shimano can stand on the sidelines as SRAM’s RockShox suspension line enables it to offer product managers seductive pricing on component and suspension packages.

Shimano’s absence from the suspension market allows suppliers to spec their suspension of choice, a lifeline for Fox, Manitou, Marzocchi, SR Suntour and others. If Shimano entered the suspension market, it would have serious repercussions for these suppliers.

Dropper seatposts are a suspension-related product and a big market segment. Four dropper patent applications by Shimano were published last year, including two on electric motorized droppers. Dropper posts is an entirely new area of development for Shimano, and electric activation easily addresses the problem of weakening hydraulic lift due to wear.

Hydraulic rim brakes for the road are not new; Magura’s HS77 and Mathauser hydraulic rim brakes were on the market about 20 years ago. But Magura’s release of a new line of hydraulic rim brakes and SRAM’s announcement that its hydraulic road brakes will arrive by fall signal a big change.

Shimano’s 16 patents and patent applications in the area of road hydraulics—brakes, levers and hydraulic plumbing hardware—were published in 2011 (covered in this month’s Tech Briefs column, page 24). Given this activity, it’s probably safe to say it will join Magura and SRAM in offering roadies hydraulic options.

While hydraulic rim brakes do nothing to mitigate braking issues with carbon rims, their power and modulation will be welcomed by many. Plus, their obvious technological benefits make hydraulic brakes an easy showroom sell, depending on pricing.

While not as obvious, Shimano’s continual work on electric integration could make the greatest impact on riders. The company continues to press forward on integrating torque sensors with gear selection—automatic or not—and tying in suspension damping and seatpost height adjustment to a central data processor. Can anti-lock braking and traction control be that far behind?

Shimano leads patent race

Published March 16, 2012

Topics associated with this article: From the Magazine

Jump to Comments